A couple of years ago, Walgreens Boots Alliance (NASDAQ:$WBA) announced that it wanted to merge with pharmacy store chain Rite Aid (NYSE:$RAD). However, with the retail industry struggling significantly recently, several investors feel that Walgreens should pay the $325 million fee to break the ongoing merger talks with Rite Aid. This is because one of the current problems causing the retail industry to sink is overpopulation, and many investors believe there are currently too many physical pharmacies in the U.S. However, pharmaceutical retailers are a bit safer from the e-commerce takeover threatening other retailers because drugs cannot be sold online.

A Quick History Lesson

Walgreens Boots Alliance announced its plans to merge with Rite Aid in October 2015. The pharmaceutical retailer offered Rite Aid a payment of $9 per share as well as taking responsibility for Rite Aid’s debt. In total, Walgreens would pay around $17.2 billion for this deal. Since then, however, Walgreens lowered their payment to around $6.50-$7 per share due to delays and concerns from the Federal Trade Commission (FTC).

Walgreens lowered the payment on January 30, 2017: $6.50 per share if Rite Aid divested up to 1,200 stores and $7 per share if Rite Aid divested up to 1,000 stores. The number of stores is based on FTC requirements for the number of store divestitures in hopes that the FTC will give approval for the merger.

The deadline to finalize the deal is July 31, 2017.

Is It Worth It?

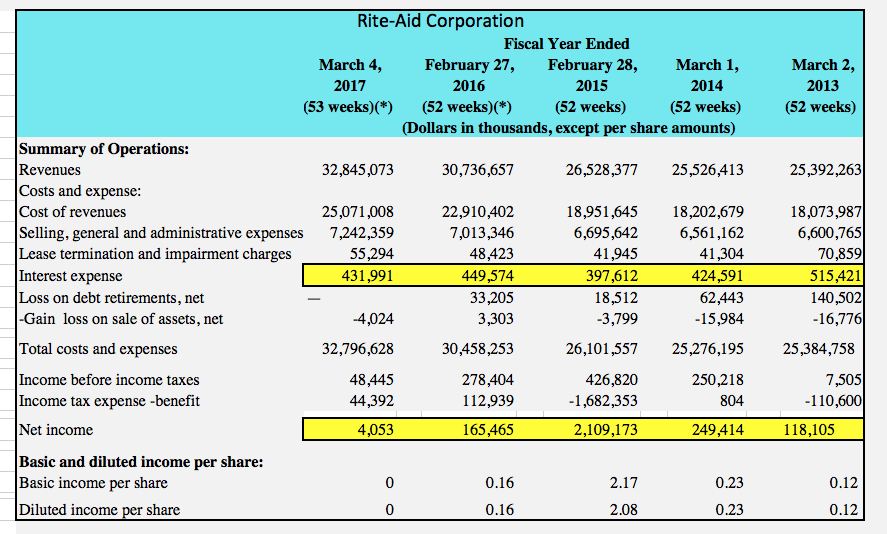

Several investors aren’t very happy with Walgreen’s incoming merger with Rite Aid. The reason becomes clear when Rite Aid’s current financial situation as well as its financial history. For most of 2013-2017, Rite Aid’s interest expense has been significantly higher than its net income. The only year where Rite Aid earned more than its interest expense was 2015.

