Volatility has headlined the market year-to-date, leaving investors frustrated and unsure of what’s on the horizon. During these times, it’s beneficial for investors to carry an extra layer of defense within their portfolios.

Investing in blue-chip stocks is a great way to add a level of defense to a portfolio. Blue-chip stocks are companies that have consistently provided quality, reliability, and the ability to operate profitably in both good and bad times.

Additionally, they generally pay dividends – another major perk for investors.

Three companies that fit the criteria – Coca-Cola

KO

, Kroger Co.

KR

, and Johnson & Johnson

JNJ

– would all provide an additional layer of defense.

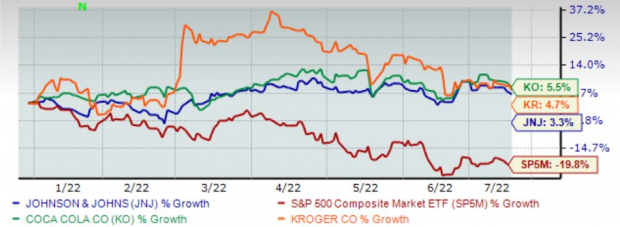

The chart below illustrates the year-to-date performance of all three companies while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three companies are in the green year-to-date and have extensively outperformed the S&P 500.

After all, defense wins ballgames.

Let’s examine each company a little closer for investors seeking an added layer of defense in their portfolios.

Johnson & Johnson

Headquartered in New Jersey, Johnson & Johnson

JNJ

is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods.

JNJ has been the definition of consistency in its quarterly reports – the company has exceeded the Zacks Consensus EPS Estimate in 20 consecutive quarters. In its latest report, JNJ surpassed the bottom-line estimate by 2.7%.

JNJ has increased its dividend for 60 consecutive years, making it a Dividend King. Dividend Kings have raised dividends for at least 50 straight years, putting JNJ in elite company. In addition, the company’s annual dividend yield of 2.6% is much higher than the S&P 500’s and has a payout ratio sitting sustainably at 43% of earnings.

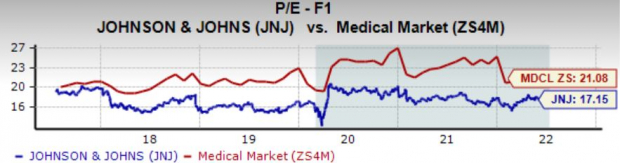

Image Source: Zacks Investment Research

JNJ’s forward earnings multiple resides at 17.2X, just a tick above its five-year median value of 17.0X and below highs of 20.2X in 2020. Furthermore, the value represents a nice 19% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

JNJ is a Zacks Rank #3 (Hold) with an overall VGM Score of a C.

Kroger Co.

The Kroger Co.

KR

, a long-time retailer residing in the thin-margin grocery industry, operates approximately 2,700 retail stores under its various banners and divisions in 35 states.

KR has been on a blazing-hot earnings streak, exceeding bottom-line estimates in ten consecutive quarters dating back to early 2020. In its latest quarter, Kroger shocked the market with a strong 13% bottom-line beat.

Impressively, the retailer has increased its dividend six times over the last five years, with a five-year annualized dividend growth rate of a double-digit 13%. Additionally, KR’s 1.8% annual dividend yield is modestly higher than that of the S&P 500 and has a payout ratio sitting comfortably at 21% of earnings.

Image Source: Zacks Investment Research

Kroger also has enticing valuation metrics, further displayed by its Style Score of an A for Value. The company’s forward earnings multiple resides at 12.2X, just below its five-year median value of 12.5X, and represents an attractive 46% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Kroger is a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

Coca-Cola

The Coca-Cola Company

KO

is the world’s largest beverage company. In addition to its namesake Coca-Cola drinks, a few of its household names include Fanta, Minute Maid juices, Powerade, and Dasani.

The beverage titan has been on an impressive earnings streak; KO has exceeded the Zacks Consensus EPS Estimate in ten consecutive quarters. In addition, Coca-Cola recorded a double-digit 10% EPS beat in its latest quarter.

Like JNJ, Coca-Cola is a fellow Dividend King; 2022 marks the company’s 60th consecutive annual dividend increase, a stellar feat that speaks volumes about the well-established nature of the company. Coca-Cola’s annual dividend yields 2.8%, with a payout ratio sitting at 73% of earnings.

The yield is much higher than the S&P 500’s.

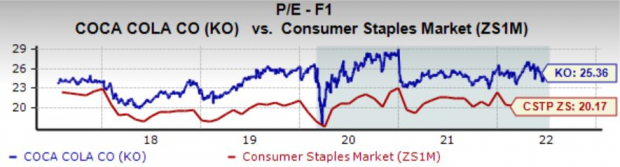

Image Source: Zacks Investment Research

KO’s forward P/E ratio resides at 25.4X, undoubtedly pricey, but the value is well below 2020 highs of 29.1X and just modestly above its five-year median value of 24.4X. Shares trade at a 26% premium relative to its Zacks Sector.

Image Source: Zacks Investment Research

Bottom Line

Investing in blue-chip stocks is a popular way for investors fight back against volatility. In addition, they generally pay dividends, making them even more enticing. After all, who doesn’t enjoy getting paid?

All three companies’ shares above are in the green year-to-date, easily crushing the S&P 500 and displaying their highly-defensive nature. In addition, all three companies have reported strong quarterly results consistently and have fully established themselves as giants in their respective industries.

All three would be solid bets for investors looking to implement a layer of defense into their portfolios.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report