It’s certainly not every investor’s cup of tea but investing in agriculture stocks can be quite beneficial. If you’re new to this sector of the market, agriculture stocks can include everything from farm equipment producers to agriculture chemicals and seed companies. Some of the major agriculture stocks include the following: Potash Corp. of Saskatchewan (NYSE:$POT), Mosaic Company (NYSE:$MOS), Agrium (NYSE:$AGCO), Deere & Company (NYSE:$DE), and Monsanto Company (NYSE:$MON).

The question that remains is, which of these agriculture stocks is a buy? Here are three stocks that investors should consider adding to their investment portfolio.

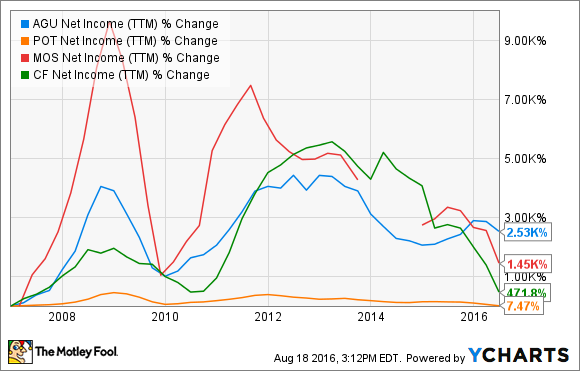

1.Agrium Inc.

Agrium is a Calgary-based fertilizer company and possibly one of the most variegated agriculture stocks in the industry. Even though the company gets a massive portion of sales from its retail business (seeds and crop-protection products), fertilizers continue to make up a greater chunk of its profit. That said, this has proven to be a problem because the fertilizer market has entered a depression. On the other hand, diversification has helped Agrium see in the dark better than pure-fertilizer plays such as Mosaic and CF Industries. Below is a chart which compares Agrium’s net income growth in the past decade to other agribusiness companies, such as Potash Corp.

It wasn’t until about three years ago, after the company was forced to reconsider its capital allocation policies, did Agrium stop being selfish about returning profits to shareholders. Since then, Agrium has seen its dividends more than quadruple and share repurchases have gone past $1 billion since 2012. Additionally, Agrium’s free cash flow per share has doubled since 2013.

Experts have predicted that capital expenditures will taper in the next few years, which means that Agrium’s cash flows and shareholder returns will increase even higher. If Agrium wants to be in position for growth when the cycle turns, the company needs to focus on expanding its retail distribution network.

2.Deere & Company.

Did you know that this is Warren Buffett’s favorite agricultural equipment stock? Deere & Company manufactures farming equipment, and without this, there wouldn’t be any way of growing crops or applying fertilizers evenly.

Deere has quite the competitive edge in comparison to its rivals as it has an advanced global footprint and distribution network, leadership and a finance arm that gives loans to customers. This edge is shown in the company’s numbers. For instance, in 2015 Deere had a return on equity of 24%.

Like Agrium, Deere is relatively diverse and we have seen them produce almost a quarter of its revenue from their forestry companies and construction-equipment. Additionally, Deere is the largest producer of four-wheeled self-driving vehicles in the United States.

Those invested in Deere have had quite a bit of luck as the company tripled its dividend in the past decade and has repurchased shares that are worth $16.4. Keep in mind that if you buy this agriculture stock today, there may be similar results in the coming years.

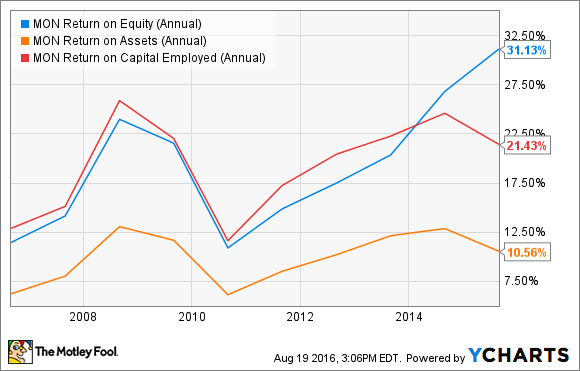

3.Monsanto Company.

As controversial as this company may be, Monsanto has a promising agriculture stock. Surprisingly, the Missouri-based company’s double-digit percentage returns are not a stroke of luck. Monsanto is unique in it’s own way as it develops seed traits but they also license them to other companies, including their competitors. Plus, the company has an advanced research and development pipeline and there has been increased global penetration of its corn and soybean traits. As a result, the company plans to grow its earnings per share by mid-teen percentages between 2017 and 2021.

Due to Bayers most recent buyout bid, Monsanto is now a potential takeover target. Despite declining Bayer’s offer, the two companies are thought to be in the talks of a potential transaction. If this were to happen, this merge would result in the globe’s largest agricultural chemicals company. But if this merger does not come about, Monsanto will look for other growth opportunities. Regardless of the direction that the company heads in, investors who add this agriculture stock to their portfolio can expect good things to come.

Featured Image: twitter