When the outside world shut down during the pandemic’s initial phases, e-commerce boomed. Shopping in-store was no longer an option, and investors noticed Shopify’s

SHOP

unique business, driving shares upward with no end in sight.

Shopify provides a multi-tenant, cloud-based, multi-channel e-commerce platform for small and medium-sized businesses.

Now, in 2022, shares have fallen extensively. This once pandemic winner has now turned into a big-time loser.

Shopify reports quarterly results before the opening bell on July 27

th

. In addition, the company is currently a Zacks Rank #3 (Hold) with an overall VGM Score of an F.

Let’s take a closer look at how the company shapes up heading into the quarterly release.

Share Performance & Valuation

If you’ve followed the stock, it’s well-known that Shopify shares have plummeted in 2022, decreasing more than 70% in value and extensively underperforming its Zacks – Computer and Technology Sector, which has declined nearly 40% itself.

Image Source: Zacks Investment Research

However, Shopify shares are still up nearly 300% over the last five years, even after the deep valuation slash. The stock seems to have found some support after shedding off its COVID-19 gains.

Image Source: Zacks Investment Research

Shopify has unbelievably high valuation levels, although it is a common theme among growth stocks. Its 8.8X forward price-to-sales ratio is nicely underneath its five-year median of 22.6X but represents a steep 105% triple-digit premium relative to the general market.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been overwhelmingly bearish over the last 60 days, with 21 downwards estimate revisions out of the 29 that have hit the tape. For the quarter to be reported, the Zacks Consensus EPS Estimate resides at $0.03, reflecting a disheartening double-digit 86% decline in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

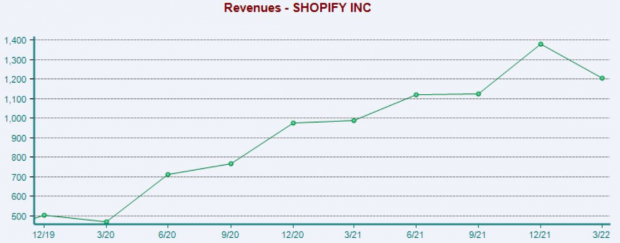

However, the top-line appears to be in much better shape. SHOP is projected to rake in $1.4 billion in revenue for the quarter, good enough for a substantial 20% uptick in quarterly revenue year-over-year. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Shopify has primarily reported EPS above expectations as of late, exceeding the Zacks Consensus EPS Estimate in five of its last seven quarters. In its latest quarter, however, the company recorded a sizable 75% bottom-line miss.

Top-line results have been stellar; over the company’s previous ten quarters, Shopify has posted eight quarterly revenue beats.

Investors should note that SHOP shares have been highly volatile following quarterly releases as of late. Following its last two reports, shares have decreased by 23% and 26%, respectively.

Bottom Line

Shopify was a big-time winner during the initial phases of the pandemic. Now, shares have fallen back to earth. The company sports incredibly high valuation levels, but that’s typical of high-growth stocks.

In addition, earnings are forecasted to fall significantly, but quarterly revenue looks to increase notably. Heading into the quarterly report, Shopify boasts a 4.2% Earnings ESP Score.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report