Fomento Economico Mexicano S.A.B. de C.V.

FMX

, alias FEMSA, looks well-poised for growth, given its investments in digital and technology-driven initiatives. The company is on track with its strategy of creating a national distribution platform in the United States through the expansion of its footprint in the specialized distribution industry. It also displays strong financial flexibility.

FEMSA’s bottom line surpassed the Zacks Consensus Estimate in third-quarter 2022, while revenues lagged. However, the company’s revenues improved year over year, driven by gains across all business units, resulting from effective growth strategies and robust demand across markets. FEMSA’s digital initiatives and business expansion endeavors have also been aiding its results.

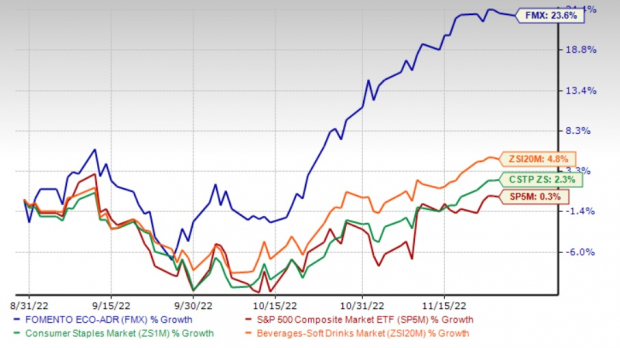

Backed by the solid third-quarter performance, the Zacks Rank #3 (Hold) company’s shares have rallied 23.6% in the past three months compared with the

industry

’s growth of 4.8%. FEMSA’s shares also compared favorably with the Consumer Staple sector’s growth of 2.3% and the S&P 500’s rise of 0.3%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Let’s take a sneak peek into the factors positioning FEMSA for growth.

Image Source: Zacks Investment Research

Digital Initiatives

FEMSA has been focusing on offering customers more options to make contactless purchases by intensifying digital and technology-driven initiatives across operations. The company’s

Coca-Cola FEMSA

KOF

is leading the way with its omni-channel business, while FEMSA Comercio is progressing with the adoption of digital initiatives.

Coca-Cola FEMSA is the flagship segment, engaged in the production and distribution of carbonated beverages. The division is the largest

Coca-Cola

KO

bottler in Latin America and the second-largest Coca-Cola bottler globally in terms of sales volume.

Coca-Cola is on track with its strategy of becoming a total beverage company through last year’s streamlining of its portfolio, focusing on the core brands and investing in its portfolio of brands to meet the evolving consumer need. KO is diversifying its portfolio to tap into the rapidly growing RTD category. The company’s expansion initiatives are likely to aid Coca-Cola FEMSA’s results.

Coming to FEMSA digital initiatives, the company’s OXXO store chain is on track with investing in digital offerings, loyalty programs and fintech platforms to evolve stronger after the pandemic and over the long term. Its OXXO digital wallet, OXXO Premia and loyalty program have been performing well.

Recently, FEMSA agreed to acquire all outstanding shares of NetPay, which offers payment services and solutions to micro, small and medium-sized businesses in Mexico. The deal, which is likely to close in the first quarter of fiscal 2023, will help expand FEMSA’s digital payments portfolio, which includes the Spin by OXXO wallet and OXXO Premia’s loyalty strategy.

In the third quarter, the company made progress on its digital efforts, with the continued addition of OXXO Premia and Spin by OXXO customers at an accelerated Pace. Spin by OXXO received its definitive authorization to operate as a fintech in Mexico. Spin by OXXO reached 4.3 million users (more than 69% active), while OXXO Premia reached 22.3 million loyalty users (above 61% active).

Anheuser-Busch InBev

BUD

, alias AB InBev, is another beverage company focused on investing in the latest capabilities for several years to better connect with customers and consumers. BUD has been rapidly growing its digital platform, leveraging technology such as B2B sales and other e-commerce platforms.

AB InBev is witnessing an acceleration in its B2B platforms, e-commerce and digital marketing trends, which has been aiding growth in the past few months. BUD’s proprietary B2B platform, BEES, is live in 18 markets and has reached 2.9 million monthly active users. BEES captured $7.4 billion in gross merchandise value in the third quarter, reflecting a year-over-year improvement of more than 60%.

Expansion in the Specialized Distribution Industry

FEMSA has been gaining from its effective growth strategies and robust demand across most markets. The company has been on track with its strategy of creating a national distribution platform in the United States through the expansion of its footprint in the specialized distribution industry. Its venture in the specialized distribution industry relates to its plan of investing in adjacent businesses, which can leverage capabilities across different markets, providing an opportunity for attractive growth and risk-adjusted returns.

With the presence of its OXXO business and other retail operations, the company has become an expert in the organization and management of supply chains and distribution systems. Notably, FEMSA serves a large number of businesses and retail customers through millions of interactions in different industries.

Headwinds to Overcome

FEMSA has been witnessing gross-margin pressures for the past few quarters. The company continued to witness a gross-margin decline in third-quarter 2021 due to contraction at Proximity, Health, Fuel, Logistics & Distribution, and Coca-Cola FEMSA segments. The gross margin contracted 110 bps at Proximity, 50 bps at Health, 10 bps at Fuel operations, 20 bps at Logistics & Distribution, and 70 bps at Coca-Cola FEMSA. Supply-chain disruptions and higher raw material costs also hurt the results.

Conclusion

Although the company continues to witness gross margin pressures due to contractions at all operating segments, it is well-poised for growth in the long term, backed by its expansion and growth plans.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report