Twitter Inc (NYSE:TWTR) shares have been surging at a robust pace over the last two weeks, buoyed by the FIFA World Cup tournament. Traders believe users engagement and ad demand will increase substantially during one of the world’s largest sporting event.

Twitter shares jumped more than 30% in the last two weeks alone, pushing the stock to its highest level in the past three years. TWTR shares have been rallying at the significant pace over the last twelve months.

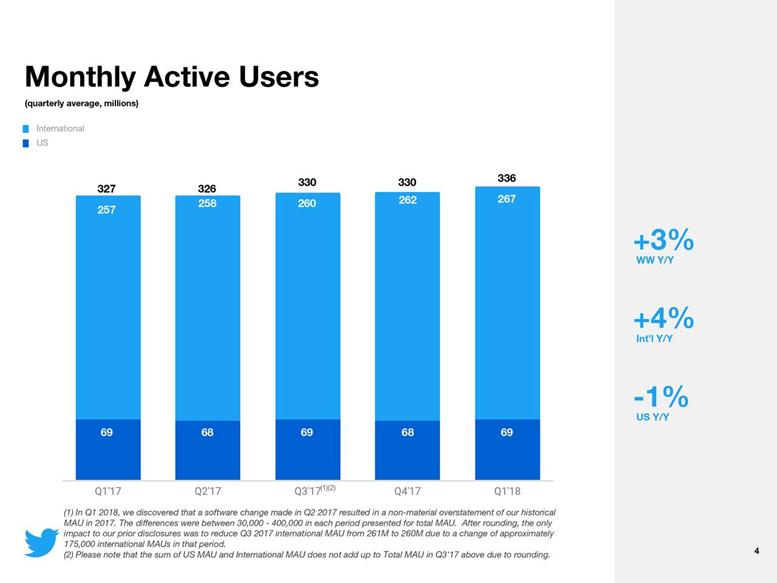

The company’s stock continues to receive support from an increasing audience and from high double-digit growth in its financial numbers.

Some short-term investors are beginning to wonder whether the 163% share price rally from the last twelve months could present a perfect selling opportunity.

Analysts Say No

Analysts, however, are quick to reject the idea.

Although short-term investors could capitalize on recent gains by selling their stock at this three-year high, the majority of analysts are suggesting that there is potential for further upside for Twitter shares.

Morgan Stanley, UBS, and Macquarie have all issued a ‘Buy’ rating for Twitter’s stock, citing strong fundamentals support for its share price. Analysts are claiming that ad growth, international expansion, sales execution, and double-digit revenue growth are the key catalysts for Twitter’s share price momentum both in the short- and long-term.

Financials and Growth Strategies are Backing Uptrend

Twitter Inc generated a year-over-year revenue growth of 21% in the first quarter. Its margins and earnings have also improved over the past year period.

Jack Dorsey, Twitter CEO, says “We grew our audience and engagement, marking another quarter of double-digit year-over-year DAU growth, and continued our work to make it easier to follow topics, interests, and events on Twitter.”

The company has also been investing significantly in organic and non-organic growth opportunities. Twitter recently announced an agreement with Disney (NYSE:DIS) to create live content and advertising opportunities from across portfolios on the Twitter platform.

Overall, Twitter appears to be in a stable position, and the company’s growth activities and financial numbers completely back its stock price performance.

>> Bearish Trend for Oracle Shares Widens Amid Decelerating Cloud Revenue Growth

Featured Image: Seeking Alpha