Toy company Mattel (NASDAQ:$MAT) saw its share price meet hit a decline of 20% year-to-date as of Monday, June 12. While the company has clearly been struggling this year, some investors and traders believe that Mattel is on the edge of a comeback.

While there have been many factors to Mattel’s falling shares, one of the biggest ones is the fact that the company had been operating with an internal strategy that did not follow the market’s trends. The toy company was used to competitors like Hasbro (NASDAQ:$HAS), but it wasn’t prepared for multimedia companies like Disney (NYSE:$DIS).

Consider some of the stuff Mattel’s former CEO Robert A. Eckert said at the company’s annual analyst meeting back in 2011, when the market was a lot more stable:

- “We are well positioned to deliver another Christmas, just as we have for the last 66 years.”

- “Product and product innovation are key reasons for Mattel’s ongoing success.”

- “The Mattel story isn’t just about product per se, but about strategic and global brand management, which is what we do best and what makes us the #1 toy company in the world.”

Eckert’s words represent a stable company who is ready to execute a well-established plan that will allow Mattel to continue to rise above other toy companies. It is clear from Eckert’s quotes that the company is playing on its highly successful legacy — which, in a stable market, can provide large benefits as reliable generate good revenue with low expenses. But in a changing market like today, expecting brands like Hot Wheels and Monsters High toys to always be in demand can create quite an inventory glut if the product is not well received by the public.

It is these preconceived notions of demand that largely caused Mattel’s downfall. To compare, Hasbro’s shares have gone up by 96% since 2014 — turning to licensing as its key strategy. As a result, Hasbro’s market capitalization reached around $14 billion, almost double Mattel’s market capitalization of $7.7 billion.

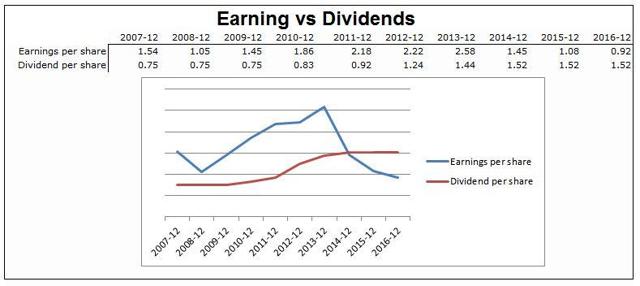

What has been keeping Mattel’s stocks afloat is its high dividend of $0.38, or 6.7%, but now even this could be at risk. Many investors are concerned as the company’s earnings per share (EPS) have dropped by 65% since 2013 while its dividend remained steady. If Mattel’s current state continues, it will be impossible for the dividend to stay at its current level.

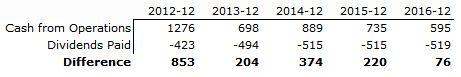

The problem becomes a lot more apparent when one considers the difference between Mattel’s dividends paid out and the cash it’s generated from operations. Over the past few years, the two line items are slowly but surely converging.

While the company is trying to fix the problem it’s created for itself, the plan is a bold and unproven one: to try and take physical brands such as Hot Wheels to digital platforms. Given the rise of technology, however, it is a plan that makes sense and is backed by new CEO Margaret Georgiadis. From the Q1 earnings call transcript, she was recorded to have said some of the following:

- “These next generation power brands will extend toy purchases and unlock adjacent revenue streams in areas such as content, gaming, and experiences.”

- “Connected track and construction systems, technology-enabled cars, gamification and communities of passionate fans.”

- “The future is about integrating digital across our product lines and unlocking more expansive levels of play and community experiences, both for individuals and even teams.”

Compared to 2011, it seems like Mattel is more focused on innovating its growth strategies rather than sticking to traditional ways — surely a good sign for investors. However, those with a bearish view of the company will argue that the plan is unproven and won’t be cheap to execute. As well, a dividend cut is extremely likely, so why buy Mattel’s shares? Considering the numbers, however, some analysts believe that a dividend cut of up to 50% won’t matter much when compared to other companies’ dividends.

Mattel’s current dividend yielding 6.7% is three times higher than Hasbro’s 2.1% yield as well as the 2.2% yield offered by the 10-Year-Treasury. If Mattel cuts its dividend by half — perhaps the worst case scenario — the resulting 3.5% yield would still be a lot higher than Hasbro’s or the one offered by the 10-Year-Treasury. The company will then be able to use the savings from the dividend cut to do share buybacks, invest in its new digital product initiatives, and have a chance for new growth. Once Mattel (hopefully) gets back on its feet, the dividend could be reset.

There is also the possibility that Mattel won’t cut its dividend — in that case, all attention could be the company’s next catalyst: the Cars 3 movie premiere on June 16. The popular Pixar series have helped Mattel’s sales significantly before. According to Drew Crum, an analyst at Stifel (NYSE:$SF), the total merchandising sales from the debut of the first Cars movie in 2006 to the release of Cars 2 in 2011 was $10 billion. From these numbers, there stands a high chance Cars 3 products will help Mattel rake in some good revenues.

Another possibility that Mattel may undertake is a guidance cut. Some analysts believe that it is unlikely, however, as the company had cut its annual guidance about two months ago. The cut was reported on April 10, in Mattel’s poor first quarter results. As well, it is the first quarter in which the company is under the leadership of Georgiadis. Many doubt that Georgiadis will call for two guidance changes in such a short time, as it could signal a lack of knowledge or control of the company.

Overall, considering the fact that Mattel is a historically rich company and have been recently trading near its 5-year lows — investors could benefit greatly from the possible catalyst that is the Cars 3 premiere. Even with a dividend cut, if the catalyst results in success, investors can still benefit.

Besides this, there are also a number of reasons why Mattel’s shares could potentially rise from its ruins. The company has been continuously working through the issue of excessive inventories of the American Girl and Monster High products. Once the issue is resolved, it will allow for better growth in revenue. As well, Mattel’s new management team is looking take full advantage of popular and established brands like Barbie, Hot Wheels, and Fisher-Price. The Cars 3 franchise could continue to help greatly — especially during Christmas season. If this potential catalyst doesn’t pull through, however, Mattel still has a backup plan of cutting the dividend.

In conclusion, the risk compared to the potential rewards could be beneficial for investors. Despite its recent track records, investors could stand to profit from an investment in Mattel.

Featured Image: Facebook