The Zacks Cable Television Industry is down -36% year to date but many of these stocks may be on the cusp of oversold territory. Comcast

CMCSA

and Dish Network

DISH

, two of the more notable names in the space, may be drawing investors’ interest as their stocks have bounced off of their October lows.

Let’s see if it’s time to buy Comcast (CMCSA) and Dish Network (DISH), for December and beyond.

Recent & Historical Performance

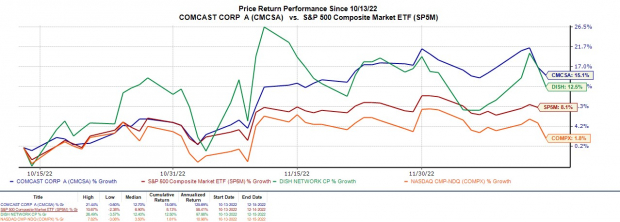

After simultaneously hitting their 52-week lows on October 13, both stocks have started to rebound, with CMCSA up +15% and DISH +12% to outperform broader indexes since Mid-October.

Image Source: Zacks Investment Research

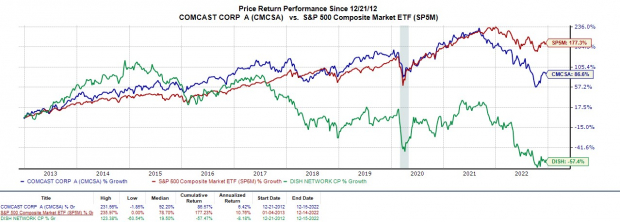

Comcast is down -31% year to date to outperform DISH’s -53%, with both lagging the S&P 500’s -17%. Over the last decade, Comcast’s total return is +86% to crush DISH but still lag the benchmark.

Image Source: Zacks Investment Research

From a decade’s view, Comcast and Dish Network stock might look oversold. Checking their outlook and the value they offer investors at current levels will give a better indication of if now is the time to buy.

Valuation

Trading at $34 per share and roughly 33% from its highs, Comcast has a forward P/E of 9.8X. In comparison, DISH is 59% off its high at around $15 a share and trades at 6X forward earnings.

Image Source: Zacks Investment Research

Both stocks look very attractive relative to their past. Comcast trades well below its decade-high P/E of 21.1X and at a 43% discount from its median of 17.4X. When comparing this period, DISH trades even further from its decade high of 50.1X and 65% beneath its decade median of 17.1X.

EV/EBITDA is also a good valuation metric to consider when looking at the valuation of cable companies. In this regard, both companies also appear to offer nice value at their current levels. Comcast sticks out at just 6.2X its enterprise valu

e but DISH is further below its decade high of 24.6X.

Image Source: Zacks Investment Research

Growth & Outlook

Pivoting to growth, both companies are making a conscious effort to expand into wireless services as linear TV begins to slowly fade and digital streaming continues to grow more popular and, in many cases, replace standard TV.

Companies like Netflix

NFLX

are challenging the core revenue of Comcast and Dish network.The ability to diversify into wireless services appears to be important in sustaining top and bottom lines as Netflix has also launched a cheaper subscription service featuring ads.

Comcast’s wireless revenue accounted for roughly 4% of its total revenue in 2021 at $2.38 billion. In addition to this, Comcast was able to turn its first profit from its wireless segment at $157 million. Last quarter, the company added a record 333,000 new wireless users. Wireless revenue also increased 30.8% during Q3 to $789 million.

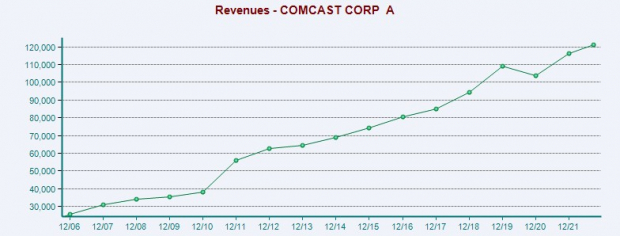

Image Source: Zacks Investment Research

Comcast’s earnings are now expected to jump 12% to $3.61 a share in 2022. Fiscal 2023 EPS is projected to rise another 3%. However, earnings estimate revisions have slightly declined for both FY22 and FY23 over the last 90 days. Sales are projected to be up 4% this year and be virtually flat in FY23 at $120.78 billion. FY23 sales would still represent 11% growth from pre-pandemic levels with 2019 sales at $108.94 billion.

Turning to Dish, the company more recently entered the retail wireless business after it acquired Boost Mobile and Ting Mobile in 2020.

Dish has also worked to expand its network services partnership with TMobile

TMUS

. During the third quarter, T-Mobile transferred 139,000 wireless subscribers to Dish Network which included Boost-branded customers from Sprint. Dish added 1,000 net wireless subscribers compared to a net decrease of 121,000 in Q3 2021. However, Dish still ended the third quarter with 8.01 million retail wireless subscribers, down -8% year over year.

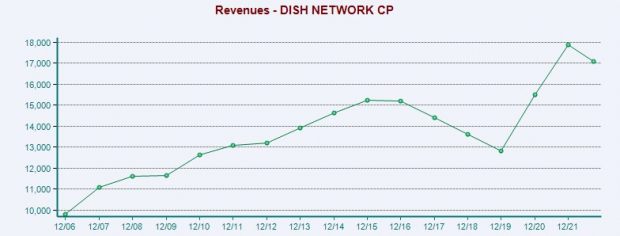

Dish Network earnings are forecasted to decline -31% this year to $2.59 per share. Fiscal 2023 earnings are projected to drop another -50% to $1.29 a share. Still, earnings estimates for FY22 have gone up slightly while FY23 estimates have trended down over the last quarter.

On its top line, Dish Network sales are now projected to drop -6% this year and decline -1% in FY23 to $16.61 billion. FY23 sales would still be a 29% increase from 2019 pre-pandemic sales.

Image Source: Zacks Investment Research

Dividends

Dividends come in handy in the current market environment, and Comcast has the advantage here. CMCSA offers a solid 3.06% annual dividend yield at $1.08 per share. On the other hand, Dish does not offer a dividend at the moment.

Image Source: Zacks Investment Research

Bottom Line

Comcast (CMCSA) and Dish Network (DISH) stock both land a Zacks Rank #3 (Hold). These stocks are starting to look attractive from a valuation perspective with Dish standing out in this regard. However, Comcast’s performance and growth appear to have the edge and CMSA has a generous dividend to support patient investors.

Holding both stocks at current levels could end up being rewarding in 2023. To that point, Comcast and Dish Networks’ fourth quarter earnings and guidance will play a big part in their stocks continuing to climb off of their October lows.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report