Skechers U.S.A., Inc.

SKX

reported stellar second-quarter 2021 results, with the top and the bottom line surpassing the Zacks Consensus Estimate as well as improving year over year. This well-known footwear company gained from growth across domestic and international channels, driven by strong wholesale and direst-to consumer sales.

During the quarter, the company witnessed higher demand for comfort products across several markets as consumers began returning to a normal lifestyle amid easing pandemic restrictions. Moreover, the company’s investments in long-term growth strategies including brands and infrastructural capabilities have been yielding. Management highlighted that the company was able to accomplish strong second-quarter results despite hurdles stemming from the pandemic like delayed shipments, port constraints and temporary store closures in certain markets.

For the remainder of the year and the following periods, the company is optimistic regarding strength of its brands and relevance of their distinct product offerings. The company updated the guidance for 2021 and provided an encouraging view for the third quarter.

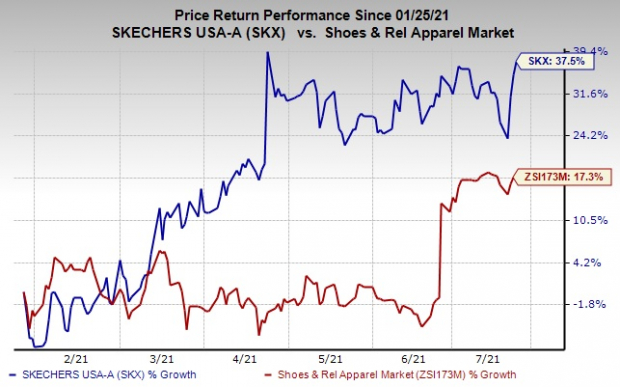

Shares of this Zacks Rank #2 (Buy) company have gained 37.5% in the past six months compared with the

industry

‘s rise of 17.3%.

Image Source: Zacks Investment Research

Let’s Analyze the Results

Skechers posted quarterly earnings of 88 cents a share that handily beat the Zacks Consensus Estimate of 52 cents. The bottom line reflects substantial improvement from a loss of 44 cents reported in the year-ago quarter.

The company generated sales of $1,657.8 million that outpaced the Zacks Consensus Estimate of $1,488 million. We note that this was the ninth straight quarter of a revenue beat. The top line surged 127.3% year over year, owing to 147.3% increase in domestic sales and 113.7% rise in international sales. On a constant-currency basis, total sales increased 117.5%.

Sales growth in the domestic and international channels was driven by strong wholesale as well as direct-to-consumer businesses thanks to the easing of pandemic-led restrictions. International wholesale segment sales surged 94.8% to $750.2 million, aided by strong growth in European subsidiaries, China and Distributor sales. Domestic wholesale sales rose 205.7% to $399.7 million on the back of higher unit sales volume.

The company’s direct-to-consumer sales increased 137.8% to $507.9 million, backed by growth across international and domestic retail stores, partly offset by decline in domestic e-commerce sales. Direct-to-consumer comparable same store sales rose 109.2%, reflecting an increase of 95.6% domestically and 165.2% internationally.

Looking at Margins

Gross profit increased 130.5% year over year to 849.5 million. Also, gross margin expanded 72 basis points (bps) to 51.2% owing to higher direct-to-consumer gross margin. Higher average selling price and lower promotional activity resulted in margin expansion in the direct-to-consumer business.

SG&A expenses were $652.4 million, up 51% year over year. Higher SG&A expenses can be attributed to 119.9% increase in selling expenses and a 39.8% rise in general and administrative expenses. Elevated selling expenses stemmed from a rise in global advertising costs. The increase in general and administrative expenses can be attributed to higher labor costs, incentive compensation, global warehouse and distribution expenses. As a percentage of sales, SG&A expenses contracted 1,988 bps to 39.4%.

Earnings from operations of $201.2 million rose from a loss of $61 million in the prior-year quarter.

Store Update

Skechers opened 352 stores in the year-to-date period, while shuttering 186 locations. During the second quarter it opened 13 company-owned stores, including key locations at Antwerp, Barcelona Berlin and Lima. The company closed eight locations in the second quarter owing to leases expiration. An additional 63 third-party Skechers stores were opened in the second quarter across 26 countries.

As of Jun 30, 2021, the company had 4,057 stores, including 512 company-owned domestic stores, 339 company-owned international locations, 482 joint-venture stores and 2,724 distributor, licensee and franchise stores.

The company opened three stores in the third quarter-to-date period. It plans to open three more stores during the third quarter and 20-25 stores by the end of the year. Additional 145-155 third-party stores are expected to open by year-end.

Other Financial Aspects

As of Jun 30, 2021, cash and cash equivalents totaled $1,091.3 million, while Short-term investments amounted to $107.6 million. The company ended the quarter with long-term borrowings (excluding current installments) of $268.9 million, and shareholders’ equity of $2,733.4 million, excluding non-controlling interests of $280.6 million. Further, total inventory was $1,057.3 million.

The company incurred capital expenditures worth $62 million during the second quarter. Management anticipates capital expenditures between $150 million and $200 million for the remaining year

Outlook

Management is impressed with the performance witnessed during the second quarter and is confident regarding business growth in the forthcoming periods. It expects that the recent resurgence of the coronavirus will be limited.

The company envisions third-quarter 2021 sales between $1.60 billion and $1.65 billion and earnings in the band of 70-75 cents a share. The Zacks Consensus Estimate for sales and earnings in the third quarter are currently pegged at $1.51 billion and 61 cents, respectively.

Skechers guided 2021 sales in the range of $6.15-$6.25 billion, up from the earlier guidance of sales in the bracket of $5.8-$5.9 billion. The company had reported sales of $4.6 billion in 2020. The Zacks Consensus Estimate for sales in 2021 is currently pegged at $5.93 billion.

For 2021, the company expects earnings in the band of $2.55-$2.65 per share, up from the prior view of $1.80-$2.00. The company had reported earnings of 64 cents in 2020. The Zacks Consensus Estimate for 2021 earnings is pegged at $2.09.

Here are 3 Key Stocks for You

The Childrens Place, Inc.

PLCE

, sporting a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 8%. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Foot Locker, Inc.

FL

, also flaunting a Zacks Rank #1, has a long-term earnings growth rate of 4%.

Abercrombie & Fitch Company

ANF

has a long-term earnings growth rate of 18% and a Zacks Rank #1.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report