Strength in the Marmaxx division has been aiding

The TJX Companies, Inc.

TJX

. The leading off-price retailer is undertaking marketing strategies to fuel growth. Also, its initiatives to enhance offline and online businesses are noteworthy. That being said, The TJX Companies is battling escalated freight costs for a while now.

Let’s delve deeper.

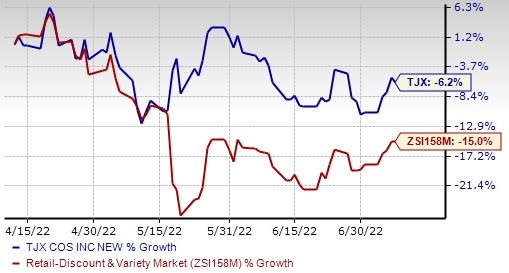

Image Source: Zacks Investment Research

Strength in Marmaxx Unit

During the first quarter of fiscal 2023, The TJX Companies’ Marmaxx (U.S.) division delivered net sales of $6,872 million, up from $6,640 million reported in the year-ago quarter. Comp-store sales rose 3% in Marmaxx, the company’s largest division. The upside was driven by increased customer traffic, up low single digits. Comp sales also gained from Marmaxx’s overall apparel business, which rose 6%. During the quarter, the company witnessed a rise in Marmaxx’s average basket led by increased average tickets stemming from pricing initiatives and apparel sales forming a higher percentage of the mix.

What Else is Working Well for The TJX Companies?

The TJX Companies remains committed to boosting growth through effective marketing initiatives and loyalty programs. Incidentally, its aggressive marketing and advertising campaigns through multiple mediums have been adding growth. In its last earnings call, management highlighted that it is sharpening marketing messages in outlets to emphasize on value leadership to consumers. The company strategically targets pockets of opportunity in specific geographies to boost the messaging. It is on track to attract new shoppers of every age, including a large number of Gen Z and millennial shoppers, to fuel growth. Also, the company’s treasure hunt shopping experience is gaining traction among shoppers.

The TJX Companies has been benefiting from its solid store and e-commerce growth efforts. The company has been expanding its footprint fast in the United States, Europe, Canada and Australia. During first-quarter fiscal 2023, the company increased its store count by 26 to reach 4,715 stores. It increased square footage by 0.4% year over year during this time. In its last earnings call, management highlighted that it witnessed solid demand for an in-person shopping experience in the last few years. Its flexible buying supply chain and store formats aid the company in opening stores across a wide customer demographic.

With an increasing number of consumers resorting to online shopping, The TJX Companies has undertaken several initiatives to boost online sales and strengthen its e-commerce business. Management is optimistic about its capabilities to provide fresh merchandise to its stores and online during the summer season.

High Costs: A Hurdle

The TJX Companies is grappling with increased freight costs. The company’s merchandise margin was hurt by incremental freight pressure in the first quarter of fiscal 2023. For fiscal 2023, management is projecting 150-160 basis points incremental freight expense. Apart from this, The TJX Companies is battling higher selling, general and administrative (SG&A) expenses for a while now. During the fiscal first quarter, the company’s SG&A expenses came in at $2,094.6 million, up from $2,065 million reported in the year-ago quarter.

That said, we believe that the aforementioned upsides will likely help this Zacks Rank #3 (Hold) company stay afloat amid such hurdles.

Although TSN’s stock has decreased 6.2% in the past three months, it has outpaced the

industry

’s 15% decline.

3 Solid Retail Picks

Here are some better-ranked stocks –

Dollar Tree

DLTR

,

Boot Barn Holdings

BOOT

and

Kroger Co.

KR

.

Dollar Tree, a discount variety retail store operator, sports a Zacks Rank #1 (Strong Buy). DLTR has an expected EPS growth rate of 15.5% for three to five years. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Dollar Tree’s current financial-year sales and earnings per share (EPS) suggests growth of 6.7% and 40.5%, respectively, from the year-ago period. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average.

Boot Barn Holdings, a lifestyle retailer of western and work-related footwear, apparel and accessories, sports a Zacks Rank #1. BOOT has an expected EPS growth rate of 20% for three-five years.

The Zacks Consensus Estimate for Boot Barn Holdings’ current financial year sales and EPS suggests growth of 17% and 4.4%, respectively, from the year-ago period’s levels. BOOT has a trailing four-quarter earnings surprise of 25.2%, on average.

Kroger, a renowned grocery retailer, carries a Zacks Rank #2 (Buy). Kroger has a trailing four-quarter earnings surprise of 20.3%, on average. KR has an expected EPS growth rate of 11.3% for three to five years.

The Zacks Consensus Estimate for Kroger’s current financial-year sales and earnings per share suggests growth of 6.7% and 6.3%, respectively, from the year-ago period’s levels. KR has a trailing four-quarter earnings surprise of 20.3%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report