Vascular Biogenics

VBLT

announced that the phase III OVAL clinical study evaluating the efficacy of ofra-vec (ofranergene obadenovec; VB-111) in platinum-resistant ovarian cancer did not meet its primary endpoint.

OVAL was a global phase III randomized, placebo-controlled and double-blinded study evaluating the combination of ofra-vec (ofranergene obadenovec or VB-111) and paclitaxel in adult patients with recurrent platinum-resistant ovarian cancer.

The study failed to achieve a statistically significant improvement in progression-free survival (PFS) or overall survival (OS) among the targeted population.

Patients treated with a combination of VB-111 and paclitaxel had a median PFS of 5.29 months worse compared with the PFS of 5.36 months in paclitaxel control arm.Interim overall OS in the ofra-vec group was 13.37 months compared with 13.14 months in the placebo study arm, which was not significant either.

Following this result, the company decided to discontinue the OVAL study.

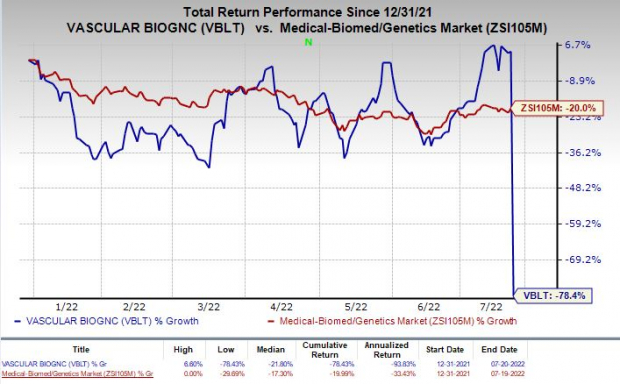

Shares of Vascular Biogenics were down 79.27% on Wednesday following the news announcement. VBLT shares have plunged 78.4% compared with the

industry

’s fall of 20%

Image Source: Zacks Investment Research

Vascular Biogenics is evaluating ofra-vec for other indications as well.

After the failed OVAL study, VBL plans to review the ongoing phase II study of ofra-vec in recurrent glioblastoma multiforme (rGBM) and metastatic colorectal cancer (mCRC). The company expects preliminary data from this study in 2022, after which it will determine the next steps with the ofra-vec program.

Vascular Biogenics’ second pipeline candidate, VB-601, an investigational monoclonal antibody that is being evaluated in a wide range of immune-inflammatory diseases, is expected to begin a first-in-human clinical trial in the second half of 2022.

VBLT expects that its current cash on hand will be sufficient to fund planned operating expenses for at least a year.

Zacks Rank and Stocks to Consider

Vascular Biogenics currently carries a Zacks Rank #3 (Hold)

Some better-ranked stocks in the same sector include

Alkermes

ALKS

, carrying a Zacks Rank #1 (Strong Buy) and

Seagen

SGEN

and

BioNTech

BNTX

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

ALKS’ loss estimates for 2022 have narrowed to a cent from a loss of 3 cents in the past 30 days. The earnings estimate for 2023 has remained steady at 56 cents in the same time frame.

Alkermes surpassed earnings in all the trailing four quarters, the average being 350.48%.

Seagen’s loss per share estimates for 2022 have narrowed from $3.50 to $3.49 in the past 30 days. The same for 2023 has widened from $1.41 cents to $1.43 cents in the same time frame. SGEN has returned 11.6% in the year-to-date period.

Earnings of Seagen missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 40.08%.

BioNTech’s earnings per share estimates for 2022 have narrowed from $34.79 to $33.51 in the past 30 days. The same for 2023 has increased from $15.60 to $16.27 in the same time frame.

Earnings of BioNTech beat estimates in all the trailing four quarters, the average surprise being 13.42%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report