Past performance is, of course, not always an indication of future success but strong management and historical dominance are surely a calming feeling for investors.

Two stocks that come to mind in this regard are Deere & Company

DE

and International Business Machines

IBM

. Let’s see if this narrative supports buying shares of these two iconic companies at the moment.

Overview

While Deere and IBM’s businesses are very different, they have both been staples of the American and global economy for many years.

Deere & Company was founded in 1837 and has established itself as the world’s largest producer and manufacturer of agricultural equipment and machinery.

International Business Machines has a long history as well. IBM was founded in 1911 and became one of the world’s most recognizable companies and a leading producer and distributor of computer hardware and software. To that note, IBM has started to adapt to current technological times to include cloud computing along with its data analytics.

Over the years, both companies have paid out nice dividends to investors, with Deere’s current annual yield at 1.03% ($4.52) and IBM’s at 4.48% ($6.60).

Historical Performance

Looking back 30 years, we can see the performance of both stocks has been stellar. Deere’s performance sticks out though, DE is up an astonishing +5,590% Vs. IBM’s very respectable +1069%.

Image Source: Zacks Investment Research

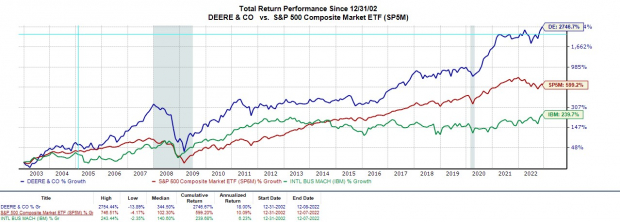

From a 20-year view, Deere’s continued dominance becomes clearer. Including dividends, DE’s total return during this period is a staggering +2,746% to easily top IBM’s +240% and the S&P 500’s 599%.

Image Source: Zacks Investment Research

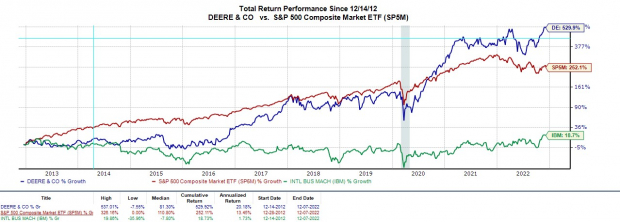

As we look over the last decade in the chart below, we can see the trend in Deer’s dominant performance continues and IBM begins to further lag the benchmark.

Companies in Deere’s Industrial Products sector are not as pressed with having to innovate as businesses in IBM’s technology sector.

IBM stock has been stable but has mostly remained in the $100-$150 range for the last 10 years as newer tech companies like Apple

AAPL

have enjoyed better price performance during more current tech waves.

In comparison, AAPL’s total return in the last decade is +800% which has topped Deere as well. Still, DE and IBM have been reliable investments in their own right and have been around much longer.

Image Source: Zacks Investment Research

Recent Performance

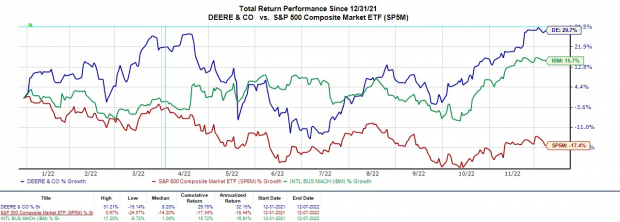

Historically speaking, both Deere and IBM have done well for investors. However, DE has continued its very impressive performance from decade to decade, while IBM stock began to lose its sizzle from the Dot.com bubble.

Interestingly, over the last year, IBM’s total return is +25% to slightly edge DE’s +23% and crush the benchmark. YTD, DE is up +30% Vs. IBM’s +16%. Both stocks have continued to blast the benchmark’s bearish-like performance.

Image Source: Zacks Investment Research

Outlook & Future Success

Deere & IBM’s recent performance does support the narrative that companies with strong historical performances can be great stocks to buy during economic uncertainty. Furthermore, a glance at both companies’ outlooks could help solidify this going forward.

Deere & Co’s current FY23 earnings are now expected to jump 17% at $27.28 per share. Fiscal 2024 earnings are projected to rise another 7%. Even better, earnings estimate revisions for both FY23 and FY24 have trended higher over the last 90 days.

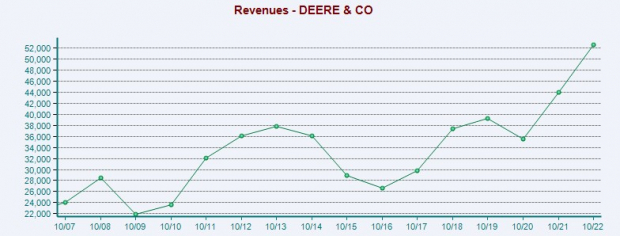

Image Source: Zacks Investment Research

Deere’s revenue growth has been very impressive as illustrated in the above chart. Sales are forecasted to climb 13% in FY23 and rise another 2% in FY24 to $55.37 billion. FY24 would represent 41% revenue growth from pre-pandemic levels with 2019 sales at $39.25 billion.

Pivoting to IBM, earnings are now expected to rise 15% this year to $9.12 per share. Fiscal 2023 earrings are projected to rise another 6%. With that being said earnings estimate revisions have trended down over the last quarter for this year and FY23.

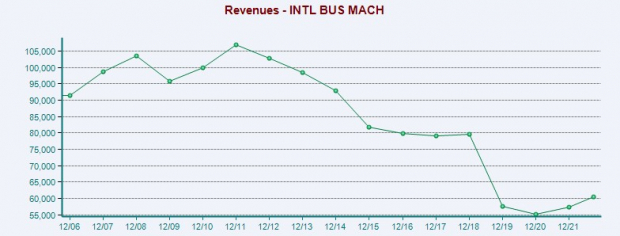

Image Source: Zacks Investment Research

On the top line, sales are forecasted to dip -16% in FY22, which makes what IBM can accomplish on its bottom line this year more impressive. Fiscal 2023 sales are expected to rise 1% at $59.90 billion. However, FY23 sales would represent a 22% decrease from pre-pandemic levels with 2019 sales at $77.14 billion.

Deere & Company’s outlook certainly supports that its future success will continue while IBM stock is less approachable in this regard despite impressive bottom-line growth.

Valuation & Significance

Deere stock trades at 15.9X forward earnings which is near IBM’s 16.1X. However, DE stock looks more attractive relative to its past. DE stock trades at a 50% discount to its decade high of 31.8X while IBM trades around its decade high of 16.3X.

Image Source: Zacks Investment Research

In addition to this, DE trades near its decade median of 16.6X, while IBM trades 47% above its decade-long median of 10.9X.

With Deere trading at $442 per share and near its 52-week highs the stock still appears to have more upside from a valuation standpoint. IBM also trades near its highs at $147 per share. But in terms of value, now may not be the best entry point or opportunity to buy IBM.

Bottom Line

The recent performance of Deere and IBM has been impressive. This certainly supports the narrative that these iconic companies are strong investments during economic uncertainty.

Deere, in particular, looks like a sound investment at the moment sporting a Zacks Rank #2 (Buy) in correlation with rising earnings estimate revisions. On the contrary, IBM lands a Zacks Rank #3 (Hold) as earnings estimate revisions are down despite solid growth expected for the company.

One thing is for sure, both of these iconic stocks will draw investors’ interest as we head into 2023 with their performances continuing to stand out.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.

>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report