Veeva Systems

VEEV

recently announced that Idorsia Pharmaceuticals Ltd has expanded its use of Veeva Vault Clinical Suite applications. This expansion includes Veeva Vault Clinical Data Management Suite (“CDMS”) for electronic data capture and coding.

Being a biopharmaceutical company with a broad portfolio of novel drugs in its pipeline, Idorsia is currently aiming to use Vault CDMS for all new trials.

The growing adoption of Veeva Systems’ applications is expected to provide a significant boost to the company’s Veeva Vault Clinical suite, a component of the broader Veeva Development Cloud product line of the company’s Life Sciences segment.

Significance of the Adoption

Veeva Systems’ Vault CDMS provides an advanced cloud application suite that is expected to enable Idorsia to expedite its study builds and speed up trial execution. Idorsia’s management believes that the partnership with Veeva Systems will provide greater speed and agility to its clinical trials, given the growing complexity of trial design and rise of clinical data sources.

Per Veeva Systems’ management, the adoption of its cloud application suite will likely support Idorsia’s clinical systems strategy with modern applications that can match up with the pace and complexity of present-day studies.

Industry Prospects

Per a report by Marketsandresearch.biz

, the global clinical data management system market was estimated to be $1574.8 million in 2021 and is projected to reach $4294.1 million by 2028 at a CAGR of 15.4%. Factors like a surge in clinical trials, a flourishing healthcare industry and increasing research collaborations and partnerships are expected to drive the market.

Given the market potential, growing adoption of the company’s applications is expected to strengthen its position in the global cloud application space.

Recent Developments

Last month, Veeva Systems’ Veeva Development Cloud was selected by the Lymphoma Academic Research Organization to enhance operational efficiency across its lymphoma therapy research.

In December 2021, Veeva Systems’ Veeva Data Cloud was adopted by hematology/oncology therapy developer, PharmaEssentia. The adoption is aimed at supporting the launch of PharmaEssentia’s BESREMi — a latest therapy for polycythemia vera, a rare type of blood cancer.

The same month, Veeva Systems acquired Veracity Logic — a cloud software provider for randomization and trial supply management. Veracity Logic will join Veeva Systems to provide industry-leading software and services that can enable companies to streamline complex processes and accelerate clinical trials.

Price Performance

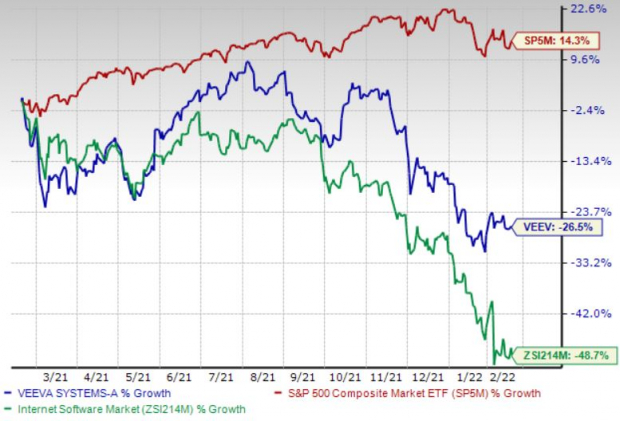

Shares of Veeva Systems have lost 26.5% in the past year versus the

industry

’s 48.7% fall and the S&P 500’s 14.3% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Veeva Systems carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are

Baxter International Inc.

BAX

,

Allscripts Healthcare Solutions, Inc.

MDRX

and

AMN Healthcare Services, Inc.

AMN

.

Baxter, having a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 9.5%. BAX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 10.2%. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Baxter has gained 7.9% against the

industry

’s 17.3% fall over the past year.

Allscripts has an estimated long-term growth rate of 11.1%. MDRX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 34.1%. It currently carries a Zacks Rank #2.

Allscripts has gained 26.1% against the

industry

’s 53.5% fall over the past year.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 19.5%. It currently has a Zacks Rank #2.

AMN Healthcare has gained 28.2% against the

industry

’s 58.5% fall over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report