Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put

Eldorado Gold Corporation

EGO

stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

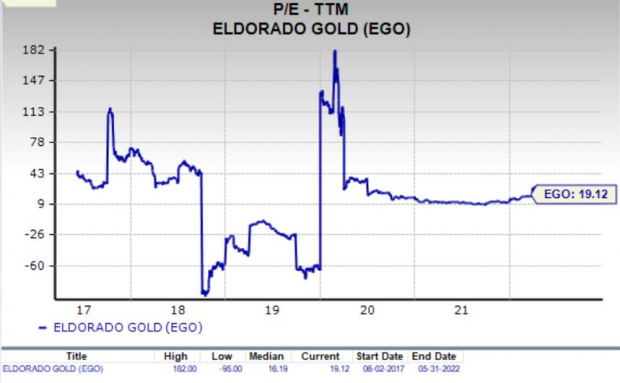

On this front, Eldorado Gold has a trailing twelve months PE ratio of 19.12, as you can see in the chart below:

Image Source: Zacks Investment Research

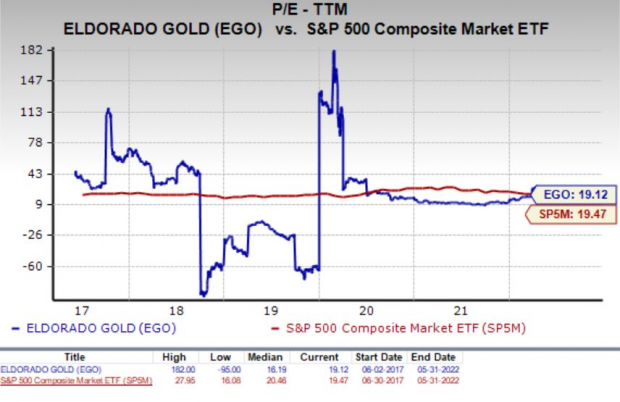

This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 stands at about 19.47. If we focus on the long-term PE trend, Eldorado Gold’s current PE level puts it above its midpoint (which is 16.19) over the past five years, with the number having risen rapidly over the past few months.

Image Source: Zacks Investment Research

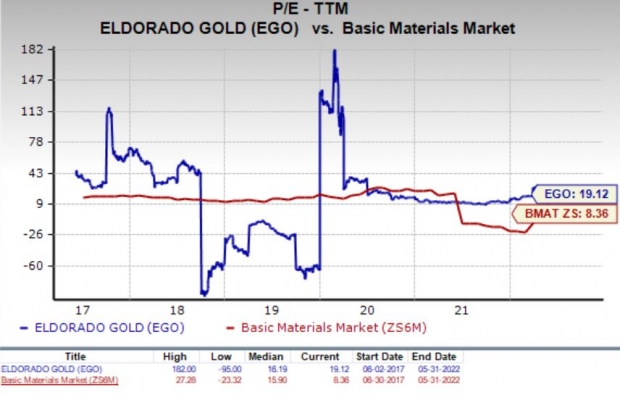

Further, the stock’s PE also compares favorably with the Zacks Basic Materials sector’s trailing twelve months PE ratio, which stands at 8.36. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

Image Source: Zacks Investment Research

We should also point out that Eldorado Gold has a forward PE ratio (price relative to this year’s earnings) of just 16, so it is fair to say that a slightly more value-oriented path may be ahead for Eldorado Gold stock in the near term too.

P/S Ratio

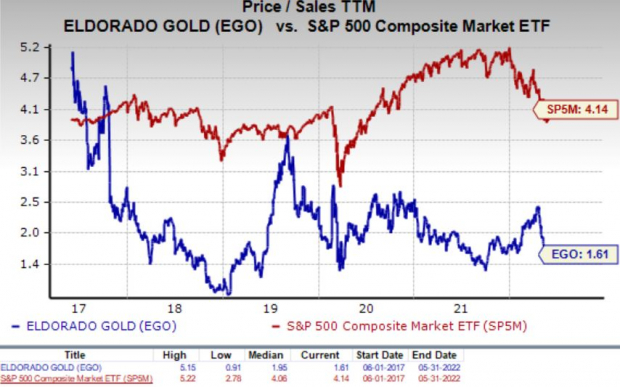

Another key metric to note is the Price/Sales ratio. This approach compares a given stock’s price to its total sales, where a lower reading is generally considered better. Some people like this metric more than other value-focused ones because it looks at sales, something that is far harder to manipulate with accounting tricks than earnings.

Right now, Eldorado Gold has a P/S ratio of about 1.61. This is a bit lower than the S&P 500 average, which comes in at 4.14x right now. Also, as we can see in the chart below, this is well below the highs for this stock in particular over the past few years.

Image Source: Zacks Investment Research

If anything, this suggests some level of undervalued trading—at least compared to historical norms.

Broad Value Outlook

In aggregate, Eldorado Gold currently has a Value Score of A, putting it into the top 20% of all stocks we cover from this look. This makes Eldorado Gold a solid choice for value investors, and some of its other key metrics make this pretty clear too.

For example, the P/CF ratio (another great indicator of value) comes in at 4.63, which is far better than the industry average of 7.37. Clearly, EGO is a solid choice on the value front from multiple angles.

What About the Stock Overall?

Though Eldorado Gold might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth Score of C and a Momentum Score of D. This gives EGO a Zacks VGM score — or its overarching fundamental grade — of B. (You can read more about the Zacks Style Scores

here >>

)

Meanwhile, the company’s recent earnings estimates have been dismal at best. The current quarter has seen none estimates go higher in the past sixty days compared to one lower, while the full year estimate has seen one up and two down in the same time period.

This has had a noticeable impact on the consensus estimate though as the current quarter consensus estimate has declined by 9.1% in the past two months, while the full year estimate has dropped by 3.8%. You can see the consensus estimate trend and recent price action for the stock in the chart below:

This negative trend is why the stock has just a Zacks Rank #3 (Hold) despite strong value metrics and why we are looking for in-line performance from the company in the near term.

Bottom Line

Eldorado Gold is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. Further, a strong industry rank (among Top 36% of more than 250 industries) instills our confidence. However, over the past two years, the Zacks Mining – Gold industry has clearly underperformed the broader market, as you can see below:

Image Source: Zacks Investment Research

So, value investors might want to wait for estimates, analyst sentiment and broader factors to turn favorable in this name first, but once that happen, this stock could be a compelling pick.

How to Profit from the Hot Electric Vehicle Industry

Global electric car sales in 2021 more than doubled their 2020 numbers. And today, the electric vehicle (EV) technology and very nature of the business is changing quickly. The next push for future technologies is happening now and investors who get in early could see exceptional profits.

See Zacks’ Top Stocks to Profit from the EV Revolution >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report