Shares of

Valneva

VALN

fell 20.6% on May 16, after management announced that the European Commission (EC) has communicated its intent to terminate the advance purchase agreement (APA) for VALN’s inactivated COVID-19 vaccine, VLA2001.

We note that VLA2001 is yet to receive a marketing authorization in the European Union (EU).

Following the receipt of the above notice of intent, Valneva has 30 days from May 13, 2022, to either secure a marketing authorization for VLA2001 from the European Medicines Agency (EMA) or propose an acceptable remediation plan.

While a final decision by the EC is yet to be made, Valneva started discussions with the member states of the EU, which are still interested in receiving its COVID-19 vaccine.

This intent to terminate is a right granted to EC, per the APA terms. The APA allows EC to exercise this right if Valneva is unable to secure a marketing authorization for VLA2001 from the European Medicines Agency (EMA) by Apr 30, 2022.

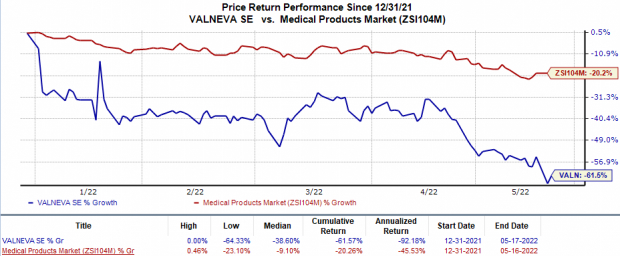

In the year so far, Valneva’s shares have plunged 61.6% compared with the

industry

’s 20.3% fall.

Image Source: Zacks Investment Research

Last month, Valneva announced that it had received a further List of Questions (LoQ) from the EMA’s Committee for Medicinal Products for Human Use (CHMP), which requested additional data to support the marketing authorization for VLA2001. Management already submitted its responses to the LoQ on May 2, expecting the responses to satisfy CHMP’s queries. A positive recommendation can be expected next month, provided the CHMP accepts VALN’s responses.

In a separate press release, management announced that Valneva’s COVID vaccine received authorization for emergency use in the United Arab Emirates (UAE). VLA2001 is already authorized for use in the United Kingdom (U.K.) and Bahrain.

The authorizations in Bahrian, the U.K. and the UAE granted to VLA2001 are based on

positive top-line data

from the pivotal phase III Cov-Compare study that Valneva had announced last October. The Cov-Compare study compared VLA2001 to

AstraZeneca

’s

AZN

COVID vaccine AZD1222. Data from the study demonstrated the superiority of VLA2001 over the AstraZeneca vaccine.

The study achieved both co-primary endpoints two weeks after the second dose of vaccination. VLA2001 produced superior neutralizing antibody titer levels to AstraZeneca’s AZD1222. Further, VLA2001 demonstrated the same effectiveness as AZD1222 in neutralizing antibody seroconversion rates above 95%.

Apart from VLA2001, Valneva is evaluating other vaccines in its pipeline for Lyme disease and chikungunya.

VLA15, Valneva’s vaccine candidate for Lyme disease, is being prepared in collaboration with

Pfizer

PFE

. Both Valneva and Pfizer successfully completed phase II studies, evaluating VLA15 in both adults (aged 18 years and above) and pediatric participants (from 5 years to 17 years). Based on data from these phase II studies, both Pfizer and Valneva plan to proceed with a phase III study of the vaccine in both pediatric and adult participants, which is expected to start in third-quarter 2022.

We remind investors that Valneva entered into collaboration with Pfizer in 2020 to develop and commercialize VLA15.

Zacks Rank & Stock to Consider

Valnevacurrently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the overall healthcare sector is

Alkermes

ALKS

, which sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 13 cents to 3 cents in the past 30 days. Shares of ALKS have risen 24.4% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report