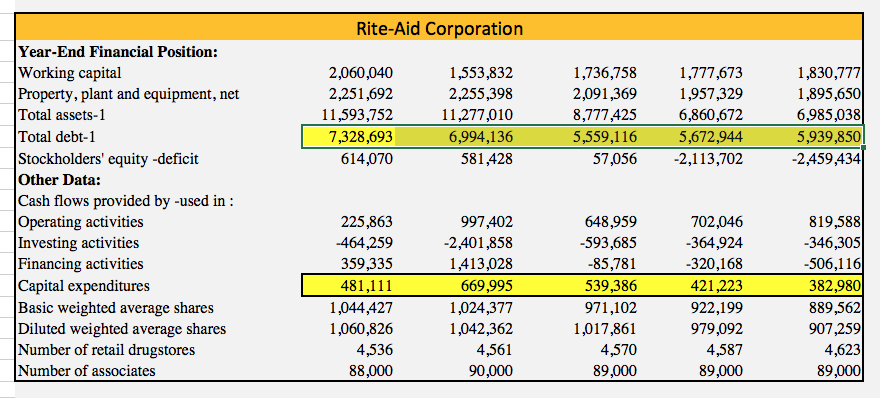

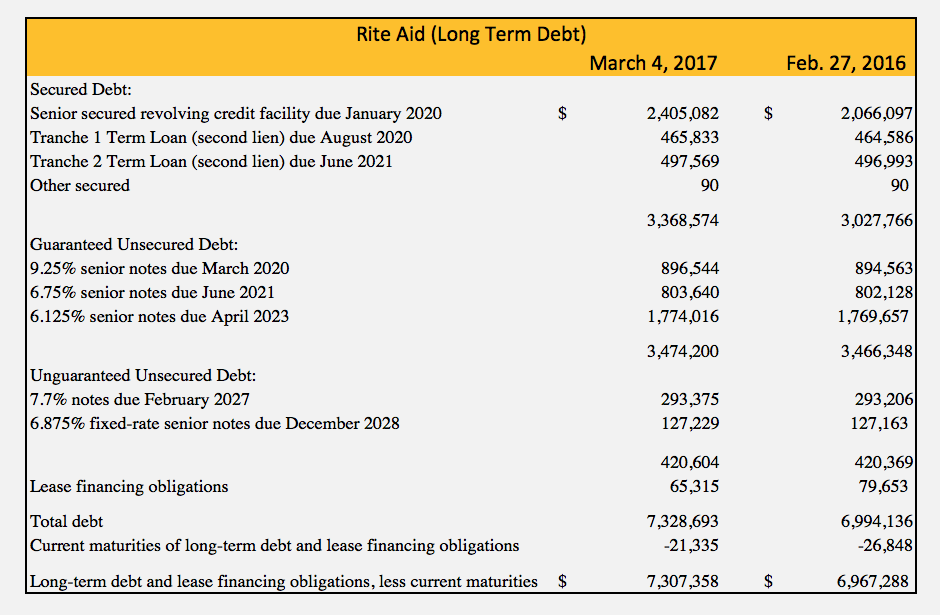

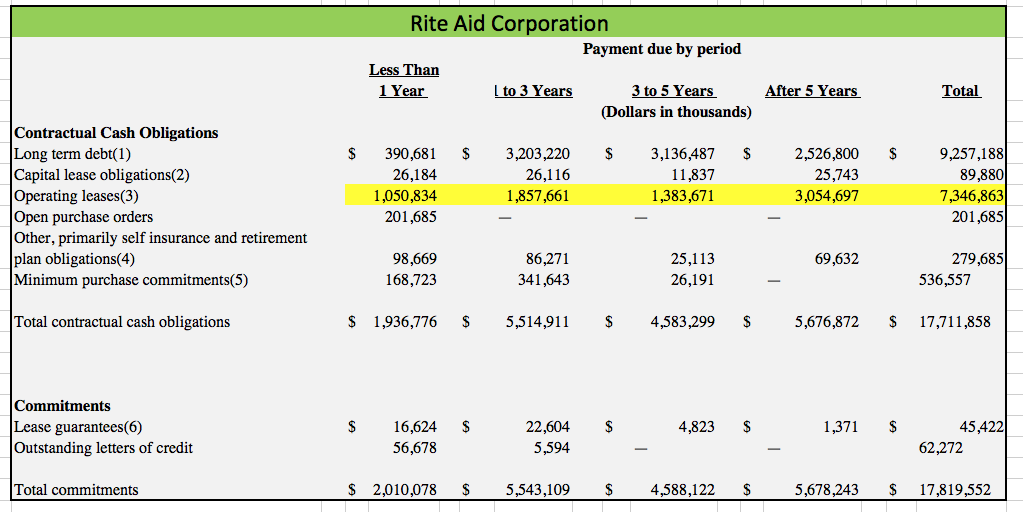

Rite Aid is also in a lot of debt — as of March 4, 2017, the company has a total long-term debt (without subtracting maturities and lease financing obligations) of $7,328,693. In addition to debt, Rite Aid’s operating leases are quite high. Over 5 years time, Rite Aid would have to pay approximately $7,346,863 in operating leases. In less than a year, the company has a total contractual cash obligation of $1,936,776.

