Like a weed growing through an asphalt crack, nature and markets always seem to find a way to recover. After a brutal bear market, an economic slowdown, or a recession takes place, an influx of mergers and acquisitions is one sign that business is picking up again. Why is this? When a larger company acquires a smaller company, the larger company must have the following:

1. The cash or stock on hand to complete the deal.

2. A risk-on, growth mindset, rather than a defensive mindset.

3. An idea that economy has turned or will be healthy enough to sustain the thought process behind the deal.

“Merger Monday” is a term used on Wall Street to label the tendency for companies to announce large deals at the start of the week. Today, details of two potential mega-deals were announced.

Horizon Therapeutics

HZNP

Amgen Inc (AMGN),

a $147 billion-dollar therapeutic company, is embarking on its largest acquisition, Ireland-based

Horizon Therapeutics

HZNP

.

While the acquisition news is not a huge surprise, there were some twists and turns in the road before the deal was agreed upon. Unless the agreement changes last minute, Amgen will buy Horizon for a whopping $26 billion or $116.50 a share (shares closed at $97 Friday).

Late last month, Zacks reported that Horizon held preliminary discussions with industry giants

Sanofi (SNY)

,

Johnson and Johnson

JNJ

,

and Amgen. The interest from three of the biotech industry’s juggernauts sent shares of Horizon jumping 27% last month. Eventually, Sanofi and Johnson and Johnson backed out of the deal due to valuation concerns, leaving the door open for Amgen.

Both Horizon and Amgen have had positive momentum in recent years. In early 2020, the FDA approved Horizon’s biggest drug, Tepezza, a treatment for thyroid eye disease. Meanwhile, Amgen’s deep pipeline of drugs has propelled the company to earn billions in profits and outperform most of its peers. Amgen and Horizon are members of the Medical – Biomedical and Genetics Group, a top 22% Zacks ranked group.

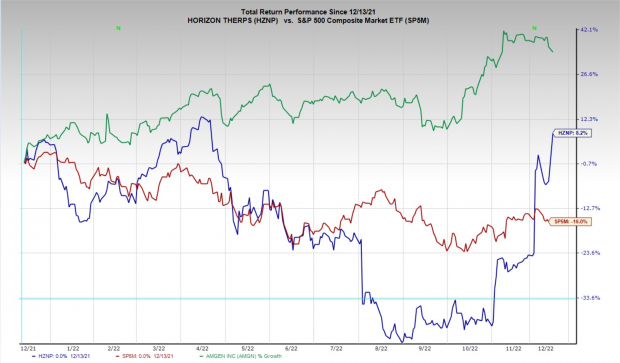

Image Source: Zacks Investment Research

Pictured: AMGN (green) & HZNP (blue) have outperformed the S&P 500 over the past year.

Coupa Software

COUP

Private equity giant Thoma Bravo sees the recent tech crisis as an opportunity. Earlier today, Coupa Software (COUP) announced that Thoma Bravo would purchase the company for 6.15 billion in cash or a 30% premium to last week’s close. Coupa, a cloud-based enterprise software company, saw its shares slide this year as macroeconomic concerns and slowing growth took their toll on the software industry.

Image Source: Zacks Investment Research

Pictured: While COUP’s stock has fallen over the past year, Zacks Revenue Estimates suggest the company is turning the corner.

Despite the rough year in 2021, Zacks Revenue estimates show the company turning the corner in 2023 (revenue for the forward 12 months pictured above). Early in today’s session, investors welcomed the deal.

Box Inc

BOX

vaulted higher by more than 7% after a

JP Morgan

JPM

upgrade.

MongoDB (MDB),

Splunk

SPLK

,

and the

IShares Software ETF

IGV

were solidly green despite the mildly red Nasdaq.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report