Rebalancing your stock portfolio is a task that many investors will be focusing on in December and January. The movement into value stocks that can sustain growth amid tougher operating environments is likely to continue into FY23.

Looking at large-cap stocks with solid value and room for growth is important in the current economic environment. Here are two stocks that will draw heavy consideration as we close out Q4 and 2022.

Costco

COST

Among the Retail and Wholesale sector, Costco (COST) shares are looking attractive. COST trades at $481 per share and 21% from its high of $612.27 a share in April and its Retail-Discount Stores Industry is in the top 19% of over 250 Zacks industries.

The bulk provider of food and general merchandise including household products and appliances could see a boost from increased spending during the holiday shopping season. Costco’s discounted prices through its membership program is why the company is so unique among retailers.

Costco stock is down -15% YTD to nearly match the S&P 500’s -17% and its peer group’s -18%, which includes notable companies such as Target

TGT

and Dollar General

DG

. COST’s total return over the last decade including its dividend is +498% to blow away the benchmark and its peer’s +280%.

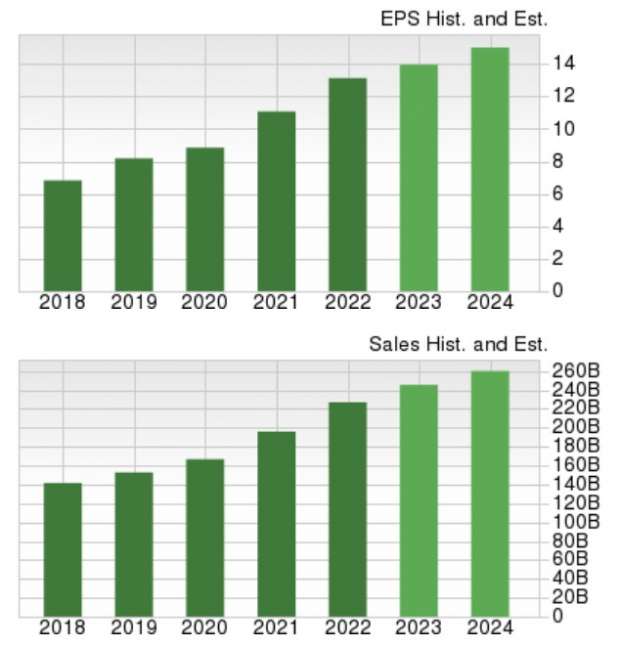

Image Source: Zacks Investment Research

Costco stock is not cheap in terms of its price per share, but its past performance and industry dominance certainly makes the stock intriguing.

Costco’s earnings are expected to rise 9% in its current FY23. Fiscal 2024 earnings are expected to climb another 9% at $15.81 per share. Earnings estimate revisions are slightly up for FY23, but have trended down for FY24 over the last 90 days.

Image Source: Zacks Investment Research

Sales are forecasted to jump 8% in FY23 and rise another 6% in FY24 to $259.77 billion. With sales at $152.70 billion in 2019, FY24 would represent 70% sales growth from pre-pandemic levels. This appears to support investors who may be considering the stock for 2023 and showcases impressive growth for a company its size and age.

Glancing at valuation, Costco shares trade at 33.9X forward earnings. This is slightly above the industry average of 27.1X. Costco does trade 26% beneath its decade-high of 46.1X and closer to the median of 29X.

Image Source: Zacks Investment Research

Costco sports an overall “B” VGM grade in our Style Scores system and lands a Zacks Rank #3 (Hold). Costco offers investors a respectable 0.74% annual dividend yield at $3.60 per share and the average Zacks Price Target suggests 15% upside from current levels.

Microsoft

MSFT

Microsoft (MSFT) is starting to stand out again within a Computer-Software Industry that is currently in the top 27% of all Zacks industries The software behemoth trades 29% below its 52-week highs seen last December.

Consumer spending among technology products and services may continue to lag with higher inflation still lingering throughout the economy but Microsoft may be poised for a rebound.

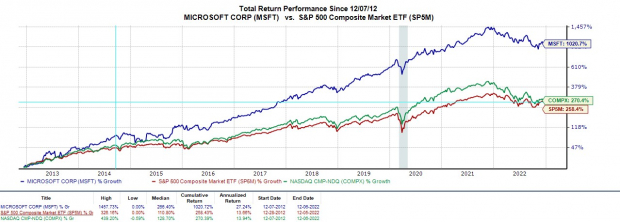

MSFT is down -27% YTD to underperform the benchmark and nearly match the Nasdaq’s -29% drop. However, over the last decade, MSFT’s total return is +1,021% to crush the broader indexes.

Image Source: Zacks Investment Research

Those looking to add positions or buy Microsoft stock for the first time may see this year’s drop as a long-term opportunity.

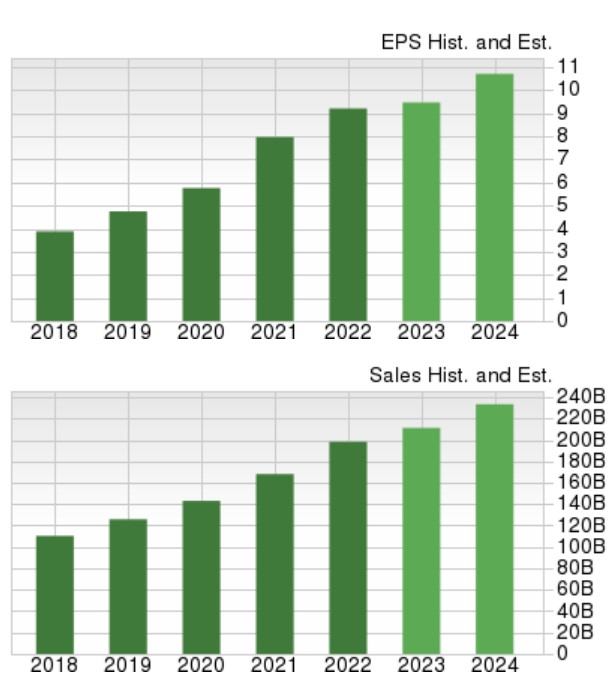

Microsoft’s “A” Style Scores grade for Growth makes up for what the stock lacks in momentum at the moment. Earnings are expected to be up 3% in MSFT’s current fiscal 2023. FY24 earnings are projected to jump 14% to $10.92 per share. With that being said, earnings estimate revisions have trended down over the last quarter, as they have for the S&P 500.

On the top line, sales are projected to rise 7% in FY23 and climb antoher 13% in FY24 to $239.40 billion. FY24 would represent a 90% increase from 2019 pre-pandemic sales.

Image Source: Zacks Investment Research

MSFT should be able to satisfy investors looking for long-term growth as it continues to expand its presence in cloud computing services. Intelligent cloud, including Azure cloud services, contributed to 38% of fiscal 2022 revenues.

Turning to valuation, Microsoft trades at 26X forward earnings. This is on par with the industry average. Microsoft shares trade at a 30% discount to their decade high of 37.4X and closer to the median of 23.5X.

Image Source: Zacks Investment Research

Microsoft has an overall “C” VGM grade and a Zacks Rank #3 (Hold). Microsoft gives investors a modest 1.09% annual dividend yield at $2.72 per share and the average Zacks Price Target suggests 18% upside from current levels.

Bottom Line

There may be better buying opportunities ahead, but Costco (COST) and Microsoft (MSFT) stocks do appear to be trading at discounts. Both companies also look like viable options to invest in for growth going into FY23. This is important as many companies and industries are expected to struggle next year as the economy slows.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report