The opportunity to invest in companies with strong growth prospects is often found in the tech sector. Furthermore, this year’s decline in tech stocks has created favorable opportunities for investors to buy shares of popular technology companies.

DocuSign

DOCU

and Block

SQ

, in particular, appear to be examples of growth stocks to buy at a discount after a 2022 tumble. Let’s see if it’s time to buy these stocks for 2023 and beyond.

Synopsis

Both DocuSign and Block are relatively newer tech companies, giving investors the opportunity to invest in what is somewhat the beginning stages of their growth.

Square/Block was founded in 2009 and went public in 2015. Formerly Square, Block has become a viable player in digital payment and point-of-sale services. Block is most known for its Square reader which allows entrepreneurs and smaller businesses to easily process transactions and take payments. However, the company is aspiring to become a consumer and business digital financial hub to include lending, cash app, and cryptocurrency services.

DocuSign has carved a niche of its own after its incorporation in 2003. With the DocuSign Agreement Cloud, its platform is a digitalized process that expedites the entire agreement process allowing users to sign contracts and other documents.

Although 2022 was rough for these two growth stocks their business models are promising for the future of technology services.

Performance & Valuation

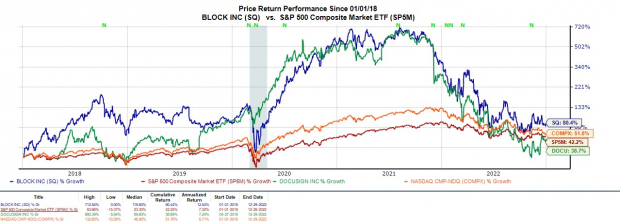

Block stock is down -61% in 2022 vs. DocuSign’s -66%. Both stocks have underperformed the S&P 500’s -22% and the Nasdaq’s -33% performances. Over the last five years, Block stock is still up an impressive +80% to top DocuSign’s +39% and the broader indexes.

Image Source: Zacks Investment Research

After this year’s drop, DocuSign and Block are now trading at reasonable and more realistic valuations relative to their past. Trading around $55 per share DOCU stock trades at 27.4X forward earnings compared to its five-year high of 6,201X. In comparison, SQ stock trades at $62 a share at 54.8X forward earnings with its five-year high being 8,362X.

Looking at the PEG ratio is also ideal for combining the price-to-earnings valuation with the company’s growth rate. In this regard, DocuSign is closing in on the optimal level of less than 1. DOCU currently has a PEG of 2 with SQ at 4.2. Both stocks are getting closer to the technology services industry average of 1.8.

Growth & Outlook

DocuSign earnings are expected to decline -2% in its current fiscal 2023 at $1.93 per share. Fiscal 2024 earnings are projected to jump 12% to $2.16 a share. Even better, earnings estimate revisions have largely gone up for both FY23 and FY24 over the last 90 days. Sales are forecasted to climb 18% in FY23 and rise another 8% in FY24 to $2.69 billion. Fiscal 2024 would be a stellar 284% increase from pre-pandemic levels with 2019 sales at $701 million.

Image Source: Zacks Investment Research

Pivoting to Block, earnings are forecasted to drop -37% in 2022 at $1.08 per share. However, FY23 earnings are expected to climb 59% to $1.72 a share. Earnings estimate revisions have also gone up for SQ stock over the last quarter. On the top line, sales are expected to dip -1% this year but jump 10% in FY23 at $19.20 billion. Fiscal 2023 would be an astounding 308% increase from pre-pandemic levels with 2019 sales at $4.71 billion.

Image Source: Zacks Investment Research

Bottom Line

Both DocuSign and Block appear to be solid investments for 2023 and beyond. With that being said, DOCU stock sticks out with earnings estimate revisions going up significantly, landing the stock a Zacks Rank #1 (Strong Buy). Earnings estimates have also trended higher for SQ stock, but not at the magnitude of DOCU. SQ stock currently lands a Zack Rank #3 (Hold).

From a long-term perspective, both stocks are worthy candidates for growth and this year’s decline appears to have created a nice opportunity for investors.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report