On Thursday, August 3, Yelp (NYSE:$YELP) announced that it is planning to sell its food delivery service business Eat24 to Grubhub (NYSE:$GRUB). Yelp will be selling off the business for $287.5 million in cash. The company had previously purchased Eat24 for $134 million about two and a half years ago. Following the announcement, Yelp’s stock shot up by about 19% in after-hours trading and Grubhub’s shares went up by 1.6%.

However, this is not just another simple acquisition deal. Yelp will be implementing online ordering from restaurants with Grubhub into its online reviews site and/or app under the same deal, effectively entering a long-term partnership with Grubhub. However, if the partnership/acquisition deal is not closed by November, antitrust conditions state that Yelp is allowed to charge a $15 million termination fee from Grubhub.

Grubhub’s acquisition of Yelp’s Eat24 signals another attempt by the company to grow its users. Just last month, Grubhub announced a deal that allows its users to order food from any 55,000 of the company’s partner restaurants. It also bought some assets of Groupon’s (NASDAQ:$GRPN) food delivery service OrderUp.

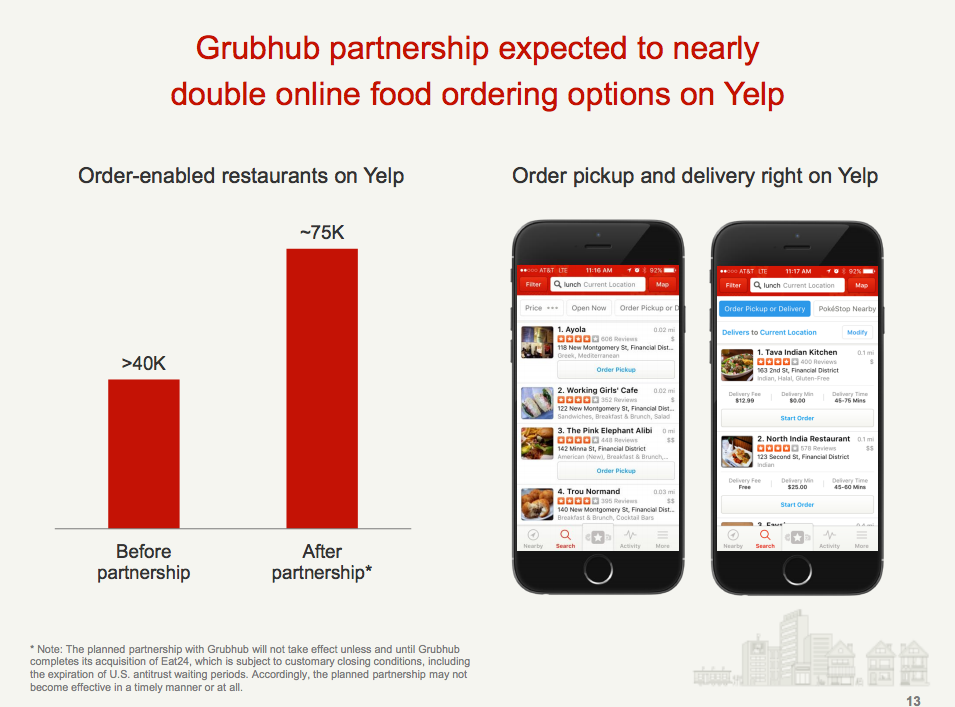

Meanwhile, Yelp’s announcement of its plans to sell Eat24, as well as buyback program worth $200 million, restarted the company’s stock on the market. The stock had closed 28% below its 52-week high on Thursday, August 3, before it released its second quarter earnings and announced the planned deal with Grubhub. According to Yelp, the deal with Grubhub could almost double the food ordering options on its site/application.

Yelp’s net revenue in the second quarter went up by 20% year-over-year, reaching $208.9 million. Net income was $7.6 million, or $0.09 per share, in Yelp’s second quarter.

Featured Image: facebook