Vertex Pharmaceuticals Incorporated

VRTX

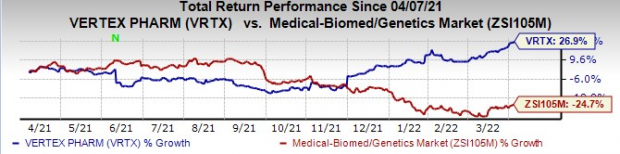

stock has risen 26.9% in the past year against the

industry

’s decline of 24.7%.

Image Source: Zacks Investment Research

Vertex’s main area of focus is cystic fibrosis (CF). With its four CF medicines, Vertex is treating the majority of the 83,000 patients living with CF in the United States, Europe, Canada and Australia.

Vertex’s CF sales continue to grow despite the impact of the pandemic. Revenue growth of 49% in 2020 and 22% in 2021 was driven by the strong uptake of Trikafta in the United States, the launch of Kaftrio in multiple countries, additional reimbursement agreements for Kaftrio in EU countries, and the approval of CF medicines for younger patient populations.

In 2022, Vertex expects continued revenue growth as there are more than 25,000 patients remaining who are addressable with Vertex’s CF therapies.

Meanwhile, Vertex is evaluating its CF medicines in younger patient populations and aims to have small molecule treatments for approximately 90% of people with CF. Additionally, Vertex is pursuing genetic therapies to address the remaining 10% of CF patients, including an mRNA approach in partnership with

Moderna

MRNA

.

Vertex and Moderna plan to begin clinical development of their CFTR mRNA therapy in 2022.

While Vertex’s main focus is on the development and strengthening of its CF franchise, the company also has a rapidly advancing early-stage portfolio in six additional diseases beyond CF like pain, sickle cell disease, beta-thalassemia, APOL1-mediated kidney diseases and cell therapy for type I diabetes. Data from multiple programs are expected in the next six to nine months.

Vertex is co-developing a gene-editing treatment, CTX001, in partnership with

CRISPR Therapeutics

CRSP

, in two devastating diseases — sickle cell disease and thalassemia. Phase I/II studies of CTX001 in adult transfusion-dependent b-thalassemia in Europe and sickle cell disease in the United States are ongoing. The preliminary safety and efficacy data from the studies were positive. Vertex and CRISPR Therapeutics plan to file regulatory applications for CTX001 for both indications by 2022 end.

In April, Vertex increased its investment in collaboration with CRISPR Therapeutics. Per the amended deal, Vertex will lead the global development and future commercialization of CTX001.

Enrollment is complete in a phase II study on VX-147, its first oral small molecule medicine in APOL1-mediated focal segmental glomerulosclerosis (FSGS). Data from the study showed that VX-147 caused unprecedented reductions in proteinuria, a marker of kidney damage, inpatients with APOL1-mediated kidney disease. A pivotal phase III study on VX-147targeting a broad patient population with proteinuric kidney disease mediated by two mutations in the APOL1 gene (AMKD) is expected to begin enrolment soon.

VX-548, a selective NaV1.8 inhibitor, is being evaluated in two phase II acute pain studies, one following bunionectomy surgery and the other following abdominoplasty surgery. Data from the acute pain studies are expected in the first quarter of 2022.

A phase I/II study was initiated on VX-880 for the treatment of type I diabetes (T1D) in March. Data from a phase I/II study for the first T1D patient announced in January 2022 demonstrated that after 150 days of the single infusion of VX-880 at half the target dose along with immunosuppressive therapy, robust improvements were seen in fasting C-peptide and glycemic control. These improvements prove a clinically meaningful therapeutic effect of a single treatment with VX-880 in the functional cure of T1D disease. VX-880 is Vertex’s first of the two investigational programs for the transplant of functional islets into patients. VX-880 is for the transplantation of islet cells alone, using immunosuppression to protect the implanted cells. The second program will involve the implantation of the islet cells inside an immunoprotective device. Clinical development on the second program is expected to begin in 2022.

Conclusion

Vertex’s dependence on just the CF franchise for commercial revenues is a concern. It needs a growth opportunity outside CF especially after failure of two candidates for alpha-1 antitrypsin deficiency (AATD), VX-814 and VX-814, in 2021.

Nonetheless, Vertex’s CF sales continue to grow despite the impact of the pandemic. Consistent rise in CF sales, the rapid progress of non-CF pipeline candidates, minimal competition in its core CF franchise, and regular business development should keep the stock afloat going forward.

Zacks Rank & Stocks to Consider

Vertex has a Zacks Rank #3 (Hold).

A better-ranked stock in the drug/biotech sector is

BELLUS Health

BLU

with a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

BELLUS Health’s stock has surged 82.6% in the past year.

The Zacks Consensus Estimate for BELLUS Health’s 2022 bottom line has narrowed from a loss of 99 cents to 77 cents per share, while that for 2023 has narrowed from $1.34 per share to $1.11 per share over the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report