Uber Technologies, Inc.

UBER

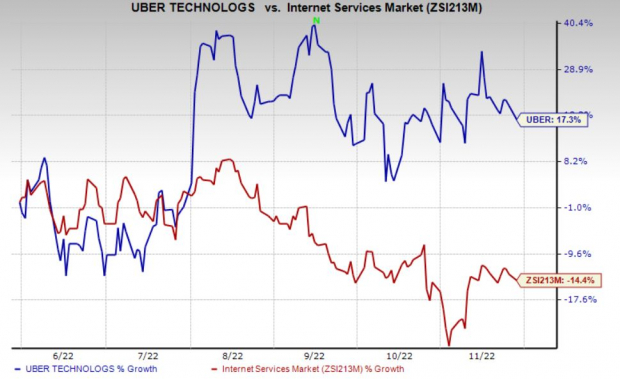

is benefiting from the improvement in Delivery operations and recovery in Mobility operations. Shares of Uber have gained 17.3% over the past six months, outperforming the

industry

’s decline of 14.4%.

Image Source: Zacks Investment Research

The company incurred a loss of 61 cents per share in the third quarter of 2022, wider than the Zacks Consensus Estimate of a loss of 17 cents. In third-quarter 2021, Uber reported earnings of 23 cents per share.

Total revenues of $8,343 million outperformed the Zacks Consensus Estimate of $8,076.5 million. The top line jumped 72% year over year, backed by contributions from the acquisition of Transplace by Uber Freight and change in the business model for the company’s UK Mobility business.

How Is Uber Technologies Doing?

Uber’s efforts to expand its Delivery operations in response to the surge in business are encouraging.Uber’s Delivery business witnessed a major boom, with online order volumes surging amid the pandemic. Revenues from the segment increased 24% year over year in the third quarter of 2022, while gross bookings from the unit augmented 7%. During third-quarter 2022, Delivery adjusted EBITDA was $181 million against an adjusted EBITDA loss of $12 million in the year-ago quarter.

Continued recovery in the Mobility business is encouraging. With increased vaccinations in the United States and some other key markets, the company is seeing continued improvement in demand for Mobility.

Mobility revenues jumped 73% year over year to $3,822 million in third-quarter 2022 as ride volumes continued to rebound, while gross bookings from the unit improved 38% to $13,684 million. For the fourth quarter, Uber expects gross bookings of $30 billion-$31 billion.

With focus on financial discipline, recovery in Mobility operations and an improvement in Delivery adjusted EBITDA and betterment in Uber’s adjusted EBITDA are encouraging. The company generated an adjusted EBITDA of $516 million in the third quarter of 2022 compared with an adjusted EBITDA of $8 million in the year-ago period. For the fourth quarter, Uber expects adjusted EBITDA between $600 million and $630 million.

However, a rise in total costs and expenses poses a threat to Uber’s bottom line. Total costs and expenses surged 66.8% year over year in the first nine months of 2022, with sales and marketing expenses rising 3% and the cost of revenue augmenting more than 100%.

Zacks Rank and Stocks to Consider

Currently, Uber Technologies carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some better-ranked stocks from the broader Zacks

Transportation

sector are

Air Transport Services Group

ATSG

,

Ryder Systems

R

and

Teekay Tankers Ltd. (

TNK

),

each currently carrying a Zacks Rank #2 (Buy).

ATSG has an expected earnings growth rate of 34.34% for the current year. ATSG delivered a trailing four-quarter earnings surprise of 17.78%, on average.

The Zacks Consensus Estimate for ATSG’s current-year earnings has improved 5.2% over the past 90 days. Shares of ATSG have gained 7.9% over the past year.

Ryder has an expected earnings growth rate of 67.12% for the current year. R delivered a trailing four-quarter earnings surprise of 30.13%, on average.

The Zacks Consensus Estimate for R’s current-year earnings has improved 6.9% over the past 90 days. Shares of R have gained 12.7% over the past year.

Teekay Tankers has an expected earnings growth rate of 214.91% for the current year. TNK delivered a trailing four-quarter earnings surprise of 42.23%, on average. Teekay Tankers has a long-term expected growth rate of 3%.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved 95% over the past 90 days. Shares of TNK have soared 190% over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report