Sensata Technologies

ST

has unveiled a new fly-by-wire inceptor for electric vertical take-off and landing (eVTOL) aircraft to tap the growing advanced air mobility market.

Per a research from

Allied Market Research

, the global advanced aerial mobility market is expected to be valued at $16.81 billion in 2025 and reach $110.02 billion in 2035, at a CAGR of 21.7 %. Per the report from

The Insight Partners

, the global eVTOL market is anticipated to witness a CAGR of 35.6% during the 2024-2028 period.

The eVTOL market is anticipated to grow since it helps to ease short-distance travel amid increasing traffic congestion and supports zero-emission flight operations.

Considering the robust growth opportunities for the eVOTL market, Sensata is looking to leverage its aircraft flight controls portfolio to boost its revenues from the eVTOL business segment.

A passive inceptor is a cockpit control device designed to collect pilot inputs and transmit it to actuators through the vehicle’s fly-by-wire system. Inceptors commonly use position sensors like rotary variable differential transformers (RVDTs) to output the actual positions of the inceptor stick to the flight control system, added Sensata.

Sensata’s passive inceptor is available in movement designs with one, two, or three axes, and each axis uses at least three RVDTs to generate exact position data.

The 3-axis inceptor has separate adjustable operating forces in each axis and is most frequently used to regulate the vehicle’s pitch, roll and yaw. The pilot grips, which include integrated switch functionality, can be customized to each vehicle’s operational needs.

The company’s aircraft flight controls portfolio is catered toward addressing the complex engineering and operating performance requirements that help customers solve significant challenges in the aerospace industry.

The current inceptor provides solutions for advanced air mobility, urban air mobility, trainers and other electric aircraft applications.

Sensata is a global industrial technology company that develops, manufactures and sells innovative sensor-based solutions.

In the first quarter

, Sensata reported adjusted earnings of 78 cents per share compared with 86 cents in the year-ago quarter. Overall, quarterly revenues aggregated $975.8 million, up 3.5% year over year.

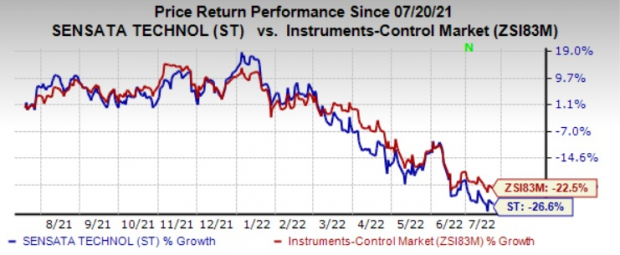

ST carries a Zacks Rank #3 (Hold). Shares of the company have lost 26.6% compared with the

industry’s

fall of 22.5% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

. Broadcom sports a Zacks Rank #1 (Strong Buy) whereas Aspen Technology and Synopsys carry a Zacks Rank #2 (Buy).You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.49 per share, increasing 0.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.3%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 22.3% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.67 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 13.1% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 5.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report