Wall Street has concluded the worst first half in more than 50 years. The tremors of record-high inflation and its aftershock in the form of an extremely hawkish Fed have shaken investors’ confidence. Market participants across the globe are keenly watching the Fed, its tighter-than-expected monetary stances and their implications on the global financial set up.

A large section of economists and financial experts have warned that the U.S. economy may fall into recession in late 2022 or early 2023. In the first half of 2022, the Fed hiked the benchmark interest rate to 1.50-1.75% from 0-0.25% in March 2020. Another 75-basis-point hike is almost certain in July.

A Pathetic First Half

The broad-market benchmark — the S&P 500 Index — has tumbled 20.6% in first-half 2022, marking its worst first half since 1970. The blue-chip Dow has plummeted 15.3% in the same period, reflecting its worst first half since 1962 and its worst monthly performance in June since March 2020.

The tech-heavy Nasdaq Composite has plunged 29.5% to record the worst-ever first half for the index. The index also recorded its worst quarterly performance in second-quarter 2022 since 2008.

The seeds of inflation were visible from March 2021. Robust pent-up demand supported by the astonishing savings of Americans (buoyed by unprecedented fiscal and monetary stimuli provided during the pandemic era), shifted the aggregate demand curve upward as the U.S. economy has reopened faster than expected driven by nationwide COVID-19 vaccinations.

However, supply failed to catch up measurably with demand due to coronavirus-led complete destruction of the global supply-chain system. Production costs climbed because of higher input costs and higher wages owing to the shortage of labor.

The global supply-chain system had shown initial recovery once the spread of the Omicron variant of coronavirus dwindled. Unfortunately, Russia’s invasion of Ukraine on Feb 24 and the resurgence of COVID-19 infection in China significantly pushed up inflation.

Will Markets Turn Around in the Second Half?

At present, a contra view to the current market situation is that a high dose of interest rate therapy and extremely tight monetary control by the Fed to combat a record-high inflation might show positive signals.

Currently, inflation is at a 40-year high. However, we can see some positives despite skyrocketing inflation. The Department of Commerce reported that personal spending — the largest component of the U.S. GDP — adjusted for inflation fell 0.4% in May, a sharp decline from the 0.3% gain in April. However, the metric rose 2.1% year over year.

Core personal consumption expenditures price index — Fed’s favorite inflation gauge — rose 4.7% year over year in May, dropping 0.2% from April. The metric, which excluded volatile items like food and energy, rose 0.3% month over month, lower than the consensus estimate of 0.4%. However, the metric is still standing at the high levels of the 1980s.

Other major economic data of May such as ISM manufacturing and services indexes, retail sales and industrial production have dropped significantly. The housing market — one of the booming sectors during the pandemic — has been declining precipitously since April.

The U.S. economy is cooling as desired by the Fed. However, recently, several major investment bankers and portfolio managers have said that the U.S. economy may not fall into a recession anytime soon despite slowing GDP growth. Even if there is a recession, the effect may be mild.

On the geopolitical front, Russia recently said that it will withdraw its forces from the Snake islands in the Black Sea providing a safe passage to shipping cargos to transport wheat and other agricultural commodities from Ukraine.

If that really happens, the ongoing global food crisis would be reduced to a great extent as Ukraine is the largest supplier of wheat globally. Moreover, prices of commodities, especially the prices of crude oil and natural gas, are showing signs of a steady decline. Food and energy are the two major sources of the current inflationary pressures.

In all likelihood, the Fed will raise the lending rate by another 75 basis points in July. The next FOMC will be in September. Therefore, the central bank will have two months to analyze inflationary trends.

Slowing Inflation: A Sharp Bounce Back of Equities

Barring any external shocks (geopolitical disturbances), chances are there that inflation may show a steady decline, albite at a slow pace, in the second half of 2022. Inflation, no doubt, will not come down to the Fed’s targeted 2% rate anytime soon. But that is not required.

A gradual reversal of the current inflationary trend and a drop in the magnitude of interest rate hikes by the central bank from September or October, will result in a sharp rebound in U.S. stock markets. Wall Street is highly oversold. Aside from major indexes, several corporate giants are currently available at lucrative valuations.

In 1970, the market’s benchmark — the S&P 500 index — had plunged 21% in the first half. However, in a complete reversal of the trend, the index rallied 26.5% in the second half, finally closing the year on a positive note. We may witness a repeat of 1970 in 2022.

How to Invest

Markets may remain volatile in the near future. However, we expect a good recovery once Fed’s policy changes are adjusted fully in the market’s valuation. At this stage, it will be better to stay with quality stocks. Invest in U.S. corporate bigwigs (market capital > $30 billion) with a favorable Zacks Rank. These companies have a robust business model and globally acclaimed brand value. They have a strong balance sheet and generate solid free cash flow.

A sharp rebound is expected in beaten-down sectors, especially the high-growth technology sector. Technological improvement is an indispensable word in the modern world and the sector is a long-term positive owing to its inherent strength of continuous inventions and innovations.

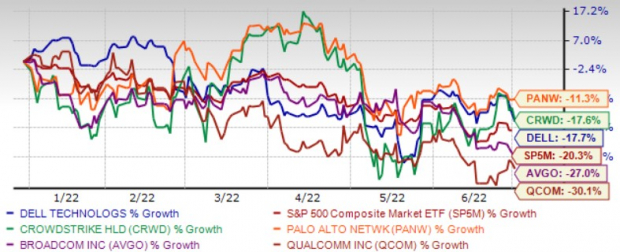

Five beaten-down technology stocks are –

Dell Technologies Inc.

DELL

,

CrowdStrike Holdings Inc.

CRWD

,

Broadcom Inc

.

AVGO

,

Palo Alto Networks Inc.

PANW

and

QUALCOMM Inc.

QCOM

.

These stocks have strong potential for the rest of 2022 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank # 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report