Shares of

Sesen Bio

SESN

plunged 31% on Jul 18 after the company announced its decision to voluntarily pause the U.S development of its lead asset, Vicineum (oportuzumab monatox -qqrs), for treating non-muscle invasive bladder cancer (NMIBC).

Vicineum — Sesen’s lead product candidate for Bacille Calmette-Guérin (BCG)-unresponsive NMIBC — is a locally-administered fusion protein designed to decrease the risk of toxicity to healthy tissues, thereby improving its safety. The candidate targets epithelial cell adhesion molecule (“EpCAM”) antigens on the surface of tumor cells to deliver a potent protein payload, Pseudomonas Exotoxin A.

In August 2021, FDA issued a complete response letter to Sesen’s biologics license application (BLA) for Vicineum for treatment of NMIBC in its present form. After meeting with the FDA, Sesen decided to conduct an additional phase III study to support a potential resubmission of the BLA. Sesen has had four productive meetings with the FDA since August 2021

The decision to pause Vicineum’s development will allow Sesen to preserve cash while it explores potential strategic alternatives to maximize shareholder value. Sesen plans to find a partner for the development of Vicineum to fund costs for an additional phase III study

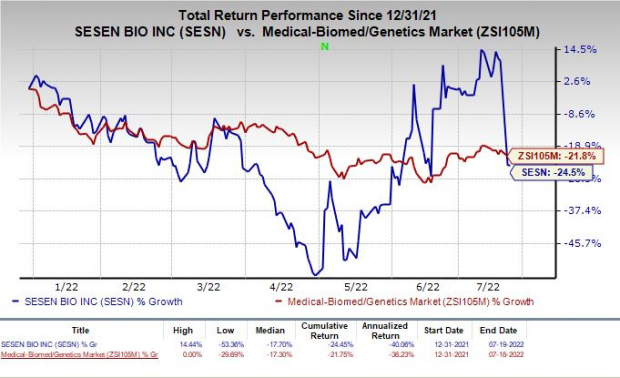

Sesen’s stock has declined 24.5% year to date compared with the

industry

’s fall of 20%.

Image Source: Zacks Investment Research

Sesen Bio announced the execution of an asset purchase agreement with

Roche

RHHBY

in a

separate SEC filing

.

Per the terms of the deal, Sesen Bio will sell all patent rights and knowledge associated with the monoclonal antibody EBI-031 legacy Interleukin-6 (IL-6) antagonist antibody technology to Roche for up to $70 million.

EBI-031 is a humanized monoclonal antibody that potently binds IL-6 and inhibits all known forms of IL-6 cytokine signaling. It is currently being developed by Roche as the potential treatment of ocular diseases.

In the original 2016 agreement, the biotech had licensed the antibodies, including EBI-031, which the FDA had cleared for clinical trials, to Roche, for an upfront payment of $7.5 million.

The execution of the new deal marks the end of Sesen’s 2016 licensing agreement with Roche, under which the former has already received $50 million in upfront and milestone payments.

The new deal includes an upfront payment of $40 million and an additional $30 million if Roche initiates a phase III study with EBI-031 before the end of 2026.

Zacks Rank and Other Stocks to Consider

Sesen Bio currently carries a Zacks Rank #2 (Buy)

Some similar-ranked stocks in the same sector include

BioNTech

BNTX

and

Seagen

SGEN

, each carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here

.

BioNTech’s earnings per share estimates for 2022 have narrowed from $34.79 to $33.51 in the past 30 days. The same for 2023 has increased from $15.60 to $16.27 in the same time frame.

Earnings of BioNTech beat estimates in all of the trailing four quarters, the average surprise being 13.42%.

Seagen’s loss per share estimates for 2022 have narrowed from $3.50 to $3.49 in the past 30 days. The same for 2023 has widened from $1.41 to $1.43 cents in the same time frame. SGEN has returned 9% in the year-to-date period.

Earnings of Seagen missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 40.08%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report