With thousands of stocks open for trading each day in the U.S stock market, how can investors identify those that are showing strength?

A variety of ways exist, but one of the fastest ways to find potential leaders is to look for stocks bucking a weak market trend – also known as relative strength. With the stock market deep in the red on Tuesday, investors can simply screen their database for stocks that are green. Since most stocks follow the market’s direction, the intuition is that securities that hold up well in a down market are more likely to outperform when the market tide turns. Below are three Chinese stocks that bucked the trend in Tuesday’s down session:

1.

Yum China Holdings (YUMC) –

Chinese stocks were clear winners on Tuesday and are starting the year with notable relative strength. Yum China is one such name. YUMC is the parent company of well-known restaurants such as Kentucky Fried Chicken, Pizza Hut, and Taco Bell. The company is independent of the U.S.-focused

Yum Brands

YUM

.

YUMC holds an impressive Zack’s Ranking of 2 and is consolidating in a bullish manner after retaking its key moving averages.

Image Source: Zacks Investment Research

Pictured: YUMC has recaptured its key moving averages and is uptrending.

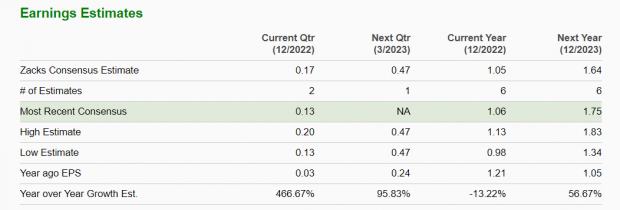

Zack’s Consensus Estimates predict that YUMC will grow EPS by a healthy 56.67% next year.

Image Source: Zacks Investment Research

2.

Yum China was not the only Chinese name to exhibit relative strength on Tuesday. Chinese internet stocks went on a tear compared to U.S equities. The

China Internet ETF

KWEB

gained ground, bolstered by names such as

Bilibili Inc

BILI

.

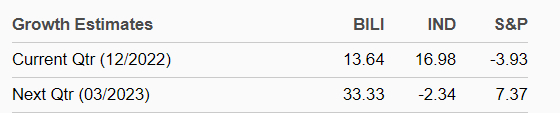

BILI provides online videos, live broadcasting, and mobile games through its entertainment platform. Tuesday, shares launched higher on expanding volume. The stock has been trending higher in recent weeks as the Chinese government has eased restrictions. Next quarter, earnings estimates suggest that BILI will outpace its industry and the S&P 500.

Image Source: Zacks Investment Research

Pictured: BILI is expected to outperform from an EPS perspective this year.

The technical and fundamental action is indicative of a potential leader. Other Chinese ADRs such as

Pinduduo Inc

PDD

,

360 Digitech Inc

QFIN

,

and

Hello Group Inc

MOMO

also flashed green sessions.

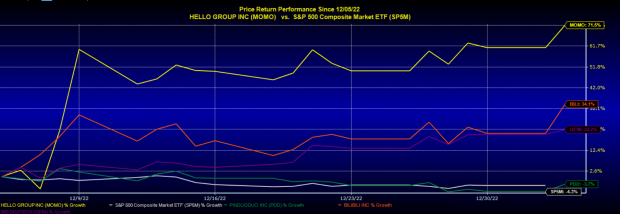

Image Source: Zacks Investment Research

Pictured: Chinese stocks are outperforming led by MOMO which is up by more than 70% in the past few months.

3.

In recent years there has been a lack of recent IPOs. The few IPOs that have emerged have failed investors. Take

Coinbase

COIN

or

Robinhood

HOOD

for example. The stocks came public at bloated valuations and a ton of hype only to fall by more than 50% over the past year.

Image Source: Zacks Investment Research

Pictured: Recent IPOs like HOOD and COIN have performed poorly.

Atour Lifestyle

ATAT

,

a Chinese hotel operator with more than 500 locations, is the exception. Since going public in November, the stock is up nearly 50%.

Image Source: Zacks Investment Research

Pictured: ATAT is up the exception to poor IPO performance. The stock is up nearly 50% since inception.

Shares of Atour have not only bucked the IPO trend but have also performed well in an overall poor market trend. Atour also has a potential catalyst – the reopening of Chinese tourism after months of stringent lockdowns. For these reasons, ATAT shares should be on investor’s lists as potential new merchandise.

Overall, Chinese stocks have shown a complete change of character in recent weeks from both an EPS and technical perspective. Investors should watch to see if the recent strength has legs.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report