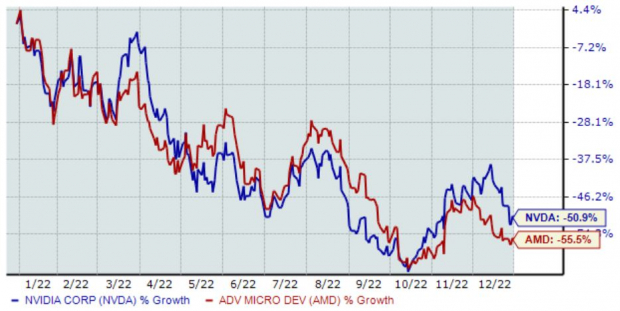

After a scorching-hot run, semiconductor stocks cooled off in 2022, impacting many portfolios. SOXX, the iShares Semiconductor ETF, is down more than 30% year-to-date, widely underperforming compared to the S&P 500.

In addition, other popular chip stocks, including NVIDIA

NVDA

and Advanced Micro Devices

AMD

, have performed poorly in 2022, as shown in the chart below.

Image Source: Zacks Investment Research

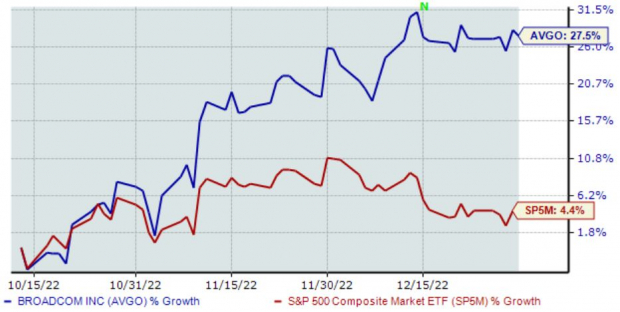

However, Broadcom

AVGO

has entirely snapped the overall bearish trend, with shares climbing more than 25% after bottoming in October. As we can see, the performance has crushed the S&P 500.

Image Source: Zacks Investment Research

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. The company’s products are used in end products such as enterprise and data center networking, home connectivity, set-top boxes, and broadband access, to name a few.

Let’s take a closer look at how the company currently stacks up.

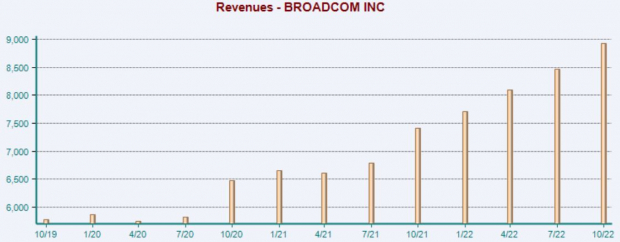

Quarterly Performance

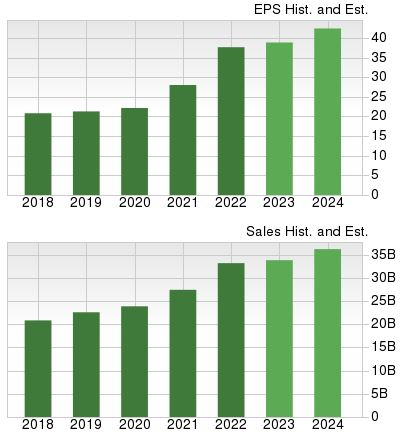

Broadcom’s earnings track record is mighty impressive; AVGO has exceeded top and bottom line estimates in eleven consecutive quarters.

The company penciled in a 1.8% EPS beat paired with revenue 0.4% above expectations in its latest release, providing shares the fuel they needed. AVGO has a favorable revenue trend, as seen in the chart below.

Image Source: Zacks Investment Research

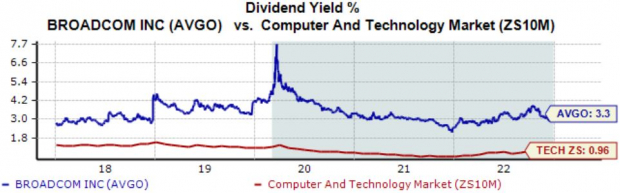

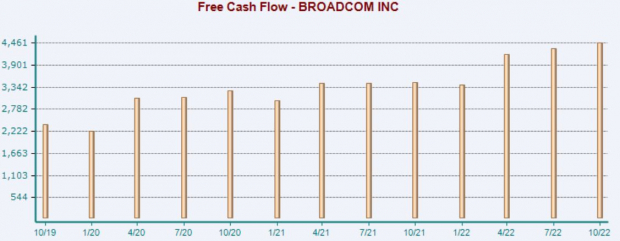

Dividends & Cash Flow

For those that seek income, AVGO has that covered. The company’s annual dividend currently yields a rock-solid 3.3%, notably higher than the Zacks Computer and Technology sector average.

Undoubtedly a positive, the company has shown a commitment to increasingly rewarding its shareholders, upping its dividend payout five times over the last five years and carrying a sizable 26% five-year annualized growth rate.

Image Source: Zacks Investment Research

In addition, the company’s free cash flow strength is hard to ignore; in its latest quarter, Broadcom generated roughly $4.5 billion in free cash flow, good enough for a 4% sequential uptick and an even larger 30% Y/Y uptick.

Image Source: Zacks Investment Research

Growth Outlook

For the cherry on top, Broadcom carries a favorable growth profile, with earnings and revenue forecasted to climb 7.4% and 5% in FY23, respectively.

And in FY24, estimates call for an additional 7% growth in earnings and a 4.9% Y/Y uptick in revenue.

Image Source: Zacks Investment Research

Bottom Line

Semiconductors have sailed through challenging waters in 2022, ending stellar runs.

However, Broadcom

AVGO

has been an exception to the poor performance, widely outperforming other semiconductor stocks and embarking on a strong run since bottoming in October.

The company has consistently exceeded quarterly estimates, rewards investors handsomely, generates solid cash, and has an inspiring growth trajectory for the foreseeable future.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report