Trex Company, Inc.

TREX

divested its wholly-owned subsidiary, Trex Commercial Products, Inc., to Minnesota-based Sightline Commercial Solutions, LLC.

In the first nine months of 2022, the segment generated sales of $35.1 million, which reflects 3.8% of the total net sales. Also, it incurred a net loss of $2.4 million in the said period.

President and CEO of TREX, Bryan Fairbanks, said, “The divestiture of the Trex Commercial segment reflects our decision to focus on driving the most profitable growth strategy for Trex and its shareholders through the execution of our outdoor living strategy. With the sale complete, we will dedicate our resources to accelerating conversion to composites from wood and further strengthen our leadership position in the outdoor living category.”

Trex Commercial’s products were installed in some of the largest and most prestigious sporting and entertainment venues in the country. Trex Commercial was also instrumental in helping the company capitalize on the growing trend toward more modern, commercially-inspired railing designs with the launch of its successful rod rail system, the new glass railing system and numerous other innovations that will drive future value for Trex.

Image Source: Zacks Investment Research

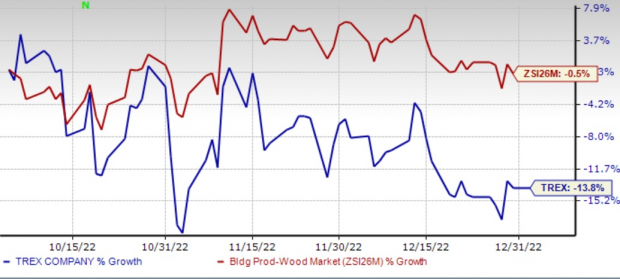

Although its shares fell 0.89% on Dec 30 and 13.8% in the past three months versus the Zacks

Building Products – Wood

industry’s 0.5% decline, wood industry’s prospect looks good. The industry is expected to benefit from higher demand across export markets, repair and remodel (R&R) activity and more funding for carbon/ESG-related projects despite continuous supply-chain woes, lower lumber prices, inflationary pressure and lower home sales. In addition, inorganic and prudent cost-containment moves should lend support to industry in future.

Trex is also well positioned to reap benefits from the above-mentioned benefits.

Zacks Rank & Key Picks

Currently, Trex carries a Zacks Rank #4 (Sell). Some better-ranked stocks that warrant a look in the Zacks

Construction

sector include

EMCOR Group Inc.

EME

,

Altair Engineering Inc.

ALTR

and

ChampionX Corp.

CHX

, each carrying a Zacks Rank #2 (Buy).

EMCOR

: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EMCOR’s 2023 earnings estimates have increased to $9.10 per share from $8.79 over the past 60 days. Earnings for 2023 are expected to grow nearly 17%.

Altair

: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair’s earnings for 2023 are expected to witness 21.5% growth from the year-ago report.

ChampionX

: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX has an expected earnings growth rate of 46.3% for the next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report