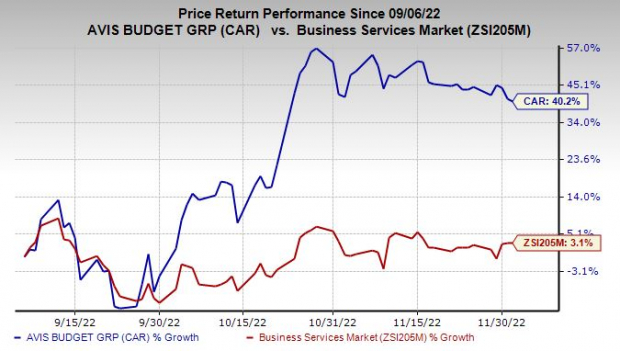

Shares of

Avis Budget Group, Inc.

CAR

have gained 40.2% in the past three months compared with 3.1% rise of the

industry

it belongs to.

Image Source: Zacks Investment Research

The upside was primarily driven by enhanced technology, connected vehicles fleet and pro-investor steps.

Reasons for Upside

Avis Budget remains focused on expanding its connected vehicles fleet. The company’s connected car program enables customers to manage their entire rental through the Avis mobile app.

Expansion of connected cars fleet allows streamlining of operations and cost reduction. It enables enhanced tracking of idle vehicles and automated processing of cars ready to rent. Also, it facilitates real-time inventory counts, mileage management and automated maintenance notification.

Additionally, the massive data generated by these vehicles related to road conditions, accident prone zones, location mapping, weather report and user preferences while driving will actually be a much-prized resource for CAR, which can be monetized later.

Avis Budget continues to improve its technology and offerings. CAR is consistent in taking user-friendly steps by simplifying customers’ online interaction for easier reservation, pick-up and return process.

Avis Budget has an impressive track record of rewarding its shareholders through share repurchases. In 2021, 2020 and 2019, the company bought back shares worth $1.46 billion, $119 million and $67 million, respectively. Such moves underline the company’s confidence in business and help instill investors’ confidence in the stock by positively impacting earnings per share.

Favorable Estimate Revision

Driven by the above tailwinds, the Zacks Consensus Estimate for current-year earnings has moved up 12.2% to $52.75 per share in the past 60 days.

Zacks Rank and Stocks to Consider

Avis Budget currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some better-ranked stocks in the broader Zacks

Business Services

sector are

Automatic Data Processing, Inc.

ADP

and

Cross Country Healthcare, Inc.

CCRN

.

Automatic Data Processing

carries a Zacks Rank #2 (Buy) at present. ADP has a long-term earnings growth expectation of 12%.

ADP delivered a trailing four-quarter earnings surprise of 3.5%, on average.

Cross Country Healthcare

is currently Zacks #2 Ranked. CCRN has a long-term earnings growth expectation of 6%.

CCRN delivered a trailing four-quarter earnings surprise of 10.1%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report