U.S. stock markets have been suffering from extreme volatility since the last week of December. All major stock indexes have fluctuated 2-3% in either direction almost regularly. The primary reasons are the rapid spread of the Omicron variant of coronavirus and market participants’ concerns regarding a tougher-than-expected hawkish Fed.

Nevertheless, the fundamentals of the U.S. economy remain strong and the proposed $1.2 billion infrastructure plan of the Biden administration should drive the stock markets. Robust performance of the U.S. economy and record-high corporate profit in 2021 are the other positives.

At this stage, investment in U.S. corporate behemoths that are currently trading at a lucrative multiple with a favorable Zacks Rank should be fruitful. Five such stocks are

General Motors Co.

GM

,

Tesla Inc.

TSLA

,

Marvell Technology Inc.

MRVL

,

FedEx Corp.

FDX

and

Zoetis Inc.

ZTS

.

A More Hawkish Fed

On Jan 26, after the conclusion of the first Fed FOMC meeting of this year, Chairman Jerome Powell signaled the first rate hike in three years as early as in March. The central bank’s quantitative easing program will also come to an end in March.

Although the Fed refrained from stating the month and magnitude of the interest rate hike, Powell said, “Inflation risks are still to the upside in the views of most FOMC participants, and certainly in my view as well. There’s a risk that the high inflation we are seeing will be prolonged. There’s a risk that it will move even higher.”

The Fed Chairman further added, “In light of the remarkable progress we’ve seen in the labor market and inflation that is well-above our 2% long-run goal, the economy no longer needs sustained high levels of monetary policy support.”

In a separate press statement, the FOMC has also indicated that the Fed is thinking of shrinking its $9 trillion balance sheet later this year. Powell said, “There’s a substantial amount of shrinkage in the balance sheet to be done. That’s going to take some time. We want that process to be orderly and predictable.”

Wall Street Tumbles

Wall Street plummeted in January owing to huge uncertainty regarding the movement of liquidity and market interest rate going forward. Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have tumbled 4.4%, 7% and 12% respectively.

The Nasdaq Composite is in deep correction territory plunging 15.1% from its all-time high. The S&P 500 briefly entered the correction zone last week and is currently trading 8% down from its all-time high. The Dow has slipped 6% from its all-time high. The small-cap-centric Russell 2000 is also in deep correction territory plummeting 19.9% from its all-time high.

Our Top Picks

We have narrowed our search to five U.S. corporate giants (market capital > $50 billion) that are currently trading on the dip. These stocks have positive growth potential for 2022 and have witnessed solid earnings estimate revisions within the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

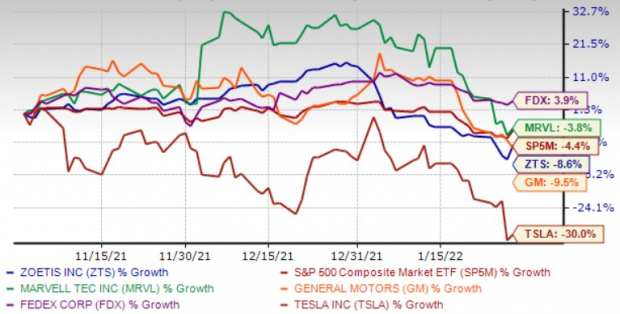

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Tesla

has acquired a substantial market share within the electric car segment. Increasing Model 3 delivery, which forms a significant chunk of TSLA’s overall deliveries, is aiding its top line. Along with Model 3, Model Y is contributing to its revenues.

In addition to increasing automotive revenues, Tesla’s energy generation and storage revenues should boost its earnings prospects. TSLA said that its overall deliveries surged 20% in the third quarter from its previous record in the second quarter, marking the sixth consecutive quarter-on-quarter gain.

Tesla has an expected earnings growth rate of 31.7% for the current year. The Zacks Consensus Estimate for current-year earnings improved 3.2% over the last 7 days. This Zacks Rank #1 stock is currently trading at a 39.7% discount from its 52-week high.

General Motors

faced challenges in the second half of 2021 due to semiconductor-driven plant downtime. While the plan to spend $35 billion through 2025 to launch gen-next EVs and self-driving vehicles augur well for GM, it would strain near-term margins.

Nevertheless, General Motors’ hot-selling brands in America like Chevrolet Silverado and Equinox along with upcoming electric vehicle launches including GMC Hummer EV and Cadillac Lyriq EV are likely to boost its prospects. GM’s Ultium Drive system and collaborations with Honda and EVgo are likely to scale up its e-mobility prowess.

General Motors has an expected earnings growth rate of 2.1% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the last 7 days. This Zacks Rank #1 stock is currently trading at a 25.2% discount from its 52-week high.

Marvell Technology

is benefiting from solid demand for its storage and networking chips from the 5G infrastructure and data-center end markets. Strong supply-chain executions are helping MRVL to address the strong demand from cloud datacenters for its Smart NICs and security adapters.

Moreover, the wireless infrastructure business of Marvel Technology is showing signs of improvements. The recent acquisition of Inphi is boosting the top line of MRVL. Further, the storage business is steadily recovering from the coronavirus impacts.

Marvel Technology has an expected earnings growth rate of 42.6% for the current year (ending January 2023). The Zacks Consensus Estimate for current-year earnings improved 15.7% over the last 60 days. This Zacks Rank #1 stock is currently trading at a 29.3% discount from its 52-week high.

FedEx

‘s efforts to reward its shareholders through dividends and buybacks even in the current challenging scenario is noteworthy. In line with its shareholder-friendly approach, FedEx’s board cleared a new $5-billion stock buyback program last year. FDX’s liquidity position is also solid. Favorable pricing and a healthy demand scenario.are also aiding FedEx.

FDX has an expected earnings growth rate of 14.6% for the current year (ending May 2022). The Zacks Consensus Estimate for current-year earnings improved 0.5% over the last 30 days. This Zacks Rank #2 stock is currently trading at a 23.5% discount from its 52-week high.

Zoetis

’ momentum continues on its innovative portfolio of petcare parasiticides, including Simparica Trio, as well as dermatology products (Apoquel and Cytopoint). ZTS also upped its annual guidance. The uptake of Librela and Solensia, its new monoclonal antibody (mAb) therapies for osteoarthritis pain in dogs and cats, is encouraging in Europe and should boost growth.

The companion animal portfolio maintains momentum for Zoetis. The launch of innovative products (ProHeart, Librela, Revolution Plus, and many vaccines) bolstered the portfolio and should fuel the growth of ZTS in the upcoming quarters.

Zoetis has an expected earnings growth rate of 11.2% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.6% over the last 60 days. This Zacks Rank #2 stock is currently trading at a 21.7% discount from its 52-week high.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report