One stock that’s always buzzing around is more than just a household name. The name of this company is a verb now immortalized in pop-culture forever. Netflix (NASDAQ:NFLX) is an interesting stock. It leads the charge into online entertainment streaming and sets a new standard for watching movies and tv shows.

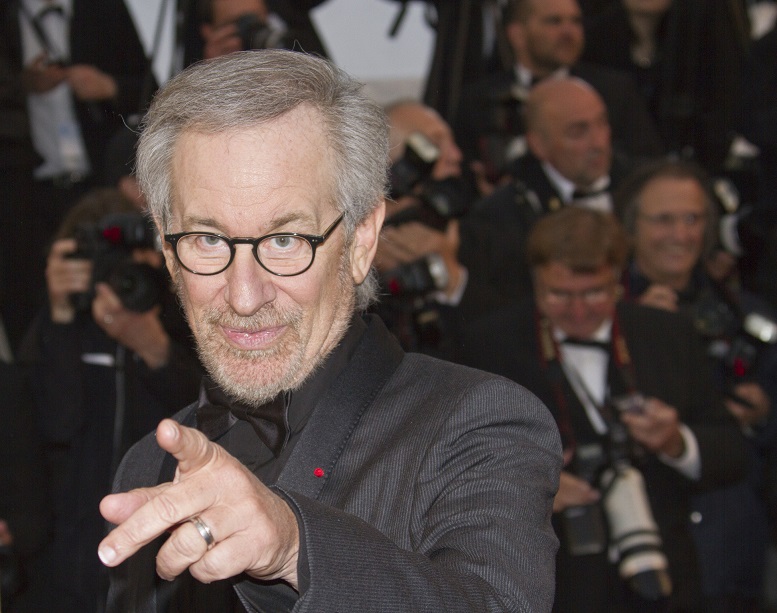

Now, Netflix (NASDAQ:NFLX) is reporting a partnership with cinematic titan Steven Spielberg. This comes as a huge irony as a pre-pandemic Spielberg had himself drawn a line between theatrically released films and “streamer” films. A 2019 article by CNN is a fantastic read today after news of the deal between Netflix (NASDAQ:NFLX) and Spielberg’s Amblin Partners.

““Once you commit to a television format, you’re a TV movie,” … “I don’t believe that films that are given token qualifications, in a couple of theaters for less than a week, should qualify for the Academy Award nomination.” -Steven Spielberg to ITV News (From CNN Businesswire)

It seems highly doubtful that an excited Spielberg would not accept an Academy Award for anything he makes for streaming audiences. However, it’s pretty obvious he wasn’t intent on slamming streaming services. At the time, they were more of an addendum to the cinema experience. People can enjoy titles they’ve seen in theatres months later at home, or catch ones they missed the cinema release for.

The global pandemic changed all that. Mandatory movie theatre closures resulted in Netflix’s (NASDAQ:NFLX) stock surging, alongside the likes of their competitors.

Netflix Going Forward: Content is King

According to the deal announced Monday, there are no specific movies decided as yet on the platform. Also, the Spielberg-Netflix (NASDAQ:NFLX) deal will have no bearing on Amblin Partner’s relationship with Universal Studios, and the groups will continue to do business as usual. One thing we can predict is the internet company will not stop its agile activities in meeting viewer demands.

Spielberg is excited to work under a different set of rules. When producing films directly for streaming audiences there seem to be a new set of standards that only a few films seem to meet. With restrictions easing up and theatres re-opening around the US, it’s not likely we will see a fall in Netflix (NASDAQ:NFLX), but rather a re-visiting of their current offerings.

Netflix (NASDAQ:NFLX) is not known for short-sighted decisions. The company constantly innovates and is known for trendsetting – and winning more often than not. With almost 208 million subscribers in Q1 2021 the company has direct access to more consumers than Apple has shipped iPhones last year. Also, a single Netflix account may mean multiple users, making that count very conservative. Earnings reports have continuously beaten analyst expectations, which makes you imagine how much celebration Spielberg’s partners had once he finally agreed.

One thing is true; Summer is tough for streaming services. Netflix’s (NASDAQ:NFLX) slight dip Monday morning might be on account of uncertain investors not keen on the end of the streaming stock surge now that life is returning to normal. Still, if there’s anything we learned from watching Netflix (NASDAQ:NFLX), the stock, not the website, then we can say it might be more than binge-worthy.

Featured Image: ID 39578756 © Wellesenterprises | Megapixl.com