SolarEdge Technologies, Inc.

SEDG

recently revealed that its 2-gigawatt battery cell manufacturing facility in South Korea, Sella 2, is now operational. The move is in sync with SolarEdge’s intent to capitalize on the growing demand for ion cells and batteries globally amid the supply-chain constraint.

The facility, which aids the company in having its own supply of lithium-ion batteries and infrastructure for product innovation, comes with the provision of scaling up further to meet escalated demand. With the expected ramp-up in production during the second half of 2022, SolarEdge is poised to strengthen its position in the battery cells manufacturing arena.

SolarEdge’s Growth Strategy

SolarEdge aims to strengthen its portfolio of storage products and gain from the expanding battery storage market. To this end, its expertise and excellence enables it to expand its product portfolio, which includes lithium-ion cells, batteries and energy storage systems.

The recent addition of manufacturing capacity highlights its continuous effort to continue to invest in the battery and its cell technology and ease its path of growth in the business. Before this development, SEDG reached full manufacturing capacity in its manufacturing facility in Israel, Sella 1, in the second quarter of 2021.

Apart from this, the company increased its manufacturing capacity in Vietnam and also plans to begin volume manufacturing in Mexico during the second half of 2022.

Such efforts by the company will not only ease the ongoing supply-chain issue for SolarEdge but also boost its long-term growth trajectory. It will also enable the company to tap the growth of the lucrative solar market.

Global Battery Storage Boom

Globally, the demand for battery storage is likely to grow manifold, driven by an increased focus on the proper functioning of the grid, an emphasis on generating energy from renewable sources and declining battery storage technology prices.

Additionally, higher energy prices are further propelling the shift to renewable sources of energy, thus providing an edge to the battery storage market. Per a report from Mordor Intelligence, the battery storage market is anticipated to witness a CAGR of 19.9% during the 2022-2027 period.

Such growth projections should benefit solar companies like SolarEdge and prominent solar players like

Enphase Energy

ENPH

,

SunPower

SPWR

and

SunRun

RUN

who are expanding their footprint in the battery storage market.

Enphase Energy produces a fully integrated solar-plus-storage solution. Its IQ battery storage systems, which come with the usable and scalable capacity of 10.1 kilowatt hour (kWh) and 3.4 kWh, are based on Ensemble OS energy management technology, which powers the world’s first grid-independent microinverter-based storage system for customers.

The Zacks Consensus Estimate for Enphase’s 2022 earnings has been revised upward by 7.5% in the past 60 days. Shares of ENPH have rallied 18.9% in the past year.

In March 2022, SunPower announced that its residential battery storage system, SunVault Storage, with 26 kWh and 52 kWh configurations, is now capable of providing whole-home backup services for customers without sacrificing essentials or comfort during an outage. The installation of the new Sunvault will begin in June 2022.

The Zacks Consensus Estimate for SunPower’s 2022 earnings suggests a solid growth rate of 414.3% from the prior year’s reported figure. The Zacks Consensus Estimate for SPWR’s 2022 sales indicates growth of 20.8% from the prior year’s reported figure.

SunRun’s Bright Box provides uninterrupted backup power for the entire home. It also excels in providing electricity during peak demand times, thus buffering customers from high rates.

The Zacks Consensus Estimate for SunRun’s 2022 sales indicates a growth rate of 17.2% from the prior-year reported figure. RUN shares have rallied 14.1% in the past month.

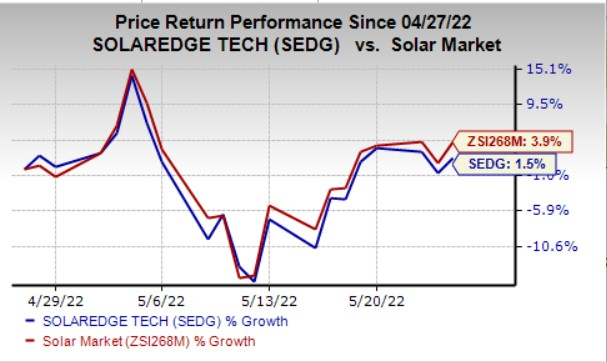

Price Movement

In the past month, shares of SolarEdge have increased 1.5% compared with the

industry

’s 3.9% growth.

Image Source: Zacks Investment Research

Zacks Rank

SolarEdge currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report