Earnings estimate revisions are the most powerful force impacting stock prices. Harnessing the power of Earnings Estimate Revisions can supercharge your portfolio. Strong EPS estimates leading to strong performance is not just an assumption – it’s backed by data. Zack’s data shows that stocks whose earnings estimates are being raised are likely to outperform the S&P 500 year after year. Stocks that hold a Zack’s Ranking of 1 exhibit this essential characteristic.

Today we will cover three stocks that boast a Zack’s Ranking of 1 and are pulling into the 50-day moving average. A security that is trading above the 50-day moving average is considered to be in an intermediate-term uptrend. Many investors use the indicator to assess the trend of a stock, though it should not be used in isolation. Using other factors, such as the Zack’s Rank in combination with the 50-day moving average, can lead to better risk-reward scenarios. Below are three stocks in different sectors with top Zack’s Rankings and strong areas of risk to reward:

Pinduoduo Inc (PDD)

is a Shanghai-based e-commerce platform that allows users to participate in group buying deals, primarily through Tencent’s Wechat app. Though Chinese markets have been the victim of a weakening global economy, a real estate crisis, and strict Covid-19 lockdowns, Pinduoduo has shown the ability to rebound from both a fundamental and technical perspective.

Image Source: Zacks Investment Research

Pictured: PDD is drastically outperforming stocks like

Alibaba

BABA

recently.

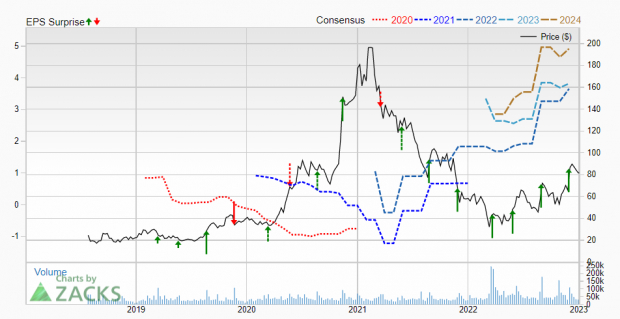

Unlike most Chinese securities (and all securities, for that matter), Pinduoduo has achieved triple-digit earnings growth in the past two quarters. PDD has also surprised on EPS for seven straight quarters.

Image Source: Zacks Investment Research

PDD is finding support at its rising 50-day moving average as Chinese stocks continue to turn around:

Image Source: Zacks Investment Research

Pictured: PDD is in a strong uptrend and is pulling back.

Texas-based

Commercial Metals Company (CMC)

manufactures, recycles, and markets steel and metal products, related materials, and services.

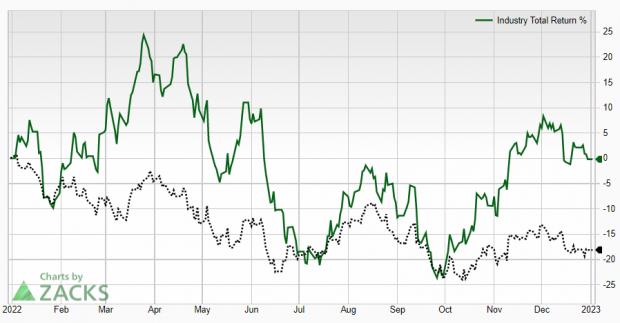

Image Source: Zacks Investment Research

Pictured: The Zack’s Steel Industry has been a rare bright spot.

Not only does Commercial Metals hold a highest possible Zack’s Ranking of 1, but it also has the industry strength wind at its back. The Zack’s Steel Producers group is ranked 9 out of 250 and has other top-ranked stocks such as

Steel Dynamics (STLD), Nucor (NUE),

and

Schnitzer Steel (SCHN).

CMC is pulling into its rising 50-day moving average:

Image Source: Zacks Investment Research

Pictured: CMC is pulling back in an attractive manner.

Over the past three years, you would be hard-pressed to find a stronger stock than beverage maker

Celsius Holdings (CELH).

Amidst a challenging general market backdrop, the stock is up by more than 2,000% in that time.

Image Source: Zacks Investment Research

Pictured: CELH’s eye-popping 3 year performance.

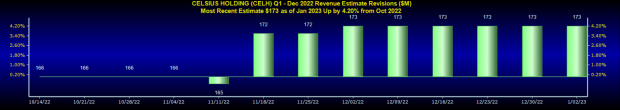

What’s driving earnings for the beverage maker? Celsius’s innovative healthy energy drinks have been caffeinating the underlying stock and revenue. Not counting last quarter (which saw 98% revenue growth), CELH’s revenue has grown at a triple-digit pace for five straight quarters. According to recent revisions, the momentum is unlikely to stop any time soon.

Image Source: Zacks Investment Research

Pictured: CELH Rev trend looks strong.

From a technical perspective, the stock is in a multi-week pullback to support – an attractive area for investors to scoop up shares.

Image Source: Zacks Investment Research

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report