Veeva Systems Inc.

VEEV

recently announced that its Veeva Development Cloud has been selected by Boehringer Ingelheim. The selection is expected to aid the latter in driving end-to-end processes and smooth information sharing for greater speed in the delivery of innovative therapies.

It is noteworthy to mention that Boehringer Ingelheim is a renowned research-driven biopharmaceutical company working on breakthrough therapies that aim to improve the lives of humans and animals, and creating value through innovation in areas of high unmet medical need.

The growing adoption of Veeva Systems’ applications is expected to provide a significant boost to the Veeva Development Cloud product line of its Life Sciences segment.

Significance of the Adoption

Boehringer Ingelheim’s adoption of Veeva Development Cloud product line is aimed at bringing together data and processes across clinical, regulatory and quality on a single cloud platform for the enterprise. This, in turn, will enable the company to establish a connected technology landscape for agile collaboration that can fast-track the development of novel medicines.

Adoption of Veeva Systems’ applications will also aid Boehringer Ingelheim to execute its Medicine Excellence initiative and further simplify its IT infrastructure and deliver a more consistent user experience. This is likely to make it easier to access information and collaborate cross-functionally.

Per Veeva Systems’ management, the adoption of its applications is expected to strengthen its long-standing partnership with Boehringer Ingelheim and enter the next stage of their tie-up.

Industry Prospects

Per a report by Marketsandresearch.biz

, the global clinical data management system market was estimated to be $1574.8 million in 2021 and is projected to reach $4294.1 million by 2028 at a CAGR of 15.4%. Factors like a surge in clinical trials, a flourishing healthcare industry, and increasing research collaborations and partnerships are expected to drive the market.

Given the market potential, growing adoption of the company’s applications is expected to strengthen its position in the global cloud application space.

Notable Developments

This month, Veeva Systems announced solid fourth-quarter fiscal 2022 results, wherein both of its segments performed impressively. The company continued to benefit from its flagship Vault platform.

Last month, Veeva Systems announced that Idorsia Pharmaceuticals Ltd has expanded its use of Veeva Vault Clinical Suite applications. This expansion includes Veeva Vault Clinical Data Management Suite for electronic data capture and coding.

In January, Veeva Systems’ Veeva Development Cloud was selected by the Lymphoma Academic Research Organization to enhance operational efficiency across its lymphoma therapy research.

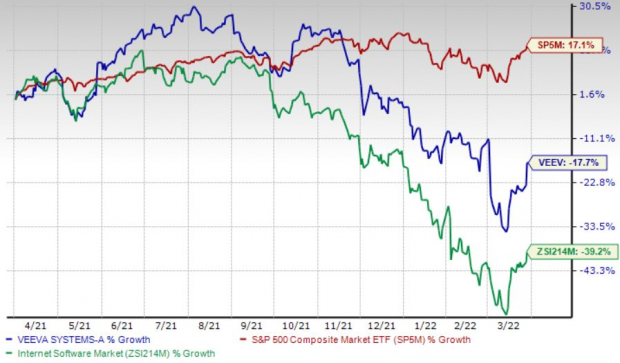

Price Performance

Shares of Veeva Systems have lost 17.6% in the past year versus the

industry

’s 39.2% fall. The S&P 500 rose 17.1% in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Veeva Systems carries a Zacks Rank #3 (Hold).

A few stocks from the broader medical space that investors can consider are

AMN Healthcare Services, Inc.

AMN

,

IDEXX Laboratories, Inc.

IDXX

and

Henry Schein, Inc.

HSIC

.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 20%. It currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 44.4% against the

industry

’s 52.7% fall over the past year.

IDEXX, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 13%. IDXX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 18.6%.

IDEXX has gained 12.8% compared with the

industry

’s 5.3% growth over the past year.

Henry Schein has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.5%. It currently has a Zacks Rank #2.

Henry Schein has gained 28.2% compared with the

industry

’s 11.2% growth over the past year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report