We expect

Biogen, Inc.

BIIB

to beat expectations when it reports second-quarter 2022 results on Jul 20, before market open. In the last reported quarter, the company delivered an earnings surprise of 17.91%.

The company’s earnings beat estimates in three of the last four quarters, while missing expectations in one. The company has a four-quarter earnings surprise of 5.86%, on average.

Biogen Inc. Price and EPS Surprise

Biogen Inc. price-eps-surprise

|

Biogen Inc. Quote

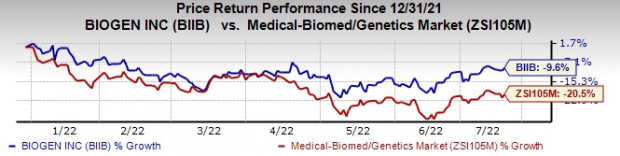

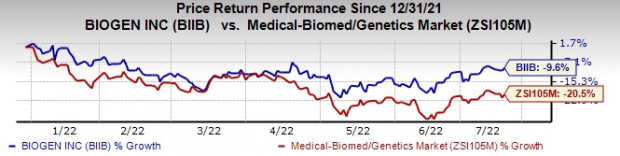

Biogen’s stock has declined 9.6% this year so far compared with a decrease of 20.5% for the

industry.

Image Source: Zacks Investment Research

Factors to Consider

Biogen’s sales in the second quarter are likely to have been hurt by lower sales of Tecfidera and Spinraza.

Biogen’s multiple sclerosis revenues have been declining since the past few quarters. It is unlikely that multiple sclerosis sales have improved in the second quarter.

Among Biogen’s MS drugs, sales of Tecfidera are likely to have declined steeply, hurt by the launch of multiple generics products in the United States. Tecfidera generics are also expected to be launched in Europe in the second quarter. It remains to be seen if generics were launched in Europe and hurt ex-U.S sales from the drug.

Sales of another MS drug, Tysabri may have benefited from volume increases and patient growth, despite increased competitive pressure and price reductions in certain European markets.

The Zacks Consensus Estimate for sales of Tecfidera in the second quarter is pegged at $341 million, while that for Tysabri is $509 million.

Sales volumes of another MS drug Vumerity are likely to have increased, driven by demand growth including the launch in Europe. The Zacks Consensus Estimate for Vumerity is $139 million.

Biogen receives royalties on U.S. sales of

Roche

’s

RHHBY

MS drug, Ocrevus, which is also expected to have contributed to the top line. The Zacks Consensus Estimate for Ocrevus royalties is $270 million.

Roche’s Ocrevus (ocrelizumab) was approved for the treatment of relapsing MS (RMS) and primary progressive MS (PPMS) in March 2017

Revenues from Biogen’s share of Roche’s drugs, Rituxan and Gazyva are also likely to have declined in the quarter due to biosimilar competition for Rituxan.

Increased competition in the United States is likely to have hurt sales of Biogen’s spinal muscular atrophy drug, Spinraza, in the United States. However, in the first quarter, Biogen had said that Spinraza new patient starts were at the highest levels in over two years, with a continued slowdown in discontinuations. It remains to be seen if this positive trend continued in the second quarter

Outside the United States, sales of Spinraza might have been hurt due to competition and currency headwinds. The Zacks Consensus Estimate for sales of Spinraza is $437 million.

Biogen is likely not to record any sales from the new Alzheimer’s drug, Aduhelm, in the second quarter. After the Centers for Medicare & Medicaid Services (“CMS”) denied all Medicare beneficiaries access to Aduhelm, in its final NCD decision, Biogen decided to substantially wind down commercial operations for Aduhelm, retaining only minimal resources to manage patients’ access programs.

Biosimilars revenues may have benefited from volume increase, which is likely to have been offset by pricing pressure and currency headwinds. The Zacks Consensus Estimate for sales of biosimilars is $200 million.

The reduction in revenues from Tecfidera and Rituxan, both high-margin products, is expected to have lowered Biogen’s gross margin in the second quarter.

Following its failure with Aduhelm, Biogen announced a set of near-term operational priorities to drive renewed growth and value creation over time. The initiatives are expected to have resulted in lower SG&A costs in the second quarter.

Earnings Whispers

Our proven model predicts an earnings beat for Biogen in the to-be-reported quarter. A stock needs to have both a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely positive surprise. This is the case here, as elaborated below.

Earnings ESP:

Biogen’s Earnings ESP is +2.87% as the Most Accurate Estimate of $4.21 is higher than the Zacks Consensus Estimate of $4.09. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Biogen has a Zacks Rank #3

Other Stocks to Consider

Here are some large drug/biotech stocks that also have the right combination of elements to beat. Here are some large drug stocks that also have the right combination of elements to beat on earnings this time around:

Merck

MRK

has an Earnings ESP of +7.18% and a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Merck’s stock has risen 23.9% this year so far. Merck topped earnings estimates in three of the last four quarters. Merck has a four-quarter earnings surprise of 13.42%, on average. MRK is scheduled to release its second-quarter 2022 results on Jul 28.

BioNTech

BNTX

has an Earnings ESP of +1.99% and a Zacks Rank #2.

BioNTech’s stock has plunged 40.1% in the past year. BioNTech topped earnings estimates in all the last four quarters. BioNTech has a four-quarter earnings surprise of 56.87%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research