T-Mobile US, Inc.

TMUS

recently unveiled the preliminary results for the fourth quarter and full-year 2022 related to key customer data. The company witnessed a record customer increase in 2022, driven by 5G network strength and a differentiated growth strategy. The company expects this growth momentum to continue in 2023 and beyond on its diligent execution of operational plans.

T-Mobile registered 314,000 postpaid net account additions in the fourth quarter, bringing the tally for 2022 to a record-high figure of 1.4 million. Postpaid net customer additions were 1.8 million in the fourth quarter and an all-time high of 6.4 million in 2022. Postpaid phone net customer additions were 927,000 in the fourth quarter, with a year-over-year improvement in phone churn of 18 basis points (bps) to 0.92% and 3.1 million for 2022 with a 10 bps growth in phone churn to 0.88%.

On the other hand, prepaid net customer additions were 25,000 in the fourth quarter and 338,000 for the full year. Prepaid churn was 2.93% in the fourth quarter and 2.77% in 2022 – the lowest in the company’s history. High-speed Internet net customer additions were 524,000 in the quarter and 2 million for 2022. T-Mobile ended the year with 2.6 million high-speed Internet customers, strengthening its credentials as the nation’s fastest-growing home broadband provider.

Total net customer additions were 1.8 million in the fourth quarter, bringing the tally to a record 6.8 million for 2022. Total customer count at the end of 2022 increased to a record high of 113.6 million as it extended its coverage across the length and breadth of the country.

Following its merger with Sprint, T-Mobile boasts an unrivaled bouquet of high- and low-band spectrum for a faster nationwide 5G rollout, undeniably disrupting the competitive landscape of the U.S. telecom market. To its credit, T-Mobile reportedly has the largest nationwide 5G network, with its Extended Range 5G covering more than 320 million people. The company is further strengthening its mid-band coverage by adding more towers and spectrum in places that already have 5G network connectivity.

T-Mobile continues to deploy 5G with the mid-band 2.5 GHz spectrum from Sprint. It is likely to provide average 5G speeds of above 100 Mbps to 90% of the population. T-Mobile’s business plan is built on covering 90% of rural America with average 5G speeds of 50 Mbps, up to two times faster than broadband. It plans to continue lighting up this 5G spectrum at an aggressive pace. T-Mobile’s 2.5 GHz 5G delivers superfast speeds and extensive coverage with signals that go through walls and trees, unlike 5G networks that are controlled by the mmWave spectrum.

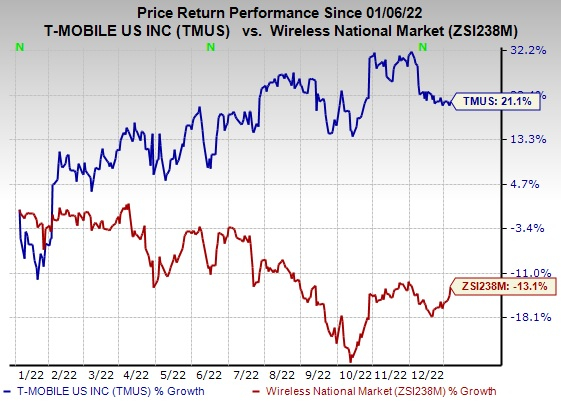

Shares of the company have gained 21.1% in the past year against the

industry

’s decline of 13.1%.

Image Source: Zacks Investment Research

T-Mobile currently carries a Zacks Rank #5 (Strong Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Ooma Inc.

OOMA

, sporting a Zacks Rank #1, delivered an earnings surprise of 21.7%, on average, in the trailing four quarters. Earnings estimates for Ooma for the current year have moved up 37.8% since March 2022. It has a

VGM Score

of B.

Ooma offers communications services and related technologies for businesses and consumers in the United States and Canada. It helps to create powerful connected experiences for businesses and consumers through its smart cloud-based SaaS platform.

Arista Networks, Inc.

ANET

, sporting a Zacks Rank #1, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 12.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Cogent Communications Holdings, Inc.

CCOI

, sporting a Zacks Rank #1, is a leading provider of low-cost high-speed Internet access, private network services and colocation center services with ultra-low latency data transmission. Its seamless network delivers high throughput, which reduces the frequency of data packets dropped during transmission compared with traditional circuit-switched networks, thereby creating a more reliable and robust network infrastructure.

Cogent has a long-term earnings growth expectation of 23.9%. Operating as one of the most interconnected Tier 1 networks in the world, Cogent provides efficient on-network and off-network connectivity solutions to various Enterprise segments, including financial companies, educational institutions and law firms, at affordable costs.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report