Although the majority of 2022 headlines have been negative, there have also been many positive ones, such as acquisition news.

Companies perform acquisitions for understandable reasons; bigger is better, as large companies carry cost-saving advantages. And, of course, they get their hands on extra talent that allows them to spur innovation and future growth.

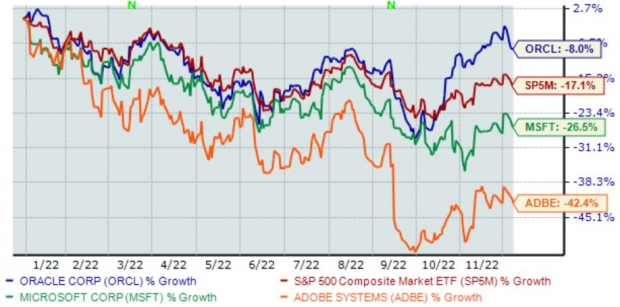

Several companies – Microsoft

MSFT

, Oracle

ORCL

, and Adobe Inc.

ADBE

– have all been on the offensive in 2022, unveiling acquisition news. Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each acquisition.

Microsoft Acquires Activision Blizzard

In January 2022, Microsoft made a significant splash, shaking the gaming world to its core by acquiring Activision Blizzard

ATVI

for a whopping $68.7 billion. It was a massive deal that caught extensive attention, as it ranks as the largest acquisition in the video game industry’s history.

Activision Blizzard is a leader in video game development and an interactive entertainment content publisher, most well-known for

Call of Duty

. MSFT already owns two massive video game titles,

Halo

– the company’s flagship video game, and

Minecraft

– the best-selling game of all time.

Microsoft intends to publish all of ATVI’s hit video game titles onto its Xbox Game Pass; this unique gaming service allows gamers unlimited access to a library of games for a flat monthly rate.

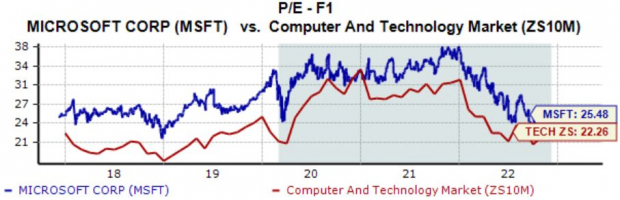

Microsoft shares currently trade at a 25.5X forward earnings multiple, off its 28.5X five-year median and above its Zacks Computer and Technology sector average of 22.3X.

Image Source: Zacks Investment Research

Adobe Acquires Figma

In September 2022, Adobe went on the offensive, announcing its acquisition of Figma for roughly $20 billion in a cash-and-stock transaction.

A privately-held company, Figma is a web-first collaborative design platform structured to aid teams who build products together. The company has made the design process faster and more enjoyable, all while increasing efficiency.

The combined company has a sizable, quickly-growing market opportunity projected to deliver substantial value for customers, shareholders, and the entire industry.

Shantanu Narayen, CEO of Adobe, said, “The combination of Adobe and Figma is transformational and will accelerate our vision for collaborative creativity.”

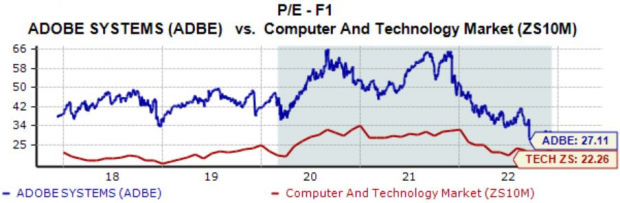

On a relative basis, ADBE shares are cheap; the company’s 27.1X forward earnings multiple is a fraction of its 44.8X five-year median and well off 2021 highs of 65.5X.

Still, the value undoubtedly remains on the higher end of the spectrum, typical of stocks with a high-growth nature.

Image Source: Zacks Investment Research

Oracle Acquires Adi Insights

In May 2022, Oracle unveiled its announcement regarding its acquisition of Adi Insights, a top provider of workforce management solutions.

Regarding the deal’s benefits, Adi Insights brings overtime management, time capture, demand forecasting, and shift scheduling to SuitePeople (NetSuite’s human resource program). It’s worth noting that Oracle leads NetSuite.

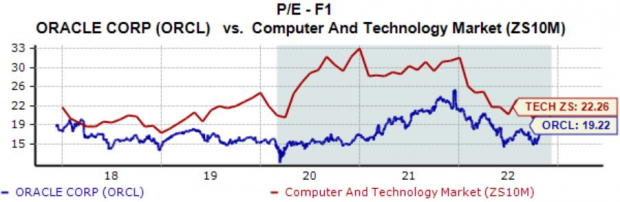

Currently, ORCL shares trade at a 19.2X forward earnings multiple, above the 16.5X five-year median but below the Zacks sector average of 22.3X by a fair margin.

Image Source: Zacks Investment Research

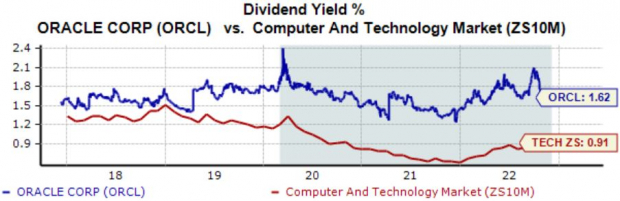

In addition, for those who have an appetite for income, ORCL has that covered; the company’s annual dividend currently yields a solid 1.6%, well above that of its Zacks sector average.

Oracle has also been growing its dividend, upping its payout two times over the last five years, translating to an impressive 14.1% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Coming out of a once-in-a-lifetime pandemic has indeed landed us in a unique economic environment in 2022, to say the least.

A hawkish Federal Reserve, lingering COVID-19 uncertainties, and geopolitical issues have all been thorns in the side of the market.

Still, amid all of the gloom and doom, there have been several notable acquisition announcements coming from sizable tech companies, including Microsoft

MSFT

, Oracle

ORCL

, and Adobe Inc.

ADBE

.

Sometimes, it’s nice to take a step back from the negativity.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report