Vertex Pharmaceuticals Incorporated

VRTX

announced that it is moving VX-147, its first oral small molecule medicine for APOL1-mediated kidney disease, into pivotal development.

A pivotal phase III study on VX-147 targeting a broad patient population with proteinuric kidney disease mediated by two mutations in the APOL1 gene (AMKD) is expected to begin enrolment later this month. The study will evaluate what impact VX-147, in addition to standard of care, has on kidney function and proteinuria in people with AMKD. The primary endpoint of the study will be a reduction in the rate of decline of kidney function as measured by estimated glomerular filtration rate (eGFR) slope versus placebo at approximately two years. At week 48, an interim analysis of eGFR slope, supported by a reduction in proteinuria will be evaluated. If the interim data is positive, Vertex will seek accelerated approval of VX-147 in the United States for patients with AMKD based on the interim data.

Previously announced data from a phase II study showed that VX-147 led to a 47.6% reduction in proteinuria (elevated protein in the urine) in patients with APOL1-mediated focal segmental glomerulosclerosis (FSGS).

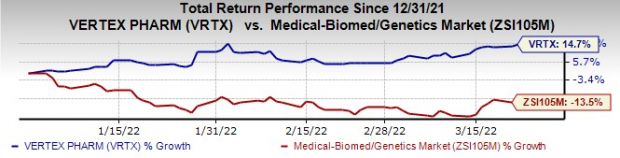

Vertex’s stock has risen 14.7% this year so far against the

industry

’s decline of 13.5%.

Image Source: Zacks Investment Research

VX-147 is part of Vertex’s rapidly progressing non-cystic fibrosis (CF) pipeline. While Vertex’s main focus is on the development and strengthening of its CF franchise, the company also has a rapidly advancing early-stage portfolio in five additional diseases beyond CF. These areas other than APOL1-mediated kidney diseases include pain, sickle cell disease, beta-thalassemia and cell therapy for type I diabetes.

Vertex is co-developing a gene-editing treatment, CTX001, in partnership with

CRISPR Therapeutics

CRSP

, in two devastating diseases — sickle cell disease and thalassemia. Phase I/II studies of CTX001 in adult transfusion-dependent b-thalassemia in Europe and sickle cell disease in the United States are ongoing. Preliminary safety and efficacy data from the studies were positive. Vertex and CRISPR Therapeutics plan to file regulatory applications for CTX001 for both indications by 2022 end.

VX-548, a selective NaV1.8 inhibitor, is being evaluated in two phase II acute pain studies, one following bunionectomy surgery and the other following abdominoplasty surgery. Data from the acute pain studies are expected in the first quarter of 2022.

A phase I/II study was initiated on VX-880 for the treatment of type I diabetes (T1D) in March. VX-880 is Vertex’s first of the two investigational programs for the transplant of functional islets into patients. VX-880 is for the transplantation of islet cells alone, using immunosuppression to protect the implanted cells. The second program will involve the implantation of the islet cells inside an immunoprotective device. Clinical development on the second program is expected to begin in 2022.

Zacks Rank and Other Stocks to Consider

Vertex has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some other stocks in the biotech sector with the same rank as Vertex Pharmaceuticals are

Voyager

Therapeutics

VYGR

and

Gamida Cell

GMDA

, each carrying a Zacks Rank #2.

Voyager Therapeutics’ loss estimates narrowed from $2.20 per share to $1.35 per share for 2022 and from $1.93 per share to $1.37 per share for 2023 in the past 60 days. Voyager Therapeutics’ stock is up 215.5% this year so far.

Voyager Therapeutics’ earnings performance has been decent, with the company beating earnings expectations in three of the last four quarters while missing in one. Voyager Therapeutics has a four-quarter earnings surprise of 41.0%, on average.

Estimates for Gamida Cell’s 2022 bottom line have narrowed from a loss of $1.83 to $1.17 per share in the past 60 days. Gamida Cell’s stock is up 72.4% this year so far.

Gamida Cell beat estimates in two of the last four quarters while missing in the other two, with the average negative surprise being 22.6%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report