Main Street Capital Corporation

MAIN

is slated to announce

first-quarter 2022

results on May 5, after market close. The company’s earnings and revenues are expected to have increased year over year.

In the fourth quarter of 2021, its results were supported by a 22% increase in distributable net investment income per share to 77 cents. Further, total investment income had increased 31% to $82.2 million.

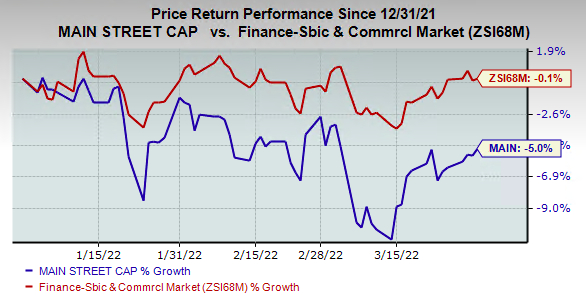

Over the past quarter, shares of the company have lost 5% compared with 0.1% decline of the

industry

.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Main Street’s earnings of 70 cents for the to-be-reported quarter remained unchanged over the past seven days. Nonetheless, it indicates a rise of 20.7% from the prior quarter’s reported figure.

The Zacks Consensus Estimate of $82.6 million for revenues suggests a 31.5% rise from the prior-year quarter’s reported number.

Key Factors to Note

Earlier in March, for the first time since 2018, the Federal Reserve hiked the interest rates and has signaled a hawkish stance to tame the raging inflation. Despite this aggressive stance, interest rates have remained relatively low. This might have hurt interest income for Main Street during the to-be-reported quarter.

Further, a decline in prepayments and refinancing as mortgage rates increased, might have dampened fee income of the company.

Nonetheless, Main Street originated approximately $226.6 million in new commitments in its private loan portfolio, with a cost basis totaling approximately $201.5 million. As of Mar 31, 2022, its private loan portfolio included total investments worth approximately $1.3 billion. Hence, new and increased private loan commitments and investments during the first quarter of 2022 are anticipated to have aided the company’s financials as concerns regarding loan activity and economy have subsided with greater vaccination penetration.

However, Main Street has been witnessing a rise in general and compensation-related expenses for the past several quarters. The trend is expected to continue, which might have hurt the company’s bottom line.

Earnings Whispers

The proven Zacks model does not predict an earnings beat for Main Street this time around. This is because Main Street does not have the right combination of the two key ingredients — a positive

Earnings ESP

and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP

: The Earnings ESP for Main Street is 0.00%.

Zacks Rank

: Main Street carries a Zacks Rank #2 (Buy).

Upcoming Releases

Fidelity National Information Services

FIS

is slated to announce first-quarter 2022 results on May 4. The company currently carries a Zacks Rank #3.

FIS’ earnings estimates for the to-be-reported quarter have remained unchanged over the 30 days. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Lending Tree

TREE

is slated to announce first-quarter 2022 results on May 5. The company currently carries a Zacks Rank #3.

TREE’s earnings estimates for the to-be-reported quarter have remained unchanged over the 30 days.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report