Looking for opportunities to buy stocks that could have a big rebound in 2023 will be a common theme over the next two weeks. Some of the most well-known companies had a tough 2022, with Disney

DIS

and Netflix

NFLX

being two that stuck out.

Let’s see what’s going on with the entertainment titans as we move closer to the new year.

Recent Developments

Long-term Disney CEO Bob Iger returned to the helms in November after briefly retiring from the company. Before retirement, Iger more recently served as Executive Chairman but came back to his more active CEO role at the request of the board of directors.

Iger returned after fears that the company and stock would continue falling in his absence. Even amid the surprising but very welcome return for Wall Street, Disney stock is back near its 52-week lows seen in November.

Meanwhile, Netflix has seen some recent volatility as well with the launch of its much-anticipated paid ad service not going as well as planned. News of Netflix missing 20% of its ad targets caused the stock to sell off last week after advertisers reportedly asked that the company return some of the money already paid for advertising slots.

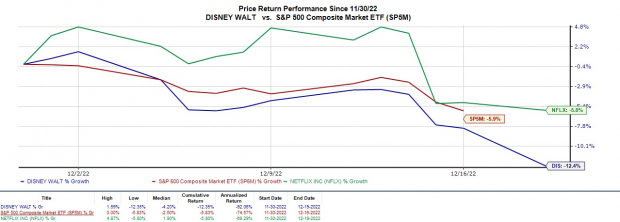

Image Source: Zacks Investment Research

Performance & Valuation

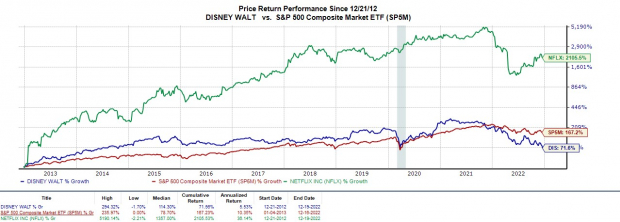

Year to date, Disney’s stock is down -44% Vs. Netflix’s -52%. DIS and NFLX stock has underperformed the S&P 500’s -19% and the Media Conglomerate Markets -37%. Over the last decade, NFLX is still up an astonishing +2,105% to crush DIS’s +71% and the benchmark. Both stocks have outperformed their Zacks Subindustry’s +9%, but Disney lagged the broader market.

Image Source: Zacks Investment Research

Trading around $85 per share and roughly 46% from its highs, Disney has a forward P/E of 22.1X. In comparison, Netflix is 53% off its high at around $288 a share and trades at 28.2X forward earnings.

Disney trades 83% below its decade high of 134.43X and slightly above its median of 19.7X. When comparing this period, Netflix looks much more attractive trading well below its decade high of 2,585X and also at a 74% discount to its median of 110.1X.

Growth

Disney earnings are now expected to jump 15% in its current fiscal year 2023 and climb another 31% in FY24 at $5.34 per share. However, earnings estimate revisions have largely gone down over the last 90 days attributed to operating losses among its streaming segments Disney+ and ESPN+.

Image Source: Zacks Investment Research

Sales are forecasted to rise 10% in FY23 and another 6% in FY24 to $96.61 billion. Fiscal 2024 would be a 25% increase from pre-pandemic levels with 2019 sales at $69.57 billion.

Look at Netflix, earnings are projected to drop -8% in 2022 and rise 3% in fiscal 2023 at $10.67 per share. Earnings estimates are slightly up for FY22 but have trended down for FY23.

Image Source: Zacks Investment Research

On the top line, Netflix’s sales are expected to be up 6% this year and jump another 7% in FY23 to $33.92 billion. FY23 would represent 68% growth from pre-pandemic levels with 2019 sales at $20.15 billion.

Bottom Line & Takeaway

Netflix’s historical performance and valuation could be an indication that the stock is more poised for a 2023 rebound than Disney. Despite Disney’s expected bottom line growth in its FY23 and FY24, earnings estimate revisions have continued to largely trend down for both years landing the stock a Zacks Rank #5 (Strong Sell) at the moment.

On the other hand, earnings estimate revisions have started to go up in Netflix’s FY22 with the stock currently landing a Zacks Rank #3 (Hold). Netflix also appears to be the better long-term choice at the moment for 2023 and beyond as indicated in its top-line growth despite short-term headwinds with its paid ad business.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report