Vertex Pharmaceuticals

VRTX

announced that the FDA cleared its investigational new drug (IND) application seeking approval to start clinical studies on VX-522, an investigational mRNA-based therapy for cystic fibrosis (CF) indication.

VX-522 is designed to treat the underlying cause of CF lung disease in patients for whom a cystic fibrosis transmembrane conductance regulator (CFTR) modulator is not beneficial. Following the IND clearance, Vertex plans to start a single ascending dose clinical study in adult CF patients with a CFTR genotype not responsive to CFTR modulator therapy in the coming weeks.

A leader in the CF space, Vertex’s main focus is on developing and strengthening of its CF franchise. The company’s portfolio consists of four medicines, all targeting the CF indication. These include Trikafta/Kaftrio, Symdeko (marketed as Symkevi in Europe), Orkambi and Kalydeco. During the third quarter of 2022, Vertex generated total revenues (entirely from CF product sales) worth $2.33 billion, up 18% year over year.

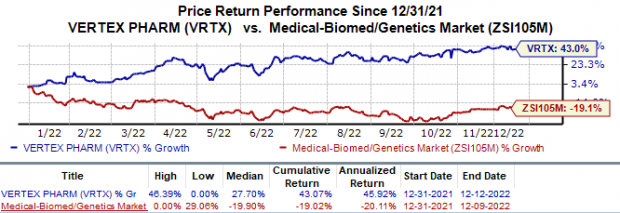

Shares of Vertex have gained 43.1% in the year so far against the

industry

’s 19.0% decline.

Image Source: Zacks Investment Research

Management estimates that more than 83,000 patients worldwide are affected by CF, a rare multi-organ disease affecting the lungs, liver, pancreas, GI tract, sinuses, sweat glands and reproductive tract. It is caused by the lack of or defects in the CFTR protein, which leads to poor flow of salt and water into and out of the cells in a number of organs.

Per Vertex, its four CF medicines target the majority of the 83,000 patients living with CF across the world. Management estimates that VX-522, if approved, could benefit around 5,000 CF patients who still cannot benefit from its four marketed CF medicines.

VX-522 is being developed by Vertex in collaboration with

Moderna

MRNA

. Both Vertex and Moderna entered into a collaboration in 2016 to discover and develop mRNA therapeutics for CF. Per the terms of collaboration, Vertex is responsible for leading the preclinical and clinical development of therapies under this collaboration. Moderna is responsible for mRNA and lipid nanoparticle (LNP) process development and manufacturing. Moderna is also eligible to receive milestone payments and royalties on sales of potential products resulting from this collaboration.

While CF is one of the main focus areas of Vertex, the company is also focused on expansion beyond the CF space. Currently, Vertex has a rapidly advancing mid- and late-stage clinical pipeline across seven disease areas beyond CF like acute pain, sickle cell disease (SCD), beta-thalassemia, APOL1-mediated kidney diseases (AMKD), alpha-1 antitrypsin (AAT) deficiency and cell therapy for type I diabetes.

The company is focused on exa-cel, a gene-therapy developed in partnership with

CRISPR Therapeutics

CRSP

in two devastating diseases — SCD and thalassemia. Vertex and CRISPR Therapeutics initiated a rolling biologics license application (BLA) filing with the FDA last month, which is expected to be completed by first-quarter 2023. If approved, exa-cel will be Vertex’s first non-CF product and CRISPR Therapeutics’ first marketed product.

Vertex has already completed discussions on exa-cel for both SCD and TDT indications with European regulatory authorities. Based on these discussions, management intends to submit the regulatory filings in the European Union and the United Kingdom by this year’s end.

Vertex and CRISPR Therapeutics entered into a collaboration agreement in 2015. Apart from exa-cel, both companies are working on developing therapies for cystic fibrosis as well as Duchenne Muscular Dystrophy (DMD) and Myotonic Dystrophy Type 1 (DM1).

Zacks Rank & Stocks to Consider

Vertex currently carries a Zacks Rank #2 (Buy).A better-ranked stock in the overall healthcare sector is

Kamada

KMDA

, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 30 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 31.8% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report