Unfortunately, the recovery of the energy industry is taking a lot longer than what was originally predicted, which has caused a number of investors to abandon their energy stocks. With that said, if you’re a forward-looking investor, this slow recovery makes it a great time to re-think stocks in the sector that are currently selling for a lot less.

As a result, here is a brief overview on the top three oil stocks investors should add to their investing portfolios in June.

-

EOG Resources (NYSE:$EOG)

While it’s true that the oil market is improving, it’s happening at a very slow pace and the sector isn’t in the clear just yet. This is mostly due to oil prices fluctuating around the $50-a-barrel mark for most of 2017, which is far lower than what was originally expected at the start of the year. This could cause problems in the long run for weak producers as there are a number of issues that still need to be worked out.

With that being said, the current state of the oil market hasn’t proven to be a problem for EOG Resources as it worked on improving its operations during the time of the crude oil price decline. This allowed for it to succeed even when there were low oil prices. EOG Resources did this by putting all of its efforts into growing its supply of premium return wells. These premium-return wells achieved 30% returns at $40-a-barrel oil.

Essentially the focus on drilling premium-return wells has changed the game for EOG Resources. The average premium well it drilled last year, for instance, delivered 200,000 barrels of oil within its first year at a cost of only $7,600 per first-year barrels of oil equivalent per day. Compare that with its non-premium wells, which generate half as much oil and cost $17,200 per first-year barrel equivalent per day. Since EOG Resources gets a lot more out of their premium wells, the company plans to spend 80% of its capital on these wells in 2017, which is up from 50% in 2016. As expected, the results from the transition towards premium wells have been exceptional. Just last month EOG Resources released a statement announcing that it crushed its first quarter guidance.

Other than higher returns, EOG is benefiting from this transition in other ways, such as delivering fascinating production growth at a lower breakpoint than its competitors. The majority of its rivals will need oil prices to reach $55 a barrel if they want to fund their budgets for 2017. EOG Resources, on the other hand, is predicted to grow output 18% in 2017 while having cash flow at $50 oil. This will prove to be an advantage for EOG Resources as there will be some companies who need to re-think spending plans if crude oil prices don’t boost.

Based on EOG’S first-quarter report, this company has the chance to advance while others are at risk failing. This, in itself, makes it a top oil stock for investors to consider for June.

-

NOW Inc. (NYSE:$DNOW)

As some may already know, the oil market has not been kind to NOW Inc., who is an oilfield equipment and parts distributor. That said, this is all for a good reason, as oil and gas producers cut their purchases of products they sell during the early stages of the oil decline.

Despite having sequential improvement in revenue in multiple quarters, the stock market continues to look at NOW Inc. negatively, with shares down 13%.

However, according to Baker Hughes of Fool.com, this creates vast opportunities for investors. Hughes stated in his June 2, 2017, rig count that there are twice as many land rigs operating in both the United States and Canada than there were in 2016. Essentially these rigs will consume the parts and supplies that NOW creates and sells, which will allow the company to get back on track to return to profitability faster. Plus this means that oilfield activity will be higher than $50 oil could support in 2016.

If you add that to NOW Inc’s position as a key supplier, you will see that its potential is a lot better than the market may think.

-

Helmerich & Payne (NYSE:$HP)

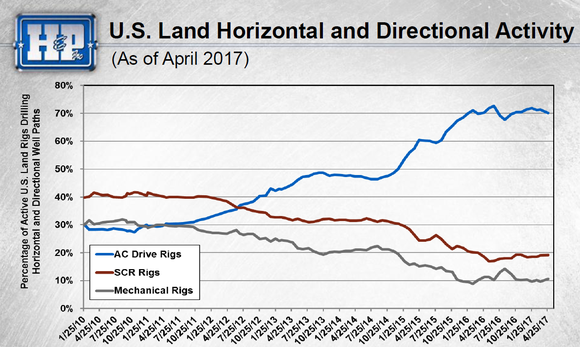

According to the last Baker Hughes report, the total rigs in the sector are 916. This is below the 1,800 rigs that were drilling before the crash. That said, there are a number of new dynamics that need to be taken into consideration. Rigs that are deployed today are a lot more effective at drilling and the ones that are drilling are required to do a complex job. As a result, Helmerich & Payne, with their massive lineup of high-specification risks, are a top oil stock pick for June.

Though oil producers want to cut costs to reach lower breakeven prices, there has been a rush towards quality in the rig sector. Companies who are drilling are choosing to rent rigs that have higher specifications.

The flight to rig quality has played a defining role in Helmerich & Payne’s success as of late and at one point, the company’s management team reported that it would be deploying one new rig every 52 hours. Plus, Helmerich & Payne have obtained a greater market share in North America.

It’s worth noting that even though Helmerich & Payne’s earnings suffered in the past two-quarters due to the company having to spend a lot of money to bring the rigs online quickly, costs are predicted to subside in the coming quarters. This means that the company will soon be in a position where their rigs are in the field when oil prices are down. It’s also important to note that, despite the positive outlook, Helmerich & Payne’s stock took a hit lately, where its shares now have a 5.2% dividend yield.

Overall, now seems like the time to buy a stock in Helmerich & Payne, a company who has proved time and time again to be a great manager of shareholder capital.

Featured Image: Twitter