Axsome Therapeutics, Inc.

AXSM

incurred a loss of $1.03 per share for first-quarter 2022, wider than the Zacks Consensus Estimate of a loss of $1.02. AXSM had reported a loss of 78 cents per share in the year-ago period.

Axsome does not have any approved product in its portfolio, currently. As a result, revenues are yet to be generated from the same.

Quarter in Detail

Research and development expenses were $12.6 million for the quarter, down 24.2% from the year-ago period’s level owing to NDA filing expenses incurred in the year-ago period.

General and administrative expenses were $25.7 million, up 128.5% year over year. The significant increase was due to higher pre-commercialization activities related to the potential launch of AXS-05 and AXS-07.

As of Mar 31, 2022, Axsome had cash worth $84.7 million compared with $86.5 million on Dec 31, 2021.

2022 Guidance

Management believes that its cash balance as of March 2022 end and its $300 million term-loan facility will be enough to fund operations into 2024.

Axsome expects an increase in operating expenses on account of pipeline development and commercialization activities.

Pipeline Update

Axsome’s key pipeline candidates, including AXS-05, AXS-07, AXS-12 and AXS-14, target multiple central nervous system indications.

AXS-05

AXS-05, one of Axsome’s lead candidates, is developed for treating a major depressive disorder (MDD), treatment-resistant depression (TRD), smoking cessation and agitation associated with Alzheimer’s disease (AD).

Axsome’s new drug application (NDA) seeking approval for AXS-05 to treat MDD is under a priority review with the FDA. After a positive interaction with the regulatory agency’s officials on post-marketing requirements, AXSM anticipates a potential approval for the drug in second-quarter 2022.

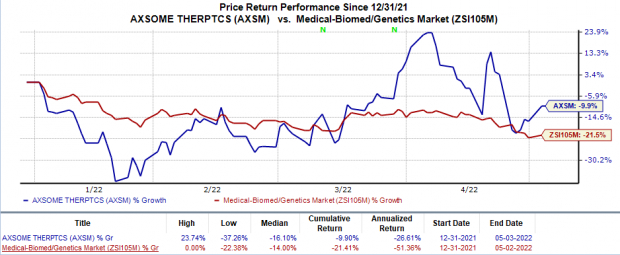

Shares of AXSM gained 7.2% on May 2, probably due to the above announcement. In the year so far, the stock has declined 9.9% compared with the

industry

’s 21.4% fall.

Image Source: Zacks Investment Research

Others

Another lead candidate, AXS-07, is developed for the acute treatment of migraine. In a separate press release issued alongside the first-quarter earnings report, Axsome announced that it received a complete response letter (CRL) from the FDA about the NDA, seeking approval for AXS-07 to address the given indication.

Per management, the FDA seeks additional chemistry, manufacturing and controls (CMC) data related to drug product and manufacturing process. The CRL was expected as Axsome had previously notified about this issue in an SEC filing last month. While AXSM believes that the FDA’s queries can be resolved, it intends to consult with the regulatory body before providing any timeline for refiling the NDA.

The CRL did not raise any concerns about the clinical efficacy or safety issues of AXS-07 nor did the FDA request any new clinical study to support the approval of the candidate.

Axsome’s AXS-12 is being developed to treat narcolepsy, a sleep disorder characterized by excessive sleepiness. AXSM is currently enrolling patients in the phase III SYMPHONY study for the given indication. Top-line data from this study is expected in first-half 2023.

AXS-14 is Axsome’s candidate for the treatment of fibromyalgia. An NDA is expected to be filed in 2023, following the successful completion of manufacturing and other activities related to the candidate.

Zacks Rank & Stocks to Consider

Currently, Axsome Therapeutics has a Zacks Rank #3 (Hold). Better-ranked stocks in the same sector include

Angion Biomedica

ANGN

,

Deciphera Pharmaceuticals

DCPH

and

Vertex Pharmaceuticals

VRTX

. While Angion Biomedica sports a Zacks Rank #1 (Strong Buy), both Deciphera Pharmaceuticals and Vertex Pharmaceuticals carry a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 30 days, estimates for Angion Biomedica’s 2022 loss per share have narrowed from $2.38 to $1.79. The same for 2023 has narrowed from $2.95 to $2.19 in the same time frame.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark on one occasion, witnessing a negative surprise of 47.5%, on average.

Deciphera Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $2.94 to $2.73 in the past 30 days. The same for 2023 has narrowed from $2.38 to $2.23 in the same time period. DCPH has risen 11.7% in the year-to-date period.

Earnings of Deciphera Pharmaceuticals missed estimates in three of the last four quarters and beat the mark once, the average negative surprise being 2.7%.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $14.52 to $14.56 in the past 30 days. The same for 2023 has risen from $15.31 to $15.35 during the same period. VRTX has rallied 19.3% in the year so far.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report