There aren’t many stocks that are widely outperforming the market this year. While we are seeing some strength back into growth and technology names in the short-term, the outlook for the remainder of the year (in terms of tech sales and earnings growth) is murky. One area in which we’re still seeing earnings estimates on the rise is discount retail.

Discount retailers primarily sell low-margin consumables such as food, household staples, and seasonal goods. It becomes more challenging for most companies to hold costs low when their own costs are skyrocketing. That’s why it’s very important – particularly in this type of highly inflationary market environment – to identify businesses that are able to pass on these increased costs to consumers without any negative effects.

One of the more defensive businesses, discount retailers are consumer staples that are fairly resilient. The leaders in this space exhibit high pricing power. They can pass on rising costs without losing much volume at all. These defensive companies tend to fare better during inflationary periods and market downturns.

Let’s take a deeper look at a leading discount retailer that is outpacing the market this year.

Dollar Tree, Inc. (

DLTR

)

Dollar Tree operates discount variety retail stores. The company is the largest single-price-point retailer in North America. DLTR provides consumable products such as food and personal care items, household paper and chemicals, health and beauty items, as well as clothing and other fashion accessories. The company acquired Family Dollar back in 2015 to expand its retail reach; it now operates over 16,000 stores in 48 states and five Canadian provinces.

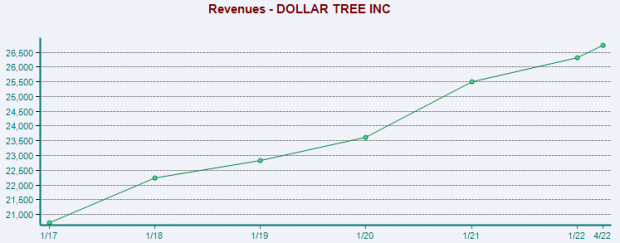

During the first quarter, sales increased 6.5% to $6.9 billion. The company has seen revenues grow steadily over the past several years as shown below. Estimates for the second quarter call for growth of 6.8% year-over-year to $6.77 billion. On an annual basis, the growth outlook remains stable with a 6.69% expected bump in sales to $28.08 billion.

Image Source: Zacks Investment Research

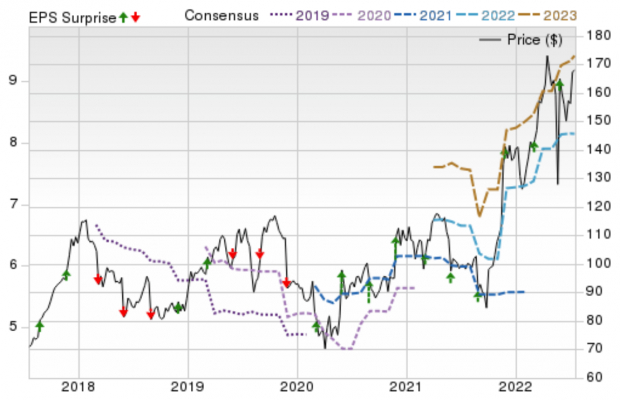

A Zacks Rank #1 (Strong Buy) stock, DLTR has been on a hot streak in terms of earnings surprises, exceeding estimates in each of the past ten quarters. The retailer chain most recently posted Q1 EPS back in May of $2.37/share, a 19.7% surprise over the $1.98 consensus. DLTR has posted a trailing four-quarter average earnings surprise of 13.12%, helping shares advance 74.6% in the past year. The stock is up roughly 23% this year while most stocks have been in bear market territory.

Image Source: Zacks Investment Research

Analysts covering DLTR have upped their full-year EPS estimates by +3.82% in the past 60 days. The Zacks Consensus Estimate now stands at $8.15/share, translating to potential growth of 40.52% relative to last year.

Make sure to keep an eye on this leading discount retailer that is bucking the overall downtrend of the market.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report