The New York Times Company

NYT

has been diversifying the business, adding revenue streams, realigning the cost structure and streamlining operations to increase efficiency. The company is not only gearing up to become an optimum destination for news and information but also focusing on lifestyle products and services.

This New York-based company has been keeping pace with changing times by utilizing technological advancements to reach the target audience more effectively. Its business model, with a greater emphasis on subscription revenues, bodes well for 2023.

Subscription Revenues – the Driving Factor

The New York Times Company ended the third quarter with roughly 9.33 million paid subscribers, with about 10.75 million paid subscriptions across its print and digital products. Of the 9.33 million subscribers, approximately 8.59 million were paid digital-only subscribers, with roughly 10.02 million paid digital-only subscriptions.

Net increases of 180,000 and 210,000 were registered in digital-only subscribers and digital-only subscriptions, respectively, compared with the end of the second quarter of 2022, with continued strong growth in the adoption of bundled products.

There was a net increase of 1,010,000 digital-only subscribers and 1,230,000 digital-only subscriptions compared with the third quarter of 2021. This excludes about 1,029,000 subscribers and 1,161,000 subscriptions that were added as a result of the buyout of The Athletic in the first quarter of 2022.

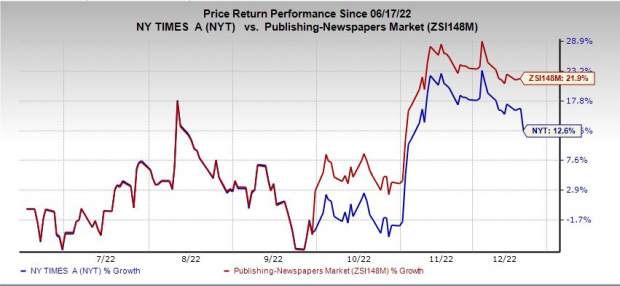

Image Source: Zacks Investment Research

In the third quarter of 2022, The New York Times Company provided the ability to access The Athletic to additional digital bundle subscribers. The move resulted in an increase of 600,000 digital-only subscribers with The Athletic.

In the third quarter of 2022, subscription revenues grew 11.7% year over year to $382.7 million. The upside was primarily due to an increase in the number of subscribers to the company’s digital-only products, the benefits of subscriptions graduating to higher prices from introductory promotional pricing and the inclusion of subscription revenues from The Athletic. Subscription revenues from digital-only products jumped 22.8% to $243.9 million.

Management envisions total fourth-quarter subscription revenues to increase about 17-20%, with digital-only subscription revenues anticipated to surge approximately 30-33%. The New York Times Company is gradually heading toward its goal of 15 million subscribers by 2027.

Management expects total fourth-quarter subscription revenues to increase 10-13% at The New York Times Group. It foresees a 6-8 percentage point contribution from The Athletic to consolidated results.

Wrapping Up

With rapid digitization in the core areas of advertising and the growing inclination of readers toward the Internet, newspaper companies have been diverting resources toward online publications. The New York Times Company has been making consistent efforts to rapidly adjust to the changing face of the multiplatform media universe.

Shares of this Zacks Rank #1 (Strong Buy) company have advanced 12.6% in the past six months compared with the

industry

’s growth of 21.9%. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Other Stocks to Consider

Some other top-ranked stocks include

Reservoir Media

RSVR

,

World Wrestling Entertainment

WWE

and

Salesforce

CRM

.

Reservoir Media, a music publishing company, carries a Zacks Rank #2 (Buy). RSVR has a trailing four-quarter earnings surprise of 35%, on average.

The Zacks Consensus Estimate for Reservoir Media’s current financial-year revenues and EPS suggests growth of 11.6% and 80%, respectively, from the year-ago period. RSVR has an expected EPS growth rate of 17.5% for three to five years.

World Wrestling Entertainment, an integrated media and entertainment company, carries a Zacks Rank #2. WWE has a trailing four-quarter earnings surprise of 25.2%, on average.

The Zacks Consensus Estimate for World Wrestling Entertainment’s current financial-year revenues and EPS suggests growth of 19.3% and 21.2%, respectively, from the year-ago period.

Salesforce, which provides customer relationship management technology, carries a Zacks Rank #2. CRM has a trailing four-quarter earnings surprise of 13.2%, on average.

The Zacks Consensus Estimate for Salesforce’s current financial-year revenues and EPS suggests growth of 16.7% and 2.5%, respectively, from the year-ago period. CRM has an expected EPS growth rate of 16.8% for three to five years.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report