With recent positive responses from Apple Inc.’s (NASDAQ:$AAPL) as well as a broker’s technology conference, investor interest in Advanced Micro Devices Inc. (NASDAQ:$AMD), a computer hardware developer, has sparked once again. As such, AMD’s stock rose again on Wednesday, setting the company on its way to their biggest weekly gain in four months.

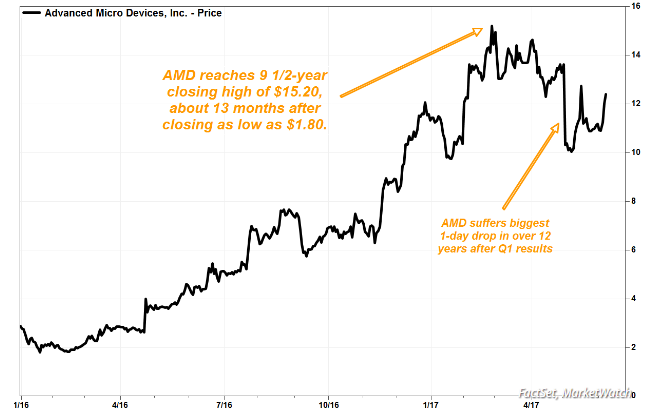

The company’s stock was doing great this year, achieving prices that were almost eight times higher than 2016’s low, but fell somewhat on May 2, 2017 when it released a first quarter report that had good numbers that not ones that matched expectations. Since then, the stock had bounced slightly before going back up steadily again this week. Within the day of June 8, 2017, the stock rose as high as 7.7% before reducing down to a close up at a 2.9% rise.

Over the last three trading sessions, AMD saw a total of 13.6% gain in their stock. There are definitely high hopes that the stock will see its biggest weekly gain by the end of this week since the 14.7% rise it saw during the week ending Feb 3, 2017. The sudden rise can be largely attributed to Apple’s announcement on Monday (June 5, 2017), declaring that the new $5,000 iMac Pro will be using AMD technology.

When interviewed by MarketWatch about the matter, Chris Hook, senior director of marketing for the Radeon Technologies Group at AMD, said, “We’ve had a tremendous amount of very positive coverage from Monday’s announcement. We’re thrilled to have Apple as a customer.”

But Apple’s interest isn’t the only reason why shares have been going up — reports of product sellouts also helped. “We’re seeing a tremendous amount of demand from the gaming space, as well as the crypto[currency] space,” Hook said, addressing the fact that AMD’s technologies are perfect for these markets.

Mitch Steves, an analyst at RBC Capital, says he is expecting low-to-mid end graphics procession units (GPUs) developed by companies such as AMD to be in high demand for cryptocurrency miners.

When it came to reports of sellouts, consumers won’t have to worry too much. Most products can still be acquired at different sales venues, Hook said, though less shop keeping units (SKUs) were available. SKUs refer to individual items for sale, which includes both different and specific versions of models.

AMD Chief Technology Officer, Mark Papermaster, also addressed recent concerns regarding competition — mainly from Nvidia Corp. (NASDAQ:$NVDA), another highly sought-after graphics chip maker company. “I think the short answer is that the product competitiveness drives share gain, right,” Papermaster said at the Bank of America Merrill Lynch’s global technology conference on Tuesday, according to FactSet’s transcript. “So when you look at Polaris, we released it last year and it’s targeted right smack in the mainstream … We’ve gained five [percentage] points of share since the release of Polaris.”

Papermaster also said that there is a high potential for the company to break into the autonomous vehicles market as well, after Tesla Inc. (NASDAQ:$TSLA) recently mentioned its consideration of using AMD products.

With all these good news, however, things could still be rocky. Despite this week’s rise in prices, AMD shares still lost 5.1% over the past three months. Meanwhile, heavy competitor Nvidia’s stock went up 51.0%, the PHLX Semiconductor Index (INDEXNASDAQ:$SOX) rose 14.5%, and the S&P 500 Index (INDEXNASDAQ:$SPX) rose 2.7%.

Featured Image: twitter