Viatris

VTRS

announced that the FDA has approved the abbreviated new drug application filed by Mylan Pharmaceuticals, a subsidiary of Viatris, which sought approval for a generic version of Restasis (cyclosporine ophthalmic emulsion 0.05%).

We note that Restasis was initially developed by Allergan, an

AbbVie

ABBV

company, to increase the natural ability of eyes to produce tears in patients whose tear production is presumed to be suppressed due to ocular inflammation associated with keratoconjunctivitis sicca (commonly known as dry eye).

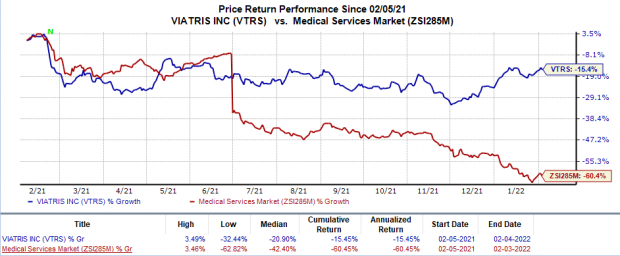

Shares of Viatris have declined 15.5% in the trailing 12 months in comparison with the

industry

’s 60.5% decline.

Image Source: Zacks Investment Research

Following FDA’s nod to the generic version of Restasis, Viatris’ subsidiary became the first to receive approval for a generic version of this drug. Viatris indicated that Mylan Pharmaceuticals plans to launch the drug immediately as a more affordable medication.

We note that Allergan received FDA approval for Restasis in 2003. In May 2020, AbbVie announced that it completed the acquisition of Allergan in a cash-and-stock deal for $63 billion. AbbVie recorded $1.2 billion as revenues from Restasis sales for full-year 2021. As part of the deal, AbbVie also acquired well-established brands like Botox Cosmetic and Juvederm as part of the transaction.

Currently, Viatris is the only company that has secured approval of a generic Restasis version. The approval of a complex generic drug like Restasis will boost Viatris’ generics division. For the third quarter, Viatris’ Complex generics and biosimilars product category declined 6% year over year to $332 million. This decline was attributed to anticipated competition in select complex generics products. In fact, this decline offset the 14% growth in biosimilars.

Zacks Rank & Key Picks

Viatris currently carries a Zacks Rank #4 (Sell). A couple of better-ranked stocks in the biotech include

Axsome Therapeutics

AXSM

and

Vir Biotechnology

VIR

. While Vir Biotechnology sports a Zacks Rank #1 (Strong Buy), Axsome Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Vir Biotechnology’s earnings per share estimates for 2022 have increased from $4.77 to $6.53 in the past 30 days.

Earnings of Vir Biotechnology beat estimates in two of the last four quarters and missed the mark on the other two occasions, with the average surprise being 13%.

Axsome Therapeutics’ loss per share estimates for 2022 have narrowed from $3.66 to $3.64 in the past 30 days.

Earnings of Axsome Therapeutics beat estimates in three of the last four quarters while missed the mark on one occasion, with the average surprise being 0.6%.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report