TransDigm Group Incorporated

TDG

has signed an agreement to buy DART Aerospace, a provider of highly engineered, unique helicopter mission equipment solutions. Valued at $360 million, this acquisition deal is expected to bolster TransDigm’s position in the global helicopter market.

The buyout is projected to get completed by the second quarter of 2022.

Rationale Behind the Acquisition

Lately, it has been observed that defense majors are frequently engaging in strategic mergers and acquisitions to expand and diversify their product portfolios. Such transactions have been increasingly gaining importance as these enable companies to achieve desired growth by expanding operations, and provide access to new capabilities and emerging technologies. This, in turn, leads to enhanced quality of products and services.

Such consolidations have not only been helping defense primes capture increased share in the growing defense space but also achieve improved scales of economies. We believe the said factors played a crucial role in TransDigm’s latest acquisition agreement.

Acquisition Prospects

Increased demand for combat helicopters amid widespread global geopolitical instability along with rising demand for utility helicopters, particularly for lightweight and emergency medical services, have been boosting the prospect of the global helicopter market.

Markets and Markets research firm projects the global helicopter market size to grow from $21.3 billion in 2020 to $36.9 billion by 2025, at a CAGR of 11.7% from 2020 to 2025.

Considering such solid growth prospects of the global helicopter market along with the fact that DART Aerospace is an industry leader in helicopter mission equipment and its unique helicopter solutions fit well with TDG’s proprietary and aftermarket-focused value generation strategy, the latest buyout decision is expected to bolster TransDigm’s future revenues.

Acquisitions by Peers

Of late, we have witnessed quite a few major mergers and acquisitions within the U.S. defense space despite the global volatile market conditions stemming from the COVID-19 pandemic.

For instance, in November 2021,

Raytheon Technologies

RTX

completed the acquisition of SEAKR Engineering, a supplier of advanced space electronics. The transaction is expected to boost Raytheon’s Space business opportunities.

RTX boasts a long-term earnings growth rate of 10.2%. The Zacks Consensus Estimate for its 2022 earnings implies an improvement of 12.2% from the 2021 reported figure.

In May 2021,

Teledyne Technologies

TDY

completed the acquisition of FLIR Systems, one of the pioneers in thermal imaging. The cash-and-stock deal was worth approximately $8.2 billion.

TDY boasts a long-term earnings growth rate of 9.2%. The Zacks Consensus Estimate for its 2022 earnings suggests an improvement of 6.8% from the 2021 reported figure.

In May 2021,

Leidos Holdings

LDOS

completed the acquisition of Gibbs & Cox, the largest independent ship design firm focused on naval architecture and marine engineering. The value of this buyout was $380 million in cash.

LDOS boasts a long-term earnings growth rate of 6.3%. The Zacks Consensus Estimate for its 2022 sales indicates an improvement of 2.4% from the 2021 reported figure.

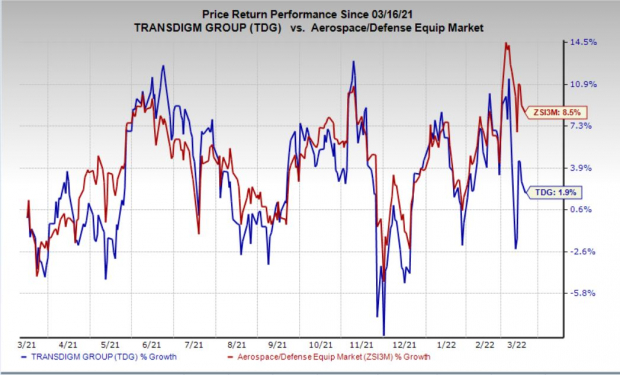

Price Movement

In the past year, shares of TransDigm Group have gained 1.9% compared with the

industry

’s growth of 8.5%.

Image Source: Zacks Investment Research

Zacks Rank

TransDigm currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report