There have been some bright spots among healthcare stocks this year, particularly among the larger-cap equities. The Large Cap-Pharmaceuticals Industry is currently in the top 34% of over 250 Zacks Industries.

The collective total return for the industry is +15% with AbbVie

ABBV

and Eli Lilly

LLY

being two of the top performers in the space. Is now a good time to buy these two pharmaceutical giants for 2023?

Here is a fundamental view of what’s going on with Abbie and Eli Lilly stock as we get closer to the new year.

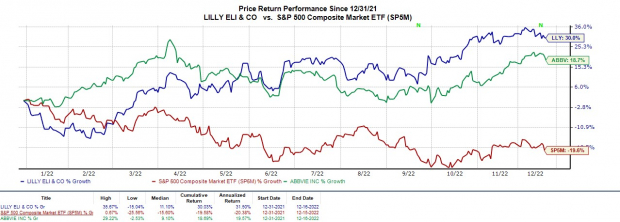

Recent & Historical Performance

Eli Lilly is up + 30% year to date to top AbbVie’s +19%. Both stocks have been defensive in nature and crushed the S&P 500’s -19% YTD performance. This has also outperformed the Large Cap-Pharmaceutical’s +12% price performance.

Image Source: Zacks Investment Research

More impressive, over the last decade, Eli Lilly’s total return is +823% with AbbVie at +601% to beat the benchmark and their Zacks Subindustry’s +255%.

Image Source: Zacks Investment Research

Valuation & Growth

Trading at $359 per share and roughly 4% from its highs, Eli Lilly has a forward P/E of 46.3X. In comparison, AbbVie is 9% off its high at around $160 a share and trades at just 11.6X forward earnings.

Eli Lilly trades just below its decade high of 48.3X but 120% above its median of 21X. When comparing this period, AbbVie looks much more attractive trading at a 45% discount to its decade high of 21.1X and slightly below the median of 11.9X.

Image Source: Zacks Investment Research

Pivoting to growth, Eli Lilly’s sales are expected to be virtually flat in 2022 and rise 7% in fiscal 2023 to $30.51 billion. On the bottom line, earnings are projected to dip -5% this year but jump 16% in FY23 at $9.03 per share. It is important to note that earnings estimate revisions have gone down for both FY22 and FY23.

Looking at AbbVie, earnings are now projected to rise 9% this year but drop -17% in FY23 at $11.43 a share. Earnings estimates have also gone down for AbbVie over the last 90 days. On the top line, sales are forecasted to be up 4% in 2022 but decline -8% in FY23 to $53.74 billion.

Dividends

The stellar total return of both stocks over the last decade shows how beneficial their dividend can be. This is certainly important to investors for additional income outside of a stock’s price performance in the current market environment.

In this regard, AbbVie has the edge again with a 3.46% dividend yield vs. Eli Lilly’s 1.09%.

Image Source: Zacks Investment Research

Bottom Line

Eli Lilly and AbbVie stock both land a Zacks Rank #3 (Hold) at the moment. Both stocks appear to be worth considering for your 2023 portfolio as their YTD performance has fought off inflationary concerns in the broader market.

AbbVie’s valuation, in particular, makes it a potentially strong candidate for 2023, while Eli Lilly’s growth could support its stock next year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report