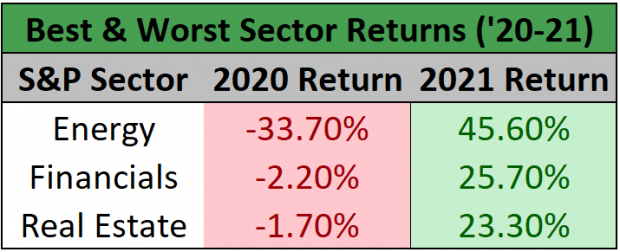

Last year surprised many investors as 2021 was the inverse of 2020 with respect to leading market sectors. The three worst-performing S&P sectors in 2020 (energy, financials, and real estate) reversed course last year and were the three best performers as we can see below.

Image Source: Zacks Investment Research

An important caveat with respect to this sector outperformance is that the majority of the gains for energy and financials in 2021 came in the first half of the year. From June to December, both sectors essentially moved sideways, notching only slight gains.

Image Source: Zacks Investment Research

While this relative

underperformance

in the second half of the year can be viewed negatively, the two sectors may have simply been taking a needed breather after starting out last year extremely strong. Energy and financials are leading the charge on the first trading day of the year and appear set to resume their next leg up. The sector consolidation throughout the last six months looks like it is paving the way for a repeat of outperformance in the beginning months of 2022.

With bond yields spiking today, we’re going to focus on two financial companies that are breaking out to the upside. The Zacks Finance sector is currently ranked #1 out of all 16 sectors. Investing in the top sectors and industry groups provides a constant tailwind to your investing success.

Jefferies Financial Group, Inc. (

JEF

)

Jefferies Financial Group is a global financial services company that engages in investment banking and capital markets, merchant banking, as well as alternative asset management. JEF offers financial advisory, debt and equity underwriting, equity research, wealth management, and corporate lending services. Jefferies Financial Group was founded in 1968 and is headquartered in New York, NY.

JEF trades at an attractive valuation (10.1 forward P/E) and has surpassed earnings estimates in each of the last eight quarters. A Zacks #1 (Strong Buy) stock, JEF most recently reported quarterly EPS back in September of $1.51, a +48.04% surprise over consensus. JEF has delivered an average earnings surprise of +222.85% over the past four quarters, supporting the stock’s climb of roughly 65% in the past year.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the

Zacks Top 10 Stocks

gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report