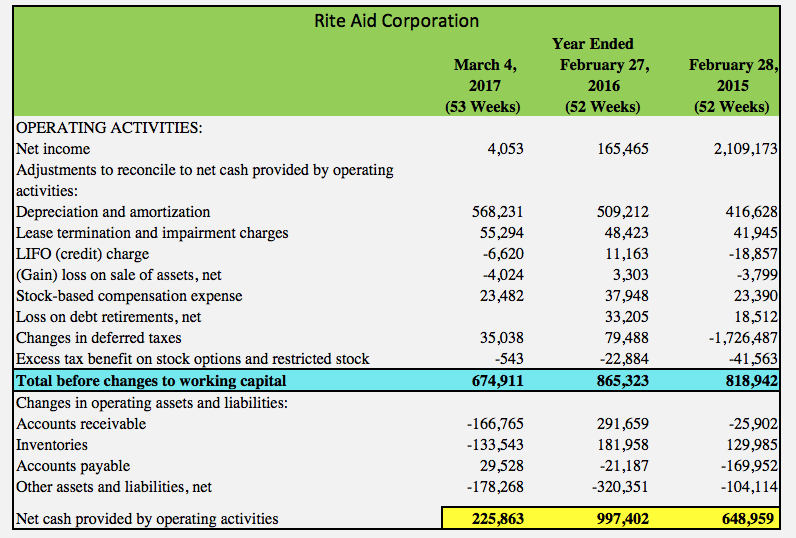

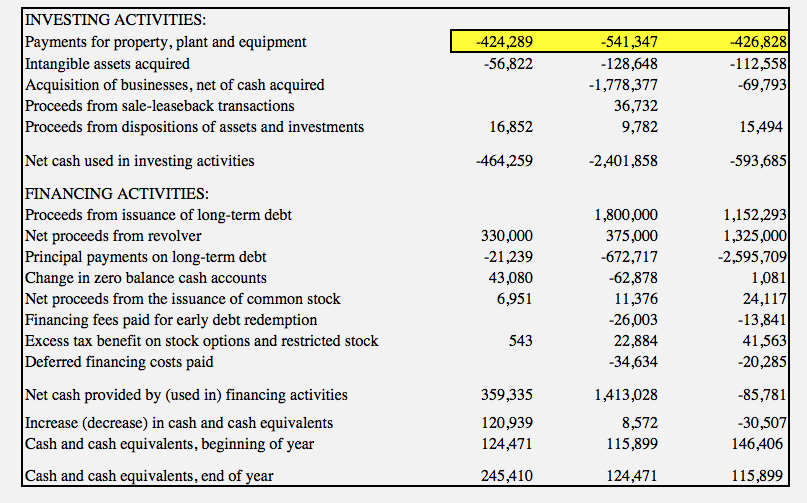

Taking into consideration all the payments Rite Aid has to make, their cash flow statement is pretty concerning. The total cash flow before changes in working capital for Rite Aid as of March 4, 2017, was $674,911. This is only about a 5.1% yield based on the $13.2 billion value Walgreens have put into Rite Aid with its $6.50 per share based on is most recently revised terms of the merger deal.

Rite Aid’s struggles can be largely attributed to the fact that there are too many physical retail pharmacies. Competitors like CVS (NYSE:$CVS) has around 7,998 stores in the U.S. alone, excluding the 1,674 pharmacies that can be found in Target (NYSE:$TGT). Investors believe that Rite Aid may have to close several of its 4,536 stores to make up for its poor net income and overwhelming debt.

Looking at Rite Aid’s financial situation — as well as the fact that Walgreens will assume Rite Aid’s debt after the merger as stated in the 2015 proposal — it is no wonder this deal is concerning for many. Rite Aid may be at the end of its rope, and Walgreens could drag itself down after this merger.

Summary

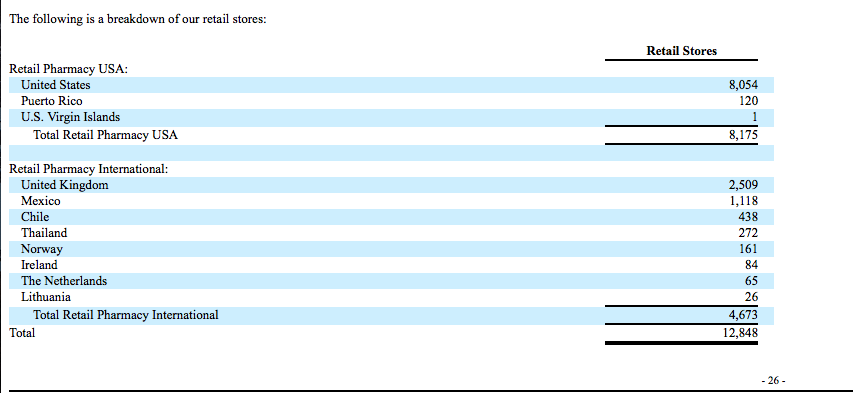

While there is no way to tell what would exactly happen if Walgreens and Rite Aid were able to merge successfully, most investors are dubious about the deal. The world, in many ways, has changed a lot since October 2015 — what seemed like a good idea then may not be a good idea now, given current situations. The U.S. is now overpopulated with physical retail stores and pharmacies. Walgreens alone has just over 8,000 pharmacies located in the U.S., compared to the 4,673 stores it has internationally.

Several investors think that there could be better ways for Walgreens to expand its company. Take CVS’s deal with Target, for example. The deal was beneficial for both parties as Target has a lot of stores and CVS saves the time and money that would have gone into new store build-outs, capital expenditures, and operating leases.

Even with a payment of $6.50 per share — about a $13.2 billion enterprise value — Walgreens is still paying way too much for a company that has a high amount of debt and has only made about $675 million as of March 4, 2017, in cash flow from operations before working capital changes. Rite Aid’s history of poor financial performances, the cost of maintenance to revamp the company’s physical pharmacies, and the increasingly changing landscape of the retail industry are just some reasons why Walgreens’ merger with Rite Aid may not be the best idea. Given these reasons, it is easy to see why several investors believe it is smarter for Walgreens to pay $325 million to break the deal rather than lose much more later on as a result of the merger.

Agreement Screenshots: walgreensbootsalliance.com – Oct 2015, walgreensbootsalliance.com – Jan 2017

# of Walgreen stores USA & International: sec.gov (page 26)

# of CVS stores USA: sec.gov (page 24)

Featured Image: twitter