Market Breadth: A Key Tool for Savvy Investors

From a Wall Street perspective, breadth refers to the number of stocks participating in the movement of a market index, most commonly the S&P 500 Index. When the stock market has more stocks rising than falling, it is said to have positive breadth. On the other hand, when more stocks are falling than rising, the market index is referred to as having negative breadth. Measuring breadth for an index is simple. Look at the entirety of an index and count the number of stocks rising versus falling; that ratio gives you the index’s breadth. If 50% or more of components are rising, breadth is positive.

Why is Breadth so Crucial for Investors to watch?

Often, the market can mask what is genuinely happening “underneath the surface” of an index. For example, imagine mega-cap stocks such as

Tesla

TSLA

, Apple

AAPL

and

Microsoft

MSFT

have very strong sessions. Since the two behemoths have significant weightings in their indexes, they can prop up the indexes to look stronger than they are. Before the market topped in late 2021, fewer stocks participated each day, despite the market rising. Ultimately, breadth was a leading indicator of what was to come.

Image Source: Zacks Investment Research

Pictured: Prior to topping in late 2021, the S&P 500 began to flash signs of distribution in the form of weak breadth.

A Reason to be Optimistic

Despite market breadth being a warning sign at times like late 2021, the indicator works both ways. Strong breadth can indicate that a bear market is on its last legs, or at least a short-term rally may ensue. In Wednesday’s session, the S&P 500 Index breadth indicator provided a reason for bulls to be optimistic. Breadth favored bulls by a ratio of 80% advancers to 20% decliners.

Breadth was not the only indicator suggesting broad participation in the rally. Outside of energy (which was down slightly), every sector in the S&P 500 Index rose – another sign of broad market participation. Lastly, “risk on” areas of the market, such as Chinese stocks, crypto-related names, and marijuana stocks bounced hard. For instance, beaten-down securities such as

Alibaba Group

BABA

,

Silvergate Capital

SI

,

and

Canopy Growth

CGC

soared 12.98%, 27.10%, and 8.66%, respectively.

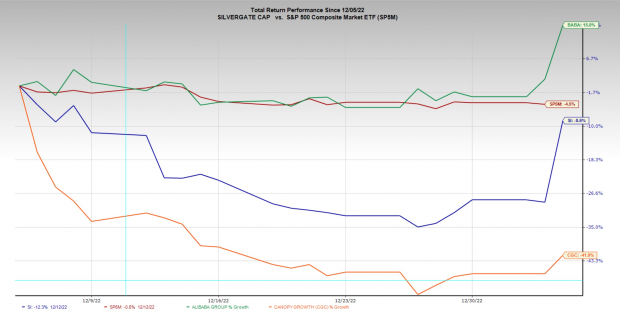

Image Source: Zacks Investment Research

Pictured: Beaten down stocks like BABA, SI, and CGC roared back with vengeance Tuesday.

Don’t Put the Cart Before the Horse

While one day of positive breadth is a battle won for bulls, the war is far from being won. The market is clearly in a downtrend for now. With that said, bulls should gain confidence if strong breadth days (80%+) begin to cluster, broad industry participation continues, and the major market indexes start to put in higher highs and higher lows. Stay tuned!

